We need a guide on how to transfer reward points between programs. It’s no secret that airlines are devaluing your miles as each day passes. Some airlines (cough, cough, Delta) often make changes without any notice.

There are two distinct strategies against this trend. The first strategy is to “earn and burn” those miles as they accrue. That way your earned miles are redeemed for the best current valuations, and before the next devaluation!

The second strategy involves changing your mindset about the points and miles game. For years, people collected airline miles because loyalty meant something — and they were rewarded by the airlines for that loyalty. Today’s economics means you might be better off with a liquid currency so you can move from one great redemption to another. That is, picking out your best value with your hard-earned points.

Along with your strategies you need a guide to understand how to transfer reward points.

The Solution? Credit Cards With Transfer Benefits

Credit cards that offer travel points — points which can be transferred to an airline’s frequent flyer program — are the cards you should hold in your wallet and use wisely for your travel plans.

Using this guide to transfer reward points to airline programs will be a valuable tool in helping you maximize value from your earned rewards.

Related: The Best Credit Card Sign-Up Offers Right Now!

Having miles accumulated with a specific airline can be great, but the value in being able to transfer points to a dozen or more airlines gives you the freedom of choice. When that next devaluation comes from your favorite airline, you can snub your nose at them and transfer your points as miles into another carrier’s program and get a great redemption.

Spotlight: Award Cost Comparison

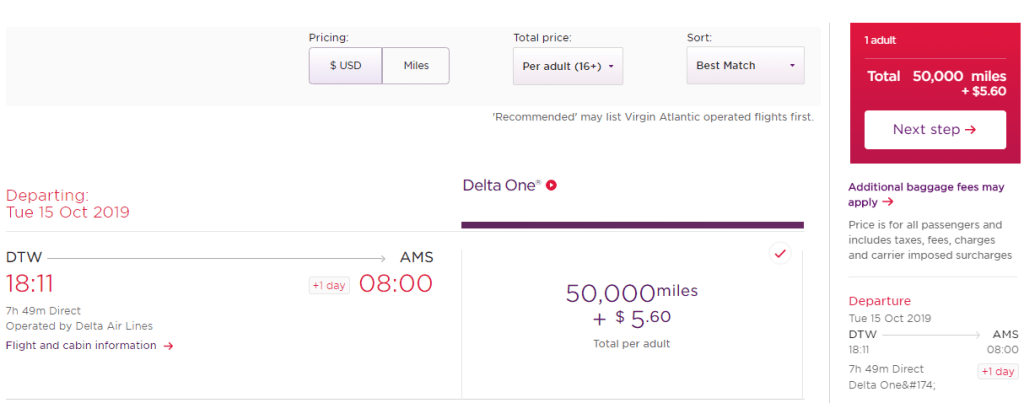

For example, let’s look at a simple transatlantic award redemption from Detroit to Amsterdam on Delta.

There are a couple of options here either including:

- Using Delta SkyMiles

- Using Virgin Atlantic’s Flying Club miles to fly on Delta.

First up: Virgin Atlantic. I’m seeing availability on various dates between Detroit (DTW) and Amsterdam (AMS) on Delta’s A330 lie-flat business class for 50,000 Flying Club miles and $5.60 in taxes.

Now, let’s look at booking that same flight with Delta SkyMiles. It’s going to be a lot more expensive — 86,000 SkyMiles and $5.60 in taxes.

This is a prime example of why programs that allow airline transfers are more valuable than pure airline miles for redemptions. In this case, American Express Membership Rewards points can be transferred to both Delta and Virgin Atlantic. At a 1:1 transfer ratio, clearly you should transfer points to Virgin Atlantic.

Find a great deal and transfer the points necessary to get the bargain redemption. Partners may often offer cheaper redemptions.

Our affiliate partner Juicy Miles can help you book any award ticket with your earned points and miles. They also offer a mileage run service helping clients earn miles and elite status.

Ultimate Guide to Transfer Reward Points

Five Major Programs With Transfer Points To Airlines & Hotels

So, let’s explore your options with five great transferable currencies from credit cards and programs you should consider having in your portfolio. With more than 50 partner airlines and different transfer ratios between them, you need some help to keep track of them all.

So, let’s show you our master list of the major programs that allow transfer of their points to airline frequent flyer programs. These programs are

- American Express

- Capital One

- Chase

- Citibank

- Marriott Bonvoy

Before we begin our exploration, you should understand a couple of things. First, the goal of collecting these program points is to transfer into an airline’s frequent flyer program. However, once the transfer is made you cannot transfer them out. It’s a non-reversible transfer. That means you should make sure you have an award flight in mind or use Juicy Miles to help.

As a general rule of thumb, your points are better stashed away in the credit card program than in an airline’s account. Remember, airlines may (and do) devalue at a whim — don’t let that happen to your points and miles, especially due to transferring.

Now, let’s take a look at transfer options and estimated times of transfer. I’ll cover those alphabetically.

American Express Membership Rewards

American Express boasts 16 airline transfer partners and three hotel partners. So while flexibility and easy earning opportunities make Membership Rewards points a must for any frequent traveler, there are a few downsides to keep in mind.

Be advised that American Express will charge a small fee (.06 cents per point) on transfers to domestic airlines. For example, if you transfer 100,000 points to Delta or Hawaiian, you’ll be charged $60. These fees are capped at $99 per transfer.

Here’s the full list of Membership Rewards transfer options:

| Program | Type | Transfer Ratio | Transfer Time |

|---|---|---|---|

| Aer Lingus AerClub | Airline | 1:1 | N/A |

| Aeromexico Club Premier | Airline | 1:1.6 | 2-12 days |

| Air Canada Aeroplan | Airline | 1:1 | Instant |

| Air France/KLM Flying Blue | Airline | 1:1 | Instant |

| Alitalia Millemiglia | Airline | 1:1 | Instant |

| ANA Mileage Club | Airline | 1:1 | 1-2 days |

| Avianca LifeMiles | Airline | 1:1 | Instant |

| British Airways Executive Club | Airline | 1:1 | Instant |

| Cathay Pacific Asia Miles | Airline | 1:1 | Instant |

| Delta SkyMiles | Airline | 1:1 | Instant |

| Emirates Skywards | Airline | 1:1 | Instant |

| Etihad Guest | Airline | 1:1 | Instant |

| Hawaiian | Airline | 1:1 | Instant |

| Iberia Plus | Airline | 1:1 | 1-3 days |

| JetBlue TrueBlue | Airline | 1.25:1 | Instant |

| Singapore KrisFlyer | Airline | 1:1 | 12-48 hours |

| Virgin Atlantic Flying Club | Airline | 1:1 | 1-2 days |

| Choice Privileges | Hotel | 1:1 | Instant |

| Hilton Honors | Hotel | 1:2 | Instant |

| Marriott Bonvoy | Hotel | 3:1 | Instant |

How to Earn Membership Rewards Points: There are a number of cards that earn Membership Rewards points, such as the AMEX Gold card, the AMEX Everyday and Everyday Preferred, just to name a few. However, the most notable and premium card that earns Membership Rewards is The Platinum Card from American Express. The card offers a bunch of benefits like 5x points on airfare booked with the airline, $200 airline fee credit, $200 in Uber credit, and more. (See rates & fees.)

Capital One

Capital One is the latest entry into the world of transferable points. The Capital One points program gives cardholders the opportunity to earn more than the one cent per point already available when booking travel directly through Capital One’s travel portal.

Points transfer to most airlines on a 2:1.5 basis. So with 40,000 points, you would get 30,000 miles on the airline of your choice. Most transfers are at a rate of 2 Venture miles to 1.5 airline miles, but Emirates and Singapore Airlines will transfer at a ratio of 2 Venture miles to 1 airline miles. There is a transfer minimum of 1,000 Venture miles and miles can be made in 100 mile increments. Read our review of Capital One’s points and transfer partners program.

Here’s the full list of Capital One transfer options:

| Program | Type | Ratio | Transfer Time |

|---|---|---|---|

| Aeromexico | Airline | 2:1.5 | Same Day |

| Air Canada Aeroplan | Airline | 2:1.5 | Same Day |

| Air France/KLM | Airline | 2:1.5 | Same Day |

| Alitalia | Airline | 2:1.5 | Same Day |

| Avianca | Airline | 2:1.5 | Same Day |

| Cathay Pacific | Airline | 2:1.5 | Up to five business days |

| Emirates | Airline | 2:1 | Same Day |

| Etihad | Airline | 2:1.5 | Same Day |

| EVA Air | Airline | 2:1.5 | Up to five business days |

| Finnair | Airline | 2:1.5 | Same Day |

| Hainan | Airline | 2:1.5 | Up to five business days |

| Qantas | Airline | 2:1.5 | Up to five business days |

| Qatar | Airline | 2:1.5 | Up to five business days |

| Singapore | Airlines | 2:1 | Up to five business days |

How to Earn Capital One Points: I already find value in the Capital One Venture card because it offers an easy way to save $500 on a flight with its standard 50,000 point sign-up bonus after spending $3,000 in three months. However, with the transfer possibilities, you could get even more value by smart transfer partner usage.

There’s an even better offer right now for high spenders. Earn up to 200,000 points with Capital One® Spark® Miles for Business card. 50,000 points are awarded after spending $5,000 in three months and then earn another 150,000 points after spending $50,000 within the first six months of card opening.

Chase Ultimate Rewards

Chase features some excellent transfer partners through their Ultimate Rewards program. With nine airline and four hotel partners, Ultimate Rewards is not the largest liquid points currency (American Express takes the cake there), Ultimate Rewards should remains a standard for any frequent flyer.

Here’s the full list of Ultimate Rewards transfer options:

| Program | Type | Transfer Ratio | Transfer Time |

|---|---|---|---|

| Aer Lingus | Airline | 1:1 | Instant |

| Air France/KLM | Airline | 1:1 | Instant |

| British Airways | Airline | 1:1 | Instant |

| Iberia Plus | Airline | 1:1 | Instant |

| JetBlue | Airline | 1:1 | Instant |

| Singapore Air | Airline | 1:1 | 12-24 hours |

| Southwest Airlines | Airline | 1:1 | Instant |

| United Airlines | Airline | 1:1 | Instant |

| Virgin Atlantic | Airline | 1:1 | Instant |

| World of Hyatt | Hotel | 1:1 | Instant |

| IHG | Hotel | 1:1 | 1 day |

| Marriott Rewards | Hotel | 1:1 | 2 days |

How to Earn Chase Ultimate Rewards Points: The Chase Sapphire Reserve is currently offering 50,000 points after spending $4,000 in three months, while also providing some of the best benefits of any card in this category. The Chase Sapphire Preferred is also offering 50,000 points after spending $4,000 in three months.

Currently, two of my favorite Ultimate Rewards cards are the Chase Ink Business Cash and the Chase Ink Business Preferred.

The Ink Cash offer includes a generous $500 cash back bonus after the user spends $3,000 in their first 3 months, and earns a fantastic 5% cash back at office supply stores and various business utility costs on the first $25,000 spent each year. It also earns 2% cash back at gas stations and restaurants for the first $25,000 a year, and 1% on everything else.

Big Sign-Up Bonuses: Chase Ink Preferred at 80,000 Ultimate Rewards points, the Chase Ink Cash at 50,000 Ultimate Rewards points.

The Chase Sapphire Reserve is still one of my top travel rewards card, while the Chase Sapphire Preferred is a solid recommendation as a first-time travel card. This card is currently offering 60,000 Ultimate Reward Points; its single highest ever public offer!

Citi ThankYou Points

While Citi is probably my least favorite rewards card program, there are still worthwhile transfer partners. Unfortunately, Citi does not any hotel transfer partners. Pooling points among friends and family members sharing the same billing address is a great advantage of the card. If one of your desired recipients has a Citi ThankYou account, then the shared address requirement is not needed. But do note the points transferred between accounts expire within 90 days.

How to Earn Citi ThankYou Points: Citi ThankYou points can be earned from the Citi ThankYou Premier and their top tier Citi Prestige credit card. The ThankYou Premier card is currently offering 50,000 Citi ThankYou points after spending $4,000 in the first three months of card membership.

Here’s the full list of ThankYou transfer options:

| Program | Type | Transfer Ratio | Transfer Time |

|---|---|---|---|

| Aeromexico | Airline | 1:1 | TBD |

| Air France/KLM | Airline | 1:1 | Instant |

| Avianca | Airline | 1:1 | Instant |

| Cathay | Airline | 1:1 | 12-24 hours |

| Etihad | Airline | 1:1 | 5-7 days |

| EVA Air | Airline | 1:1 | 1-3 days |

| Garuda Indonesia | Airline | 1:1 | 1-2 days |

| JetBlue | Airline | 1:1 | Instant |

| Malaysian Airlines | Airline | 1:1 | 2-3 days |

| Qantas | Airline | 1:1 | 1-2 days |

| Qatar | Airline | 1:1 | 1-2 days |

| Singapore | Airline | 1:1 | 12-48 hours |

| Thai | Airline | 1:1 | 4-7 days |

| Turkish | Airline | 1:1 | 1-2 days |

| Virgin Atlantic | Airline | 1:1 | Instant |

Marriott Bonvoy Rewards

Marriott’s rewards program isn’t a credit card company per se, but their Marriott Bonvoy program features 44 airline transfer partners in all.

Of all the transferable points programs, Marriott easily provides the most airline transfer partners. You can transfer Marriott points to most of these partners at a 3:1 ratio, but some transfer at a different rate — so check out the list below.

With more than 40 airline transfer partners, Marriott hotel points are perhaps the most flexible in the points and miles category.

A 3:1 transfer ratio to most airlines makes these points one of the few, if not the only, hotel point currencies which make sense to transfer. The kicker: Marriott adds a transfer bonus by adding a 5,000-mile bonus for every transfer of 60,000 Marriott points. For most airlines, this makes a 60,000 Marriott points transfer equate to 25,000 miles.

I consider it my top program when buying miles to top off an airline account to book an award.

My Tip: Transferring Marriott points is not an instant process. You should expect it to take anywhere between one day to two weeks so plan your transfer carefully if you need those points for an award you are planning to book.

Here’s the full list of Marriott Bonvoy transfer options

| Program | Type | Ratio | Transfer Time |

|---|---|---|---|

| Aegean Airlines | Airline | 3:1 | 3 Days |

| Aeroflot Bonus | Airline | 3:1 | 20 Days |

| AeroMexico ClubPremier | Airline | 3:1 | 4 Days |

| Air Canada Aeroplan | Airline | 3:1 | 4 Days |

| Air China Phoenix Miles | Airline | 3:1 | 5 Days |

| Air France/KLM Flying Blue | Airline | 3:1 | 3 Days |

| Air New Zealand Airpoints | Airline | 200:1 | 1-2 Days |

| Alaska Airlines Mileage Plan® | Airline | 3:1 | 4 Days |

| Alitalia MilleMiglia | Airline | 3:1 | 7 Days |

| ANA Mileage Club | Airline | 3:1 | 4 Days |

| American Airlines | Airline | 3:1 | 48 hours |

| Asiana Airlines Asiana Club | Airline | 3:1 | 4 Days |

| Avianca LifeMiles | Airline | 3:1 | <24 hours |

| British Airways Executive Club | Airline | 3:1 | 3 Days |

| Asia Miles | Airline | 3:1 | 5 Days |

| China Eastern Airlines Eastern Miles | Airline | 3:1 | 3-4 weeks |

| China Southern Airlines | Airline | 3:1 | 3 Days |

| Copa Airlines ConnectMiles | Airline | 3:1 | 3 Days |

| Delta SkyMiles® | Airline | 3:1 | 1-2 Days |

| Emirates Skywards® | Airline | 3:1 | 3 Days |

| Etihad Guest | Airline | 3:1 | 3 Days |

| Frontier Airlines EarlyReturns® | Airline | 3:1 | 4-6 weeks |

| Hainan Airlines | Airline | 3:1 | 8 Days |

| Hawaiian Airlines HawaiianMiles® | Airline | 3:1 | <24 hours |

| Iberia Plus | Airline | 3:1 | 1-2 Days |

| Japan Airlines JAL Mileage Bank | Airline | 3:1 | 48 hours |

| Jet Airways JetPrivilege® | Airline | 3:1 | 7 Days |

| JetBlue TrueBlue | Airline | 6:1 | 1-2 Days |

| Korean Air SKYPASS | Airline | 3:1 | 1-2 Days |

| LATAM Airlines LATAMPASS | Airline | 3:1 | 7 Days |

| Lufthansa Miles & More | Airline | 3:1 | 2-3 Days |

| LATAM Multiplus | Airline | 3:1 | 5-6 Days |

| Qantas Frequent Flyer | Airline | 3:1 | 4-6 Days |

| Qatar Privilege Club | Airline | 3:1 | 3-5 Days |

| Saudia Airlines | Airline | 3:1 | 5 Days |

| Singapore Airlines KrisFlyer® | Airline | 3:1 | 1-2 Days |

| South African Airways Voyager | Airline | 3:1 | 3 Days |

| Southwest Airlines Rapid Rewards® | Airline | 3:1 | 1-2 Days |

| TAP Air Portugal | Airline | 3:1 | 3-7 Days |

| THAI Airways | Airline | 3:1 | 4 Days |

| Turkish Airlines Miles&Smiles | Airline | 3:1 | 3-5 Days |

| United MileagePlus® | Airline | 3:1.1 | 1-2 Days |

| Virgin Atlantic® Flying Club | Airline | 3:1 | 1-2 Days |

| Virgin Australia Velocity Frequent Flyer | Airline | 3:1 | 1-2 Days |

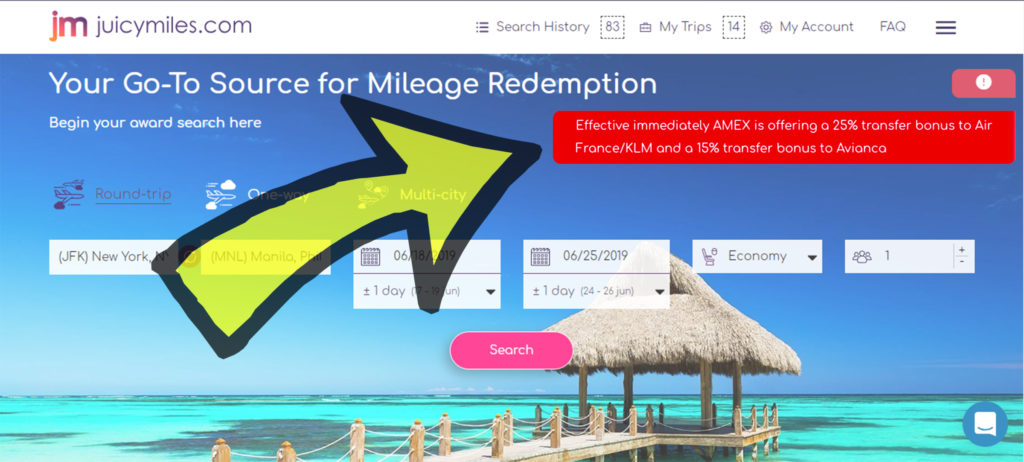

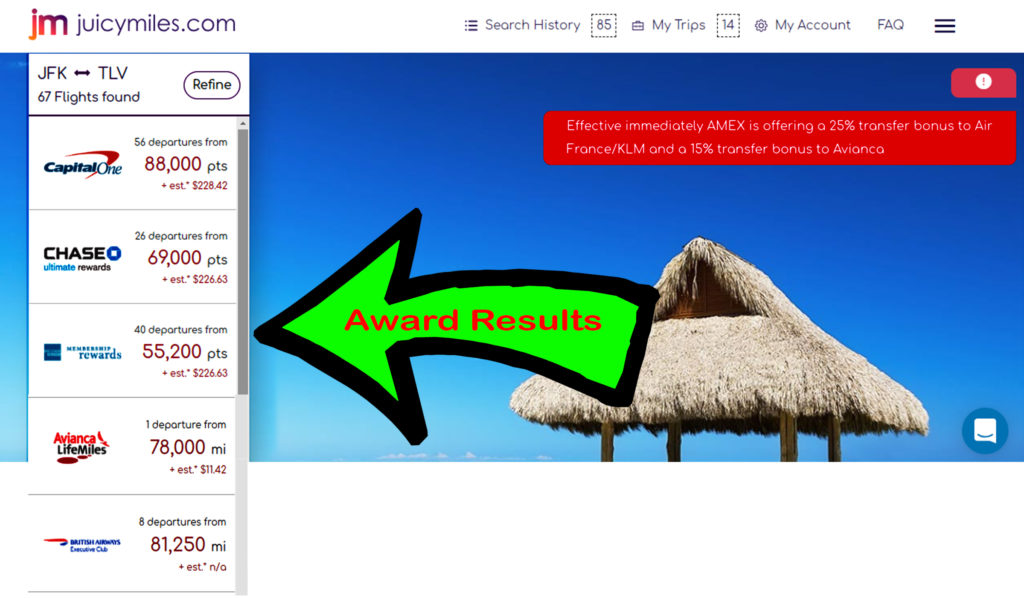

Juicy Miles Expert Help

If you don’t want to bother learning all the rules, partners, and transfer ratios, you can simply sign-up for one of Juicy Miles’ membership plans which easily present redemption options and calculations in a Kayak-like award search tool. Better yet, the tool now incorporates limited time transfer bonuses when calculating award pricing and alerts you to the latest transfer bonuses!

For example, using the tool to find a New York to Tel Aviv flight the site reveals more than 65 possible flights, spread across nine potential currencies (points and miles.) The award redemptions for a business class flight result in a range from a high of 168,000 Points + $228.42 to a low of 55,200 Points + $226.63. If your primary concern is saving a cash outlay, Juicy Miles will provide an award itinerary that costs 82,500 points and only $11.22 in cash.

Of course, you can also let the professional team at Juicy Miles do all the work for you. There is even an option that once you find an award using the tools included in your membership to have Juicy Miles book the award for you or let the team work with you one-on-one for that perfect redemption based on your points/miles/programs and travel wishes.

The Upshot

We get it. Keeping track of the various points and miles programs, along with transfer ratios, rules, partners and time of transfers is complex. However, it’s worth learning the basics of transfers instead of always using travel portals and airline miles directly. Use this Guide to Transfer Reward Points information to acquire and manage those programs most advantageous to your travel needs.

What program do you find the most valuable to transfer points to?

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

1 comment

[…] American Express’ 35% rebate on Membership Rewards points to purchase flights on their primary carrier (Delta) and business class fares with the […]