Southwest Airlines is my favorite carrier to fly. Second isn’t even close. Part of that is my family has held a companion pass since 2017, which we’ve used to travel all over the US and Mexico thanks to our high balance of Rapid Rewards points. Like any avid traveler, I had several trips planned this year that have gotten canceled thanks to COVID-19 meaning I had a lot of travel funds in my Southwest Airlines account. As of today, Southwest Airlines is allowing those travel funds to be converted into Rapid Reward points.

Terms of Transfer

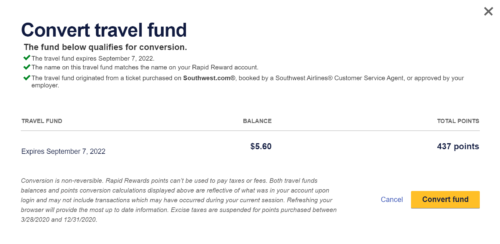

- Travel funds must have an expiration of September 7, 2022.

- The name on the travel fund must match the name in the Rapid Rewards account.

- The travel fund originated from a ticket purchased on Southwest.com or booked by a Southwest Airlines Customer Service Agent

- Corporate tickets aren’t eligible for conversion unless approved by your employer.

- The conversion must be completed by December 15, 2020.

- The conversion is non-reversible.

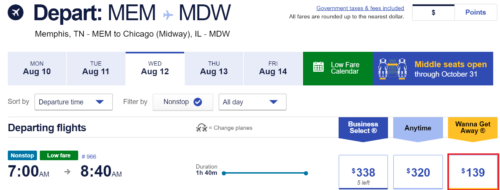

Middle seats will be open on Southwest Airlines till at least October 31. Photo Credit: Southwest Airlines

How to Convert

In order to take advantage of this opportunity first log into your Southwest account. From there click on the “My Account” and the top most link will be “View Travel Funds.”

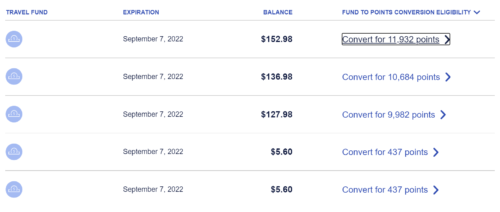

After, click that button and you will see a summary at the top of the next page showing how many Travel Funds Available for conversion. If you scroll down you will be able to see the individual breakdown of the fund to points conversion eligibility. In my account, I have 5 possible travel funds available to convert.

If you click on the column to the right, it will bring up the specific fund. From there, click the “Convert fund” button. I tested one of my $5.60 credits and the points showed upon immediately in my account.

Upsides of Converting

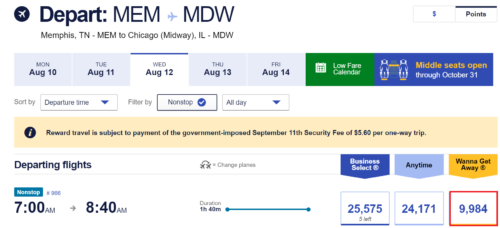

Overall, Southwest is being more than generous with their conversion rates. For example, I held a Travel Fund of $127.98 which would convert to 9,982 Rapid Rewards points for a rate of $0.0128 per point. However, if you go to book a flight say from MEM to MDW you can see that 9,984 points are worth $139.

This means that by converting you can essentially get almost 1.4c per point which at face value is very fair. In addition, by converting to points you can now book a flight for anyone vs. just the originally-ticketed passenger. Combine that with the fact that the points never expire and are never subject to change or cancellation fees and it truly is an amazing offer.

This Seems Like A No Brainer? What’s the Drawback?

The upsides of conversion are pretty large, so what’s the catch? First, travel funds can be used to pay taxes and fees associated with your ticket whereas with points you’ll need to pay that out of pocket. Second, by making a booking with Travel Funds you’ll earn Rapid Rewards points for the flight, like a cash booking would vs. with a points booking, no additional Rapid Rewards points are earned. This could become a deciding factor for those trying to earn A-List Status or a Companion Pass via points.

Upshot

Ultimately, I’m pretty sure we are going to end up converting all of our travel funds to points as I love the flexibility Rapid Rewards points offer. However, I’m still going to wait until closer to the December deadline to convert the rest of mine and my family’s travel funds just to be sure we aren’t going to do any traveling in the near future. I hate losing out on any possible points! Are you planning on converting your Travel Funds into points?

Have any questions about other Southwest Airlines policies? Here’s our Complete Guide to all things Southwest!

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

3 comments

Thanks for the writeup. I don’t think this is a no-brainer though. There are a couple disadvantages that I think you overlooked. First, if you convert to points, you’ll need to have enough points to book a ticket. For instance, let’s say I have $30 in travel funds. If I leave those as funds, I can supplement a ticket cost with a credit card. But if I convert to points, I’ll need to have enough points in my account to book a ticket, since you can’t pay with a mixture of points and cash. Which brings me to my second point. Chase UR is worth a minimum of 1.5cpp (and often much more). If you don’t have enough Southwest points to book a ticket, supplementing with UR would be a devaluation of the UR you transfer because, as you point out, it’s only worth 1.4cpp when it lands. So if you don’t have enough points in your Southwest account to book a ticket, you’re either stuck sitting on those points waiting for them to accrue organically, or you have to devalue your Chase points to use your Southwest point. I think it makes a lot of sense to stick with travel funds, personally.

Anybody know if funds converted to points count toward A-list and companion pass?

They would not count and its the reason to keep them as travel funds.