On a recent family trip, we ran into the prospect of being stranded overnight in Dallas. A bought of fog in the Bay Area led to a too-close connection on the final leg of our trip.

In the past I made sure that everything travel related was charged to my Chase Sapphire Preferred card (more info), to take advantage of all of the different travel insurances and reimbursements. I hoped that I would never have to use them, however, on this particular vacation, the weather decided to interfere with my travel plans.

In this case, I had to decide whether or not to spend the night in Dallas, or plan an alternate route home that night. I wasn’t sure if Chase’s travel protection would cover my DIY diversion.

Chase came through for me in the end, but not as easily as I would have expected.

Chase Travel Delay Reimbursement

Chase’s travel delay protection kicks in when the following conditions apply:

- Reimbursement for expenses such as meals and lodging if your common carrier (airline, bus, cruise ship, train) travel is delayed more than 12 hours or requires an overnight stay.

- The claim must exceed any expenses paid by any other party, including applicable travel insurance.

- Trip must be away from the cardholder’s city of residence and be less than 365 days in length

- The fare has been purchased with an eligible Chase card or with rewards earned on an eligible Chase card.

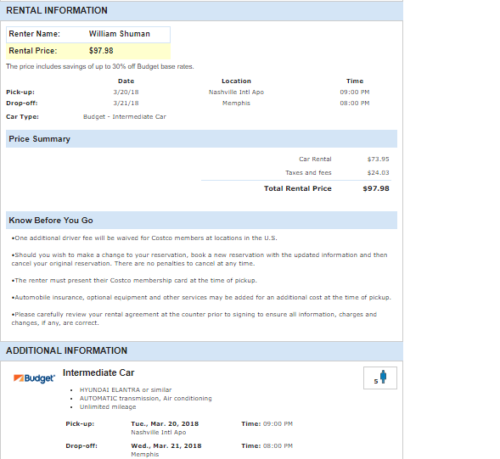

Had I stayed overnight in Dallas, it would be clear that 100-percent of my lodging and meals would be covered. However, since I decided to take a flight to another airport and rent a car my trip reimbursement insurance might become questionable. Therefore, I contacted Chase on March 24 to see their initial thoughts about the situation and the representative I spoke with encouraged me to file a claim with their department to have our $111.73 rental car and gas expenses reimbursed.

Background

When my family and I took an 11 night trip earlier this year to Hawaii, we had flights booked through Memphis (our city of residence), Chicago, San Francisco, Kona, and Dallas airports. Apparently, five airports were not enough, and on the last night of our trip, we found ourselves sitting in the Dallas airport, on weather delays, with a 3-year-old and no flight home to Memphis.

On the morning of March 20, we were scheduled to fly out of San Francisco on Southwest at 11:10 a.m. The flight was scheduled to arrive in Dallas at 4:40, from there we were going to take a connecting flight at six that was going to get us home to Memphis.

My wife and son’s flight were booked using 11,052 Southwest Rapid Rewards points and $5.60 each. My flight, due to my wife’s companion pass, only cost us the 9/11 fee of $5.60. Even though I only had to pay $16.80 out of pocket for all three flights I made sure that all of the 9/11 fees were charged to my Chase Sapphire Preferred card. This was enough to provide protection for everyone on our itinerary.

Our first flight that morning was being delayed by 93 minutes due to severe fog and rain in the Bay Area. Sitting at the gate, Southwest informed us that while it would be close, we should make our connecting flight. Midair we discovered that two planes were leaving Dallas bound for Memphis. Our flight, departing at 6:00 p.m. and the last flight of the night at 6:10 p.m. We had wheels on the ground at 6:01 p.m. and while we made it to a customer service desk by 6:09 we found out the bad news that both flights had departed for Memphis as scheduled.

The next available flight was at 11 a.m. next day.

Dense fog delayed the crew at SFO airport that was supposed to arrive from LAX. Image by Bill Shuman

A Creative Solution

A few months prior I had started a new teaching job and prearranged time off work to make this trip happen. This meant I was already missing two days with my students and spending the night in Dallas would mean losing another full day. This factor, plus the fact that my son was homesick after being gone 11 nights, led to me continue to talk with the customer service from Southwest. The goal: find an alternate way home.

Fortunately for us, there was a 7:25 p.m. flight that would take us to Nashville. After landing, we still needed to make the three and a half hour drive home after landing.

After making a few phone calls, I was able to book a rental car, and we hopped on a flight to the “wrong” airport. We finally arrived in Memphis around 1 a.m., almost six hours after our intended arrival time.

What Did the Process Require?

For the initial claim, I provided proof of the initial itinerary, the updated itinerary, and the emailed receipts from Southwest for the flights. I also submitted the rental car and gas receipts at this time. I then waited until May 3, when Chase responded stating there was not enough proof of a delay.

A verification letter from the carrier about the weather-related delay was needed. I took to Twitter and submitted proof of that conversation to Chase on May 12 along with the email that was sent by Southwest. Chase responded to my claim a few days later, this time stating that the email and twitter conversation screenshots were not sufficient and would require a letter on official company letterhead.

After one more conversation with Southwest, I obtained that letter and uploaded it to the Chase Eclaims portal.

Finalizing the Details: Do I Have a Son or Not???

Chase took another week to respond to the claim this time asking for proof that the tickets were paid for on my Chase Sapphire Preferred card. After uploading statements that showed the 3x$5.60 charges from my online Chase statements. At this point, I began worrying as I was approaching the 100-day window from the date of the incident, so I made several phone calls to Chase urging them to provide an answer before June 28. Around the middle of June I finally heard back, and this time I needed to provide proof that my wife and son were related to me!

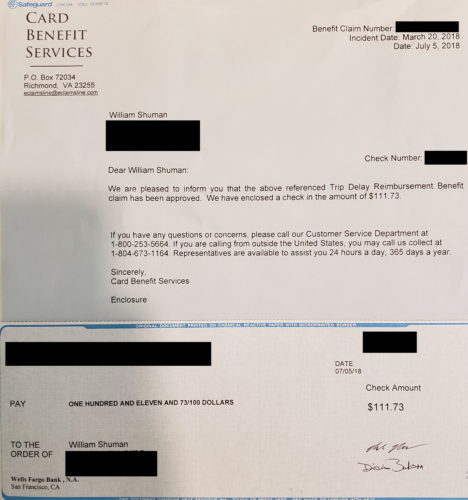

Once again, I was back to the Eclaims Portal uploading a marriage certificate and a birth certificate. Finally, on July 5, 103 days after submission and 107 days after my flight Chase sent me a letter stating the claim was approved!

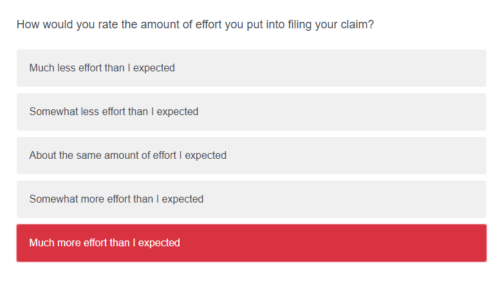

Interestingly, I just received an email Sept. 18 asking about my experience during the trip reimbursement process. Even though I am satisfied to have the expenses reimbursed, it required a significant effort (and ridiculous documentation!) to resolve. In the survey, I did not hesitate to let Chase know how I felt.

Final Thoughts

Overall, this process was long and tedious for the small sum of money, but it did shed some light on how the process works. Perhaps this was due to the unique nature of the claim. However, because Chase went out of the way to come through for me I will continue to use my Chase Sapphire Preferred card to book all travel related expenses.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

7 comments

No. The answer to your question in the title is no..if you need to rush home on a trip because your loved one has a heart attack or something, chase will not pay for you to fly home. They will reimburse you for prepaid expenses you lost out on (up to a point) but will not cover you at all for the new flight, even if you have the reserve . Citi provides coverage (to a point) for the new flight. I use citi for travel protection.

That’s a totally different situation and one I would not expect covered as the trip is being changed. In the situation outlined above it was a weather delay to a scheduled trip which is why the benefits kicked in. Part of the reason I posted this was to highlight the difficulty in the process and also to demonstrate that if you get delayed you might be able to be creative in a solution and still be covered with the card benefits.

I have noticed similar headaches in making Chase claims through eclaimsline vs Amex benefits which have been no issue and paid in 24-48 hours

Always ask for a “Military Excuse” when the flight goes wrong to begin. To met all the proof of flight cancellations is still. Chase should easily be able to find this info where are the average customer has a hard time re-creating this info which is to me an excuse to require this as a way to not pay as many claims.

Good to keep in mind on the military excuse letter. We were so busy trying to come up with solutions that I forgot that part at the gate. Thankfully Southwest was easy to deal with afterwards.

I’m curious if anyone else has used this process and their results as it was hard to tell if it was the unique route I chose that made things difficult or if the process always goes this way. I also was left wondering if any of the other companies handle things better. Regardless, I’m the type of person that keeps meticulous records and don’t mind doing the extra legwork to save some $.

Iwent through a similarly ridiculous process submitting a claim for travel cancellation due to illness for a trip I booked on my Chase Sapphire Reserve card. I received at least 3 separate requests for additional documents (many of which I had already submitted). I also found that I got completely different answers to my questions each time I called. I was eventually reimbursed for many of my expenses but the whole process seems designed to get people to give up in frustration.

On another occasion when I missed a connecting flight in Oslo due to my first flight taking off late, I was by the insurance representative on the phone that Chase’s delay insurance only applies if the initial flight is delayed by 12 hours+ and never covers missed connection delays. They really need to do a better job training staff.

[…] Related: Information On Chase’s Travel Insurance Benefit Coverage […]