Do you have all the time in the world to keep track of all the airlines? There are airline alliances. Then there’s knowing which airlines are adding flights and routes, and which routes are being canceled? I certainly don’t have the time needed to keep track of all this information. Booking airline award tickets is challenging. I’m reminded of this when airlines announce new non-stop routes like United did when announcing its new non-stops to Europe for Summer 2018.

It’s Complicated When Airlines Announce New or Seasonal Routes

Sure, these are seasonal routes, but still, for those of us who work hard accumulating miles and points, this is exactly the kind of knowledge we need. Booking those award tickets, and booking them early is essential. Knowing when award charts open, and seasonal route award seats are bookable, is just not something I’m good at keeping track of.

In addition to United’s new Summer routes, United also started daily service between LAX and Singapore and between New York and Buenos Aires. See what I mean? That’s a lot of news to follow. And that’s just United.

Too many possibilities to keep track of!

My Solution

For this kind of information, and for getting the best routing for my award tickets, I’ve grown to rely on my award booking team. After all, this is what they do for a living. They are seeing what’s available NOW as well as through the months ahead. When I’m thinking about booking an award ticket they’ll know way more than I could ever keep track of. Or want to keep track of. I’ve come to accept that. So I’m thrilled for the help available to guide me.

Booking An Award Ticket Trip To Spain

Recently, I booked two separate trips using miles & points. For one trip I was planning, I wanted to take advantage of the 40% bonus that American Express Membership Rewards was offering at the time for transferring points to British Airways Avios. Then I wanted to use those Avios for an Iberia flight to Spain, but only on the outbound.

For the inbound, I wanted to use American Airlines miles. It was confusing for me because which way did it make more sense to use which miles? And with lots of other miles and points folks taking advantage of the American Express transfer bonus, I didn’t want to see award seats slip away while I fussed with all these specifics.

Score One For My Award Booking Team

My award booking team helped me every step of the way and we got the flights booked and itinerary squared away. Does booking airline award tickets, in this case two tickets, come off without a hitch? No. If you book lots of award tickets you know what I mean. They are almost never hitch-less. That’s why I’m happy to have help! It’s well worth the fee.

I’d much rather plan which sites to visit then fuss with booking award tickets./ Image by Shutterstock.com

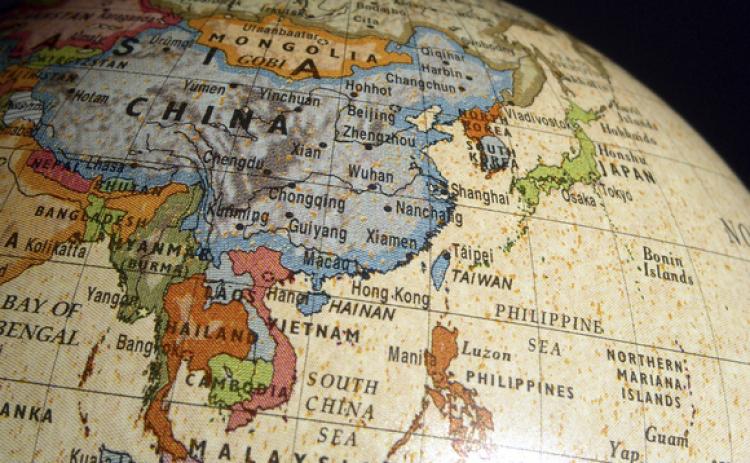

Booking an Award Ticket for a Multiple Country Trip to Asia

Not too long ago I booked an award ticket for an extended trip around Asia. I wanted to use up some of my stash of American Airlines miles. My dates were fairly flexible, but not totally. I had no idea how to plan the flights for a trip like this as I’d never done an extended trip to so many countries before. It required me really thinking through where I wanted to go and coupling that with the availability of flights and award seats.

My award booking specialist had so much patience with all my questions and asked me the right questions. In the end, given my parameters with dates, requested class of service, and chosen locations, booking airline award tickets was a huge win and I had a great trip!

The world truly is an amazing place.

My Criteria for Recommendations

I never recommend any service I don’t use, because that’s just not how I roll. And I recognize that like me, there are plenty of others who enjoy adding to a stash of miles and points and then traveling to explore amazing locations. However, the whole process of actually booking airline award tickets is just not something we’re good at. It’s just not my cup of coffee and I’ve learned to ask for help!

There’s a lovely Danish Proverb: “He who is afraid of asking is ashamed of learning.” I’m not afraid to ask for help because what I’ve learned in the award ticket booking world is that there are people who can do it much much better than I can. It is even more puzzling to me is that they like doing it! So it’s a win-win, for sure.

Upshot

I trust my team over at Juicy Miles for booking airline award tickets. They book all my award tickets. Give them the opportunity to see what they can do for you. It doesn’t cost anything to ask and they don’t charge a fee until your satisfied.

Shelli Stein is a health and fitness entrepreneur who travels the world in search of culture, food, and fun! Besides contributing to PointMeToThePlane, you can find her at Joy in Movement.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

2 comments

As a once upon a time travel agent and someone who enjoys constructing trips, I normally have little need for a booking service. I looked at one blogger’s booking service information request form, but it really didn’t have what I’m looking for, which is more or less a conversation about what is possible and what is not before asking for specific dates. For example, I’m interested in booking a flight for 2 people from SE Asia to the USA via Frankfurt in first class on Singapore at saver level. I know that these are highly sought after, so arrangements need to be made far in advance, but just how far in advance? How many miles would this cost with a stopover? What routing restrictions exist? Any idea if what I’m asking about is realistic? I don’t mind paying for a booking service, but don’t need one for a simple itinerary. Any thoughts would be welcome.

Christian, The questions you ask in your comment are exactly the kinds of questions an award booking team member would answer. They are the normal inquiries any client would ask and a good award booking service would answer for you before going forward. Of course, the one question I can imagine them asking you is what stash of miles/points you have already in place. The dialogue that happens before the award booking goes forward is where all the particulars get fleshed out. I’d for sure give Juicy Miles a go at your itinerary and see what they can come up with. Never hurts to reach out to them. Thanks for reading!