Happy New Year everyone! Prior to heading out for the festivities last night (Coldplay / Jay-Z @ the Barclays Center) the USPS delivered a few credit card presents. I had been away for the week in Curacao and so most of the cards from my December App-O-Rama had not yet been delivered. That makes a total of eight cards for December including my second Ink Bold and Sapphire Preferred cards, my previously received Ink Plus card, and the yet to arrive Bank of Hawaii Visa(14 days after being approved).

All told my December churn is worth 350,000 points and requires $20,000 in spend. I anticipate most of that spend to be covered with the help of $500 Vanilla Reload cards. Luckily, I’ve found that the CVS stores in the NYC suburbs seem to stack tons of Reloads (we’re talking 50+ at most locations) while the ones in the city continue to have one or two at most. The NJ and Long Island locations I’ve visited allow only one Vanilla Reload per transaction, but were more than happy to ring one and then another right after. I’ll be sure to rotate my cards and of course make regular purchases as well in order not to set off any alarms. I will be transferring the Vanilla funds to my Bluebird card which I’ll use throughout 2013 to pay for expenses that normally wouldn’t accept credit card payments, including my monthly rent.

Citi Visa – 50,000 after $2500

Citi AMEX – 50,000 after $2500

Chase Ink Bold – 50,000 after $5000 (second card)

US Airways – 40,000 after first purchase (second card)

Chase Sapphire Preferred Card – 40,000 after $3000 (second card)

Hawaiian BoA – 35,000 after $1000

Chase Ink Plus – 50,000 after $5000

Hawaiian Bank of Hawaii – 35,000 after $1000

This was by far my largest AoR ever and I was a little concerned about how my credit scores would be impacted. Prior to the AoR I was just shy of 800, post churn my Transunion score registered a drop of 8 points while my Experian score dropped by 2 points. Eight points is a lot, though I’m not looking to obtain a mortgage or other line of credit any time soon. Additionally, my score is still very close to 800, considered an excellent rating. Get your free TransUnion score from CreditKarma and your free Experian score from Credit Sesame.

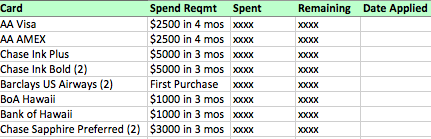

It’s also important to track your spending requirements which I do using a simple Excel sheet.

I’ll be beginning my daily Vanilla Reload purchases tomorrow! Check out my previous post for full details on each card and data points regarding prior applications, time elapsed, and total cards with each bank.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

22 comments

Have you had any issues doing 2x beans per day? I’ve been only doing about one per week being worried about a financial review or getting shut down by chase. Maybe I’ll step it up a little slowly… Also, lets get that nyc meet up going now that the holidays are over!

@Paul – I’ve been very conservative. 1k per card per week. I’m going to be testing the waters now…the NJ and Long Island CVS stores seem to have 50+ reload cards in several of the locations I’ve visited. Yes, I’m going to send out a NYC meet-up message this week!

How did you get your second Chase card bonuses? Don’t they give one per card? BTW congrats, the total is amazing!!!!

@Lori M – the Sapphire Preferred was a MasterCard instead of the VISA that I previously had. Some reps consider this the same card while others considerate it different. Make sure you get the name and location of the agent that confirms you’ll receive the points. The Chase Ink card was for a new business and I applied using an EIN number.

Usually I never care, but a blogger promoting 2x Reloads daily, that’s $15k a month. Talk about being greedy and promoting greed.

@CodeAdam10 – Several of the NJ and Long Island CVS stores have 50+ reload cards in several of the locations I’ve visited. I’ll be going to different stores each day which means I’m taking 2 cards of 50+ out of circulation. In terms of being careful with the banks, I always make sure to use the cards for normal purchases as well and will be rotating the cards I purchase the Vanilla Reloads with.

Great information!

Can you tell me for those 3 ‘second cards’, did you cancel the first cards before applying?

@Chister – For the US Airways card, I canceled the first card about 100 days prior. For the Chase cards, I had the previous ones still opened.

Welcome to the game!

Interesting. Did you already have those Citi cards? If so, were they still open?

@Joe – The last time I successfully received a sign-up bonus for a Citibank AAdvantage personal card it was February 2010, about 34 months ago! I must have been on Citi’s unofficial deny list, as FlyerTalk and MilePoint members generally report receiving approval 18-20 months after their last successful application. I applied at the 20 month mark with no luck and then again at the 26 month mark, also with no success. I did not have either of the cards at the time but had them in the past.

How far out in LI? Been doing cvs runs with my buddies in NJ but prefer something without a toll if possible. There are quite a few that will do up to 2 card per transaction and can buy upwards of 6 cards per visit. They have multiple hooks of them.

@Singapore Flyer – These locations are 35-45 minutes from the city. Shoot me an email at adam@pointmetotheplane.com and I can give you more details.

Looking forward to the NYC meet up!

How did you get 3 chase cards same day?

@Jannath- the reconsideration line is your friend. If you have any Chase cards they will allow you to adjust your limits to get the new cards approved!

[…] purchased, 8 different credit cards utilized across 6 different banks, a nice dent of required minimum spend for some new cards hit, and rent prepaid via Bluebird for a few months. I even got in some bonding time in with Dad […]

[…] last churn was almost 90 days ago on December 16th. At that time, I applied for eight cards including my second and third Ink cards. I already had an active Chase Ink Bold but decided to […]

[…] offer from Bank of America for a free $15 gift card from BestBuy, Starbucks, or Target for using my new Hawaiian Airlines card for a mobile, internet, insurance, or cable payment by May 31, […]

[…] December’s eight card 350K churn, I decided to go a little smaller this time around, only 5! Here are the cards I applied for, a […]

Adam, in which NYC suburbs were you able to buy the VR cards? Hopefully, there are still VR cards at these CVS stores. Thanks.

[…] my credit score. However, this year has been a bit different. In fact, my last AoR post dates all the way back to January 1st (Eight Cards for 350K). Right about the time when I would have normally started on my next application cycle, I began a […]