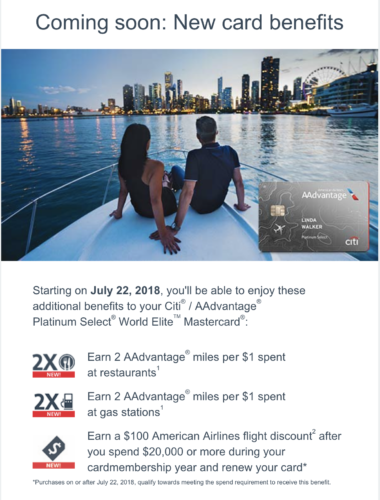

Beginning July 22nd, Citi is adding additional benefits to the Citi® / AAdvantage® Platinum Select® World Elite™ MasterCard®. The new editions include 2x points per $1 spent at restaurants and gas stations as well as a $100 American Airlines flight discount after spending $20K or more during your cardmembership year and renewing the card (purchases from July 22nd onwards count towards that requirement). Meanwhile, the annual fee will increase from $95 to $99 per year (though first year fee free for new applications).

Don’t have the card or has it been 24 months since you opened or closed it? You are eligible for up to 200K AAdvantage miles…

American Airlines AAdvantage Opportunity for 200K Miles

The number of American AAdvantage miles on offer right now is 200K miles from credit card sign-ups alone, and that’s before hitting the spend requirements thanks to limited time offers from both Citi and Barclaycard! Of course, these can be used for amazing partner redemptions on Etihad, Cathay, JAL, Qatar, and more.

I personally took advantage of 3 of the offers a few months back, though my total haul was 170K as Citi was offering 60K on both cards then. The best ever offer remains for the business edition of the card.

AAdvantage

Citi and American are providing applicants 50,000 AAdvantage miles after $3K in purchases within the first 3 months for the Citi® / AAdvantage® Platinum Select® World Elite™ MasterCard®. The normal public offer for this card is as low as 30K miles and sometimes jumps as high as 50K. This special 50K offer includes a $0 annual fee for the first year, priority boarding, and a free checked bag. In addition, you’ll earn 10% of your redeemed AAdvantage® miles back — up to 10,000 AAdvantage® miles each calendar year.

You can check out full details for this card and other top airline cards here.

- Earn 50,000 American Airlines AAdvantage® bonus miles after making $2,500 in purchases within the first 3 months of account opening*

- First checked bag is free on domestic American Airlines itineraries for you and up to four companions traveling with you on the same reservation*

- Enjoy preferred boarding on American Airlines flights*

- No Foreign Transaction Fees on purchases*

- Receive 25% savings on in-flight food and beverage purchases when you use your card on American Airlines flights*

- Double AAdvantage® miles on eligible American Airlines purchases*

- For a limited time, earn 60,000 American Airlines AAdvantage® bonus miles after making $3,000 in purchases within the first 3 months of account opening*

- First checked bag is free on domestic American Airlines itineraries for you and up to four companions traveling with you on the same reservation*

- Enjoy preferred boarding on American Airlines flights*

- Earn 2 AAdvantage® miles per $1 spent on eligible American Airlines purchases*

- Earn 2 AAdvantage® miles for every $1 spent on purchases at telecommunications, car rental merchants and at gas stations*

- Earn 1 AAdvantage® mile per $1 spent on other purchases.*

Remember, Citi does limit individuals from receiving sign-up bonuses to once every 24 months after opening or closing the same type of card (an open account past the 24 month mark…even for the same card is OK). There is also guidance that you should apply for no more than one Citi card per day and that you wait 8 days in between applications…and that you submit no more than 2 applications per 60 day period. So for this 120K combo, I’d apply for one card today and then another 8 days later.

THEN, Barclaycard is offering 50K AAdvantage miles after your first purchase within 3 months for their AAdvantage® Aviator™ Red World Elite Mastercard®. There’s no minimum spend, but there is a $95 annual fee which is not waived. The normal offer for this card is 40K miles. The T&Cs state that the offer “may not be available if you already have or have had an account with us”. The FlyerTalk Wiki is a bit more specific – existing cardmembers, existing accounts, and previous cardmember with accounts closed in the past 24 months may not be eligible for this offer. This does not include members who were transitioned from a US Airways card to an Aviator Red card. Also, there are numerous posts of existing and previous cardmembers receiving the sign-up bonuses multiple times (myself included), which seems to points to the more liberal policy stated in the application T&Cs. The card also offers first checked bag free and 10% of your redeemed miles back. Barclycard is also offering 40K for the business version of the card –AAdvantage® Aviator® Business Mastercard®.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.