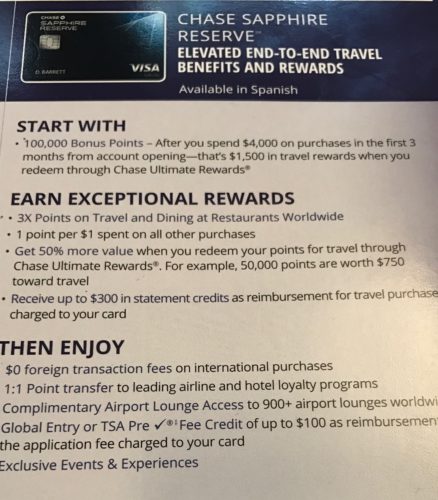

As many of you are probably aware, the 100K in-branch sign-up offer for the Chase Sapphire Reserve ends this week (either on March 11th or 12th…some discrepancy there based on branches). I was hopeful that I’d miraculously be pre-approved for the card at the branch after being denied due to the 5/24 rule in December.

I headed over to the nearest branch at lunch to apply and learned some interesting information (of course, some of this may be specific to the branch or New York branches in general):

- I was pre-approved for multiple personal cards, but technically not for the Chase Sapphire Reserve. I asked the banker to show me the screen and although the pre-approved application link was missing, I saw that the Sapphire Reserve card was still shaded in green like the other pre-approved cards. He told me that about 3 1/2 weeks ago, the pre-approval application link simply disappeared for the Chase Sapphire Reserve, although the product still showed up in the list and was colored green for some clients.

- The approval process was painless as the system already had the majority of my information

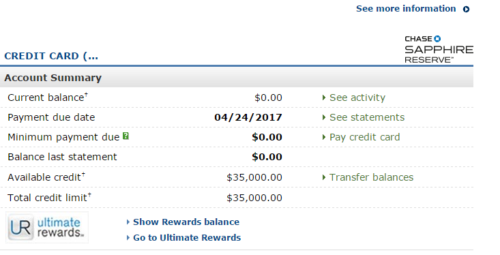

- I was approved within seconds and the card already displays within my Chase online profile

So the takeaway here, even if you’ve been denied for the card due to the 5/24 rule, make the trip to the branch (if it’s close, otherwise I’d keep calling until you get a banker who will tell you your status over the phone). Then, even if you are told you are not pre-approved in the branch, ask if the card is shaded green on their screen. If the card is green but the pre-approval link is missing, you’ll likely still be approved as per my banker. Again, results will likely vary.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

49 comments

Did you fall below 5/24 between December and now? Or are you over 5/24 and saying that the rules don’t seem to be enforced now?

@Matt B – I still have not fallen below 5/24 (though I’m currently only at 6/24 which is also where I was in December). I believe the approval is likely due to the “sort of” pre-approval that displayed for me in-branch.

Got it, thanks. I think i’m at 15/24, so they may not be as generous. But then again you never know until you try. Thanks for the post.

Were all six personal cards? Were any of them business cards?

@Spencer – All six were personal cards

Same question as Matt B.

@ David H – Answered!

Other that having other Chase credit cards are you a Chase bank customer? The only connection I have with Chase are various credit cards that I’ve enrolled and sometimes cancelled over the years.

@ Ed – Nope, I’m not currently a Chase checking, savings, mortgage, etc customer

You’re lucky. I applied on 3/1 even though i’m 8/24. I will be 4/24 in October. I’ve called about five times and I get the same response. They cant do anything when it comes to too many cards in the last two years. I bank with them and I currently have the freedom,Marriott and Chase ink plus.

Hi,

I went to the branch today and the banker said, I am pre-approved for the Freedom w/300 back. but in the same dropdown he showed me I have CSR listed with2 other cards as Special offers. i am at 7/24. I am confused what should I do? Should i take the chance and apply or not hurt my report anymore by being denied and having another entry? Any suggestions?

Thanks!

@Vish – If you are truly pre-approved, I’d pull the trigger and risk the pull, though of course you might not be approved. However, first I’d make sure that your banker truly understands the difference between pre-approvals and offers available for application. Also, confirm that the card is shaded in green.

Adam,

I called the banker as per your suggestion and asked if it was shaded in green and he said it was not. He said the special offer is more like an invitation as chase thinks i might get approved for the card and is not a pre approval 🙁

@Vish – Smart of you to call! Yes, definitely don’t waste the pull on an invitation.

[…] of Point me to the Plan reports he got approved for the Chase Sapphire Reserve card in branch despite getting 5 credit line […]

My wife is at 8/24, but 5/24 if you don’t count three AU cards. One card will drop off this month, so here is our plan. She will apply this week (and be rejected, almost certainly, just as she has been turned down twice similarly). In April, she’ll call for reconsideration and hope that Chase can see that she’s then at 4/24.

Unfortunately that plan likely won’t work as even in April, Chase will be using the credit report pulled at the time of the application. Has she been turned down in branch or only online?

Both. Once online and once in-branch.

Is this the case? I really thought I read that calling recon after an account drops off will get a re-evaluation based on most recent data. Am I remembering wrong?

I’m hoping Dave is right. She applied yesterday and was denied. She’ll call recon in April when she’s 4/24 after the card she obtained March 2015 falls off.

What was the first sentence of the credit card disclosure form that you signed? And what was the apr on the Schumer box? A fixed rate or a range?

[…] seen a pre-approval offer, there may be a glimmer of new hope: Adam, from Point me to the Plane, reports that he was approved yesterday despite being over 5/24, having been denied for the Sapphire Reserve this past December, and […]

I tried again and didn’t have luck. I have one card opening 4-15 but they said it won’t come off until May. Such a bumper. And they weren’t very nice about it either

when you say you tried, does that mean you saw that the CSR was shaded green and you applied when you were denied?

which NY branch was it?

It was the NYC HQ branch on 47/Mad

I just came back from one more downtown, no such thing as green shaded items, I saw the screens, even for those the had pre-approvals.

Went for it anyway and it is pending. question now is to wait or call Chase recon line?

@AKAK – There are green shades, I saw them with my own eyes yesterday!

@ Adam, did you get a chance to check your paperwork per my questions from yesterday?

@PointsYak – I’m sorry, I don’t have the actual paperwork with me, I had a flight last night.

@Adam – That’s unfortunate, because that one sheet of paper would answer half the riddle of your post.

@Adam my office is one block from there! I also don’t have any checking account with them. Maybe your banker? Is there anyone I should talk to? Or should I just talk whoever greed me that I want to apply for CSR?

@Shannon – Hah, crazy! My banker was on vacation so they sent me to the first banker available (who is also the fist one to the right when you walk in). His name was Carlos

I’m at 5/24 and went to the local branch here in Indiana today. I was pre-approved for every other credit card they offer but I was denied. Figured it was worth a shot.

saw a DP with similar situation, might be worth trying to recon

http://frequentmiler.boardingarea.com/2017/03/08/last-call-chase-sapphire-reserve-new-hope/#comment-1905753

Just adding a data point. Called Chase branch today and asked if I was approved for CSR. Answer: pre-approval links have been removed from that card. Asked if the card showed shaded in green. Answer: it didn’t even show up under offers.

I decided to go into the branch anyway to apply. Met with the Branch Manager, provided details and submitted request. Application came back as pending. Branch Manager called recon and explained he had me in branch and would like them to evaluate the pending application. He put me on the phone and the rep asked if I would be willing to move credit from other Chase cards. I was more than happy to comply. After about 3 minutes, he came back and advised I was approved.

I am currently at 5/24, but one of those is a Chase business card. Previously I saw those were being included in the count, so I’m not sure if it was not counted or if the 5/24 was ignored in this case.

Cards not reported on your personal credit report will not count. Vast majority of business cards are not reported on personal credit reports, including Chase. If a business card appears on your personal credit report, call the bank to have it removed.

Chase will only count cards on your personal credit report!

[…] I took one more in-branch stab at the Chase Sapphire Reserve, acting upon the glimmer of hope from Adam’s experience yesterday. […]

Sad DP from me: I went through the trouble of transferring funds up to 100K to chase to become CPC. I am currently an AU on my dad’s CSR so the inbranch application wasn’t showing up. They advised me to apply online (they guaranteed they’d make an exception to give me additional 50k since the inbranch application wasnt showing up) and then we called recon but they were extremely firm that they couldnt do anything because I was 11/24. I’ll enjoy my temporary CPC status for a year, and then remove all my banking accounts with them altogether. I’ve properly been with Chase for over 10 years and now after upgrading to CPC, they really won’t do anything about it. Maybe cuz I waited too long and they’re tough on apps now, but they’re really taking this 5/24 too far and will be losing my business.

[…] Point Me To The Plane stated that they were at 6/24 and applied & was approved for the card. They said that they saw that the Chase Sapphire Reserve was still shaded in green like other card pre-approvals. Not sure what’s going on here, but I suspect it’s most likely that they are actually under 5/24 for whatever reason as others don’t seem able to replicate this. […]

[…] on 3/12 will work. I didn’t want to risk it, and am currently at 6/24, so when I read that Point me to the Plane was approved in-branch at 6/24 I bit and applied that same day. AHHHHHHH! I was not as lucky as he, […]

Hail Mary….. and it’s caught!

Ah, I had totally forgotten about the bonus after the online offer was pulled.

If my calculations are correct, my wife is at 5/24 currently. She applied for the CSR in December when she was 6/24 and was quickly denied.

On a whim we stopped by our local branch (LA) on the way out of town on Friday. Banker roulette landed us with a CPC banker on a very empty afternoon. He didn’t really know about 5/24 or the difference between pre-approvals and invitations, hmm… He showed us the pre-approval drop down which listed a number of credit products but not CSR. In our case it was a drop down menu, and never links that could be shaded green.

He was friendly and suggested we apply anyway. Even though my wife has two existing credit cards with Chase, it took a minute for the application to be completed — what a trip signing documents and receiving paper copies of everything, blast from the past. We applied, he disappeared into a back room for a couple of minutes, returned and the decision was waiting for him.

Approved with a $34k credit limit.

It was your post that set a process in motion, and I thank you.

@Darin – Congrats, that’s awesome news!!! Hah, I enjoyed the blast from the past printed out forms as well!

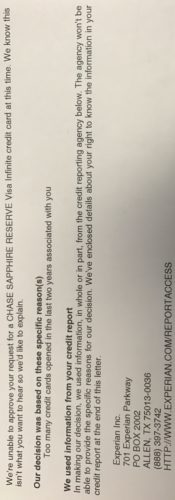

Hi there, Just wanted to share my story about the Chase Sapphire Reserve as a data point for you guys. I applied for the card February 25th and was denied about a week later for too many accounts.

I decided to send a secure message and request a reconsideration. 3 cards were AU and one was a chip and pin we had applied for prior to traveling to Europe. I figured I had two points of argument 1) the AU cards and 2) Chase doesn’t offer a chip and pin and we had to have it for travel. I knew there were arguments that had tried and failed before but I thought why not try.

I received a number to call to speak to a rep. The first guy gave me the standard line that the “Too Many Accounts” denial couldn’t be reconsidered. I decided to call back again when I reviewed my report again and realized there were only four cards on my report. The second rep I worked with was much more helpful. He quickly reopened the case and encouraged me that the authorized user cards should not be have been considered, as well as an Old Navy card, since it was a branded store card. My application has been reopened and routed for approval.

Obviously, there is still the chance that it will be turned down, but I think this is a good example of “You never know!” and it’s at least worth the phone call!

@Brittney – Wow, that’s great! Persistence and HUACA may have actually worked. Please keep us updated as to whether you receive that final approval!

The card showed up in my account online so I’m thinking that’s a yes! Or a very cruel joke. I’ll feel better when I get that baby in my hands.

[…] on 3/12 will work. I didn’t want to risk it, and am currently at 6/24, so when I read that Point me to the Plane was approved in-branch at 6/24 I bit and applied that same day. AHHHHHHH! I was not as lucky as he, […]

[…] See: Approved In-Branch Today: Sapphire Reserve 100K despite 5/24 & No Pre-Approval […]

[…] are past cases we’ve documented, however, when early sign-ups and in-branch Chase sign-ups were approved for cardholders with more than five new […]