Last week, United Airlines joined a growing number of competing airlines when it rolled out a completely new way of pricing award seats.

Dating back to the beginnging of many frequent flyer programs, airlines based award redemptions on charts that outlined how many points/miles were needed to fly a certain distance, or between certain regions. Over time there have been added features, like peak pricing and different tiers of pricing.

But now, major carriers including Air France, Delta Air Lines and now United are throwing the award charts in the trash and will decide how many miles a flight costs on a case-by-case basis.

The new pricing model, known by industry insiders as dynamic award pricing, has some frequent flyers and points afficianados fuming. There may be a simple reason for the upset: dynamic pricing is totally unlike what has been done in the past, and thus requires a completely different skillset to maximize how points and miles are redeemed.

I help book dozens of awards each year for clients through Juicy Miles, and after working with these changes on a near daily basis for the past year, I can offer the following points of guidance on how to rethink your points and miles strategy to cope with dynamic pricing.

Breaking It Down:

Throw Out The Old Lingo

If you thought the 60,000 bonus points you got through your United MileagePlus Explorer card signup were worth a round-trip to Europe, you were right, but get ready start thinking differently. For flights after Nov. 15, that same chunk of United MileagePlus miles may only get you part of the way, or it may get you there with more miles to spare. It’s now more difficult to assess just how far a specific number of miles will get you.

This is an important point in rethinking not just recent offers, but in thinking about how to use points and miles generally. Miles are starting to behave more like a free-floating currency, and less like the old coupon systems they were first designed to replace.

Be Ready To Shop Around

Like airfare, award rates in dynamic pricing models will float freely. Many frequent points and miles users have become accustomed to the luxury of using points for last-minute flights, which were often an outsize bargain considering that award prices were fixed while cash prices drifted upwards.

This does not, however, mean that award prices will always track airfare prices. Just because miles aren’t pegged to a chart doesn’t mean airlines don’t surprise customers with last minute deals or business class bargains.

Since Air France moved to a dynamic mileage award pricing scheme, I’ve been able to book business class seats for less than 50,000 miles one-way, far fewer than what was previously possible. Image by Air France

The two big dynamically priced frequent flyer programs I’ve worked with over the past year (Air France and Delta) maintain their miles pricing model independently from their revenue pricing model. I’ve found great mileage rates through Air France and Delta for business class flights that were pricing at normal or even above-average rates in cash airfare. I’ve also found some great last minute deals on Delta flights, even after cash prices soared.

Unlike before, these prices are less reliable. That means shopping around and jumping on deals when possible. Trying different nearby airport combinations can have dramatic effects on award pricing in dynamic pricing systems like the ones Air France, Delta, and United are now using.

Empowerment: Flexible Rewards Programs

Shopping around is a key theme in this post, in case you haven’t noticed yet, and nothing favors shoppers more than choice.

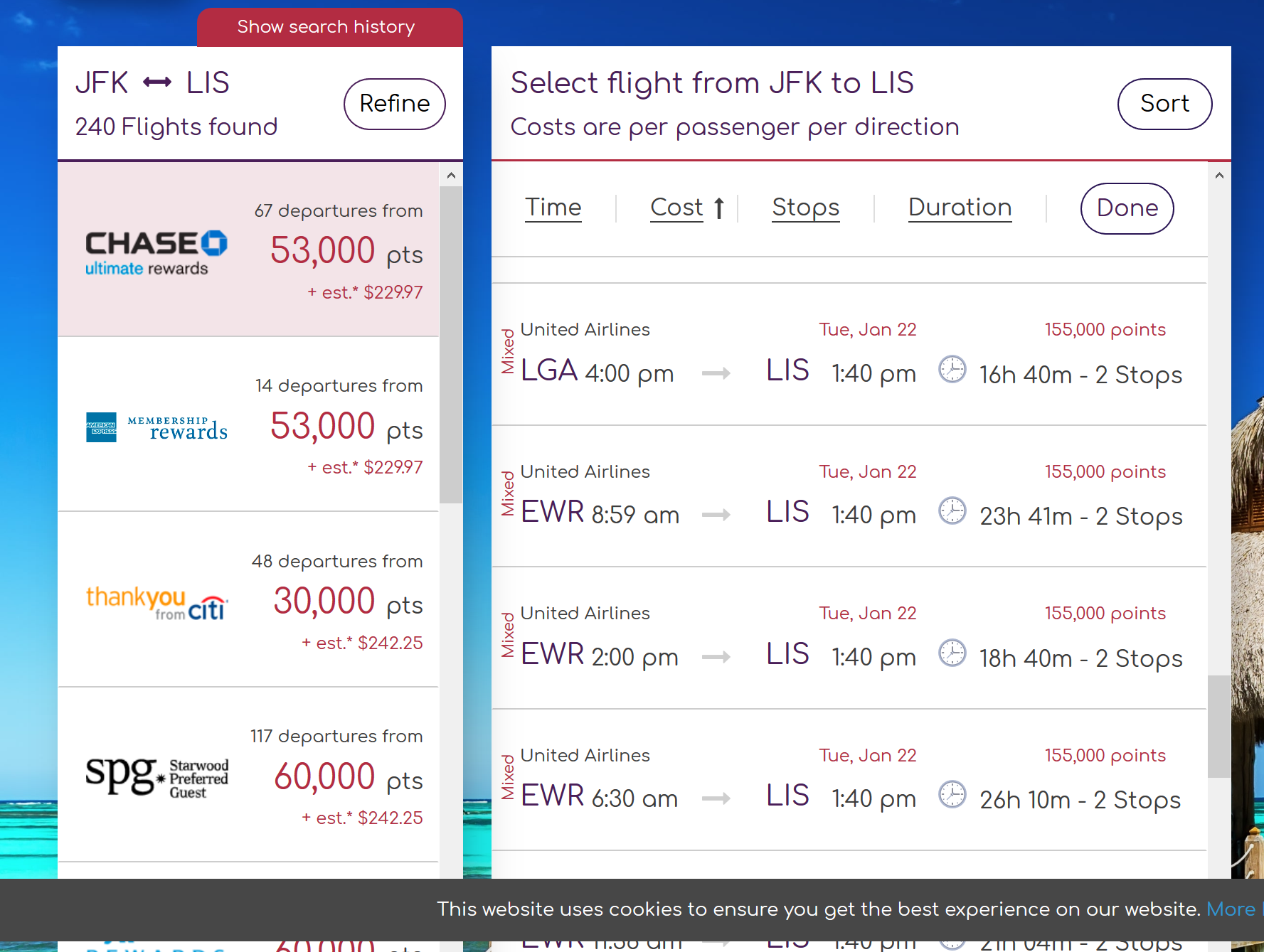

I’ve already changed how I manage to spend on my own travel cards. As often as possible, I’ll make purchases using cards with transferable points, increasing the likelihood I get a decent rate on whatever flight I’m needing to book. There are over a half-dozen transferable points rewards cards available to consumers.

- American Express Gold Card, Platinum Card, Business Gold Card and Business Platinum Card

- Chase Sapphire Preferred, Sapphire Reserve and Ink Business Preferred

- Citi ThankYou Premier and Prestige Card

- Capital One Venture Rewards Card

Take Advantage Of New Tools To Compare Award Prices

Technological innovation has helped flyers get a foothold on cheaper airfare. Online travel agencies like Expedia were first to provide a forum to compare airfare. Now fare aggregators (think Google Flights, Kayak, Skyscanner) pull in fare data from just about as many places as it can be found.

Award pricing tools are just now coming on the market. Like fare compare engines, they make it possible to see awards as priced across airlines, and even across multiple dates. The tools represent tremendous time savings for those with transferable cards, which have dozens of different airline partners all with different award prices. They can also be helpful for those with mileage in several different airlines.

A slew of new award search tools, like Juicy Miles, can show you multiple points booking options in just one search. Just be prepared to pay a fee upfront — these sites can’t collect on your airfare.

One key difference is that, unlike fare engines, which take a cut of your airfare, award search engines cost money to use up front. Fortunately, they tend to be relatively inexpensive to sign up for and can save hours of time otherwise spent searching for award flights through different airline websites.

Don’t Overreact: Learn

Some feel that airlines are taking away control over how they use their reward miles. Systems for redeeming miles that were simple and somewhat reliable are now being manipulated behind the scenes.

It’s easy to feel as though airlines are pulling away from their end of the bargain.

But, while these new systems are radically different, there hasn’t been much empirical evidence confirming the theory that airlines are pulling the plug on customers. After a 2017 report by McKinsey Co. chided airlines over growing frequent flyer mile stockpiles, some data indicate that airlines have started releasing a higher percentage of seats for frequent flyer redemption.

Airlines operate frequent flyer programs so that customers want to use their airline more frequently than they might otherwise. That means, at the end of the day, that airlines have to balance new changes with pleasing customers like you. The whole point of the program is to keep your business.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.