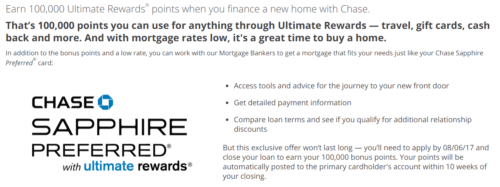

I keep receiving this offer as I scroll through my Facebook newsfeed, sometimes with Chase Sapphire Reserve language, other times with Chase Sapphire Reserve (probably time to clear my browsing history) language. In any case, it’s open to customers who signed up for a Sapphire, Sapphire Reserve or Sapphire Preferred credit card prior to 05/07/2017. Those that qualify can obtain 100K Ultimate Rewards points upon closing.

This offer is only available for new, residential first mortgage purchase loans submitted directly to Chase. Applications must be submitted between 05/08/2017 and 08/06/2017. Chase mortgage loan must be funded and closed in order to be eligible to receive 100,000 Ultimate Rewards points. Upon the customer’s enrollment, Chase will review the account to ensure the eligibility criteria are met. This offer is not transferable, is limited to one per property at any given time, and may be discontinued at any time without notice. 100,000 Ultimate Rewards points will be posted to the Primary Cardholder’s account within 10 weeks after closing a purchase mortgage with Chase. Your participation in the program may result in the receipt of taxable income from Chase and we may be required to send to you, and file with the IRS, a Form 1099-MISC (miscellaneous income). You are responsible for any tax liability, including disclosure requirements, related to participating in the program. Please consult your tax advisor if you have any questions about your personal tax situation.

If you meet the qualifications, but haven’t been targeted, you can click here for the offer or reach out to your local banker.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

1 comment

I would shop for the best deal and if it happens to be Chase then consider it. We have refi’d repeatedly over recent years, never seen Chase pop up in the running. Of course, YMMV?