Wouldn’t it be nice to earn non-flying miles without having to sign-up for another credit card? A new player on the scene has found a way to differentiate itself by offering American Airlines AAdvantage® members a chance to earn miles simply by saving for the future!

Instead of interest, Bask Bank’s new Bask Savings Account lets account holders earn American Airlines AAdvantage® miles at a rate of one mile annually for every dollar saved.

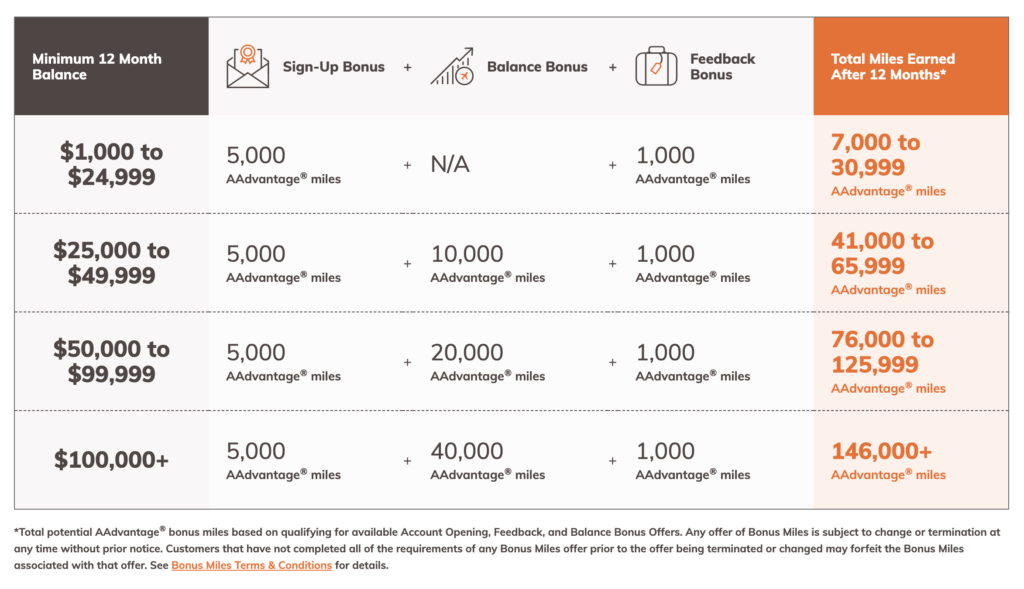

Better yet, the new bank is offering some very generous incentive bonuses for new customers.

https://www.youtube.com/watch?v=LCBg50QnPiU

About the Bask Savings Account

Most readers already know that you can earn significant miles by signing up for credit cards and then hitting required spending goals. However, non credit card options have been limited in recent years. Bask Bank is plugging that hole in the marketplace with their no-fee savings account that provides miles for saving, not spending! Given the measly interest paid by most banks for savings accounts, Bask Bank’s partnership with American Airlines could be quite attractive.

Miles earned can be used to book trips around the world to destinations like Casablanca, Morocco served by American Airlines and its future oneworld partner, Royal Air Maroc. Photo by Doran Erickson | Unsplash

Each dollar saved in a Bask Savings Account earns one mile annually. The miles are earned daily and awarded monthly. The miles are then deposited directly into your linked AAdvantage® account. You can calculate how many miles you’ll earn using a calculator on their website.

The FDIC-insured account works like any other online savings account. You can easily deposit or withdraw funds online or using their app. Having an active Bask Savings Account will also keep your AAdvantage® account active and miles from expiring.

Signup Incentives

Looking for a bigger mileage boost from the start? Bask Bank is offering special incentive offers for early adopters of the Bask Savings Account.

Account Opening Bonus

- If you open an account before March 1 and deposit $1,000 in your Bask Savings Account, you’ll earn 5,000 bonus American Airlines AAdvantage® miles. You’ll need to hold the minimum $1,000 balance for 30 consecutive days within 60 days of opening an account.

- If you open an account between March 1 and June 30, you can earn 1,000 bonus miles by depositing $1,000 in your Bask Savings Account. Like with the other promotion, you’ll need to hold the minimum $1,000 balance for 30 consecutive days within 60 days of opening an account.

Balance Bonus

Bask Bank is also offering incentives for users to increase the balances in their savings account.

- If you maintain a $25,000 balance in your Bask Savings Account for 12 consecutive months within 14 months of opening an account, you’ll earn 10,000 bonus miles. The first 5,000 miles will be paid after the first 6 months of maintaining the required balance and the second 5,000 will be deposited after 12 months. The bank notes that it may take 6-8 weeks for the miles to post.

- By maintaining a $50,000 balance, users earn 20,000 bonus miles. Like with the $25,000 bonus, you’ll need to maintain the balance for 12 consecutive months within 14 months of account opening. The first 10,000 miles will be paid after 6 months of maintaining the required balance and the balance will be paid after 12 months.

- Finally, users can earn a larger 40,000-mile bonus by maintaining a $100,000 balance. This offer also requires maintaining the balance for 12 consecutive months within 14 months of account opening. Bask Bank will pay the first 20,000-mile bonus after 6 months and the rest after 12 months.

Feedback Bonus

Even more miles! Bask Bank is also offering a 1,000-mile bonus for users who complete their feedback survey within 60 days of opening an account. This offer expires on June 20.

The value of this bonus will be reported to the IRS and the recipient is responsible for any federal, state or local taxes on this offer.

The Upshot

Most of the time, financial institutions incentivize you to spend more to earn miles. Bask Bank is trying something different here. With the Bask Savings Account, the more you save, the more you earn, bringing your next trip that much closer – and leaving you money to spend on the trip!

The Bask Savings Account lets you earn based on what you save, not spend, bringing your next trip that much closer.

Personally, I plan to sign up for the account before the end of the month to earn the 5,000-mile account opening bonus. If you max out the sign-up, balance, and feedback bonuses, we are talking 146,000+ American Airlines AAdvantage® miles!

Bask Bank and BankDirect are divisions of Texas Capital Bank, N.A. Member FDIC. The sum of your total deposits with (i) Bask Bank; (ii) BankDirect; and (iii) Texas Capital Bank, N.A. are insured up to $250,000. Additional coverage may be available depending on how your assets are held.

![]()

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

4 comments

do you get a 1099 from them?

This is a total ripoff!

I can get 1.6% return on a high interest account at Ally Bank

Even assuming 50% tax (less if in kid’s name) I get 0.8c AFTER Tax

Here, I get 1 mile per year + a 1099 of 0.42c = tax of 0.2c

So I would lose 0.8c after tax + PAY 0.2c tax = 1c lost for 1 mile

All to get a value of 1 mile from most AA redemptions

I value AA at 1.4 cents per mile, so this offer (without bonuses is 1.4%). Both cash and miles will give a 1099, but the miles will only be valued at .42 cents per mile). You actually get a tax break of sorts with the miles (taxess on .42 rather than 1,4 cents per mile). The returns after taxes for miles are better at 22% tax rate. The returns for dollars is slightly better than for mile at a 12% tax rate.

The bonus tilts things toward the miles FOR YEAR ONE. After that the returns go back to about equal. Note that you have to keep the funds in place for a year once you;’re doing the $25K or more, so I would use an interest rate of more like 2%. (one year CD rate). At the 2% rate I find miles to be MARGINALLY better dollars, but not enough that I would do a lot.

I think to call it a rip-off is hyperbole. Personally I did a $1,000 deposit and did the feed back. In a year I will have 7,000 miles ($98 value at 1.4 cents) for nearly a 10% return before taxes, I may still keep it in place after rewards to be sure I an always extending the miles even if drop my AA credit card (or may remove it after 60 days).

So., I’m not jumping in big, but it’s certainly a decent return and not a ripoff.

Can one open a business account and receive the miles benefits?