Starting March 5, TD Bank started adding steep fees for customers using their TD Bank accounts. The charges include fees for using non-TD Bank ATMs and accessing their funds outside the country.

While travel may be on hold as the Coronavirus crisis stops international travel, this is a tough blow for TD Bank customers. Many of them chose to bank with TD Bank precisely because they don’t charge any foreign transaction fees. Luckily, there’s an alternative that continues to provide (and exceed) the international benefits TD Bank customers are used to.

Breaking It Down:

Fees Charged By TD Bank

But first, what fees does TD Bank now charge?

The bank is levying a $3 fee on customers anytime they use their debit card to withdraw funds at any ATM that is not owned by TD Bank. In addition, they charge a hefty 3% foreign transaction fee for any transaction outside the United States or in a foreign currency.

With TD Bank Adding Fees Customers Look for an Alternative

TD Bank Customers have been blunt in their dissatisfaction since the changes were announced. Many have taken to Twitter to express their outrage and search for an alternative bank.

https://twitter.com/AmyMyersNJ/status/1230650910801584129

@TDBank_US just received a notice about upcoming account changes and am I understanding this correctly? If, after March 5th, I use my debit card for a purchase while visiting another country OR for an online purchase from an international site I will be charged a 3% fee?

— Natalie (@hey_itsnataliek) January 17, 2020

Well, @TDBank_US will be losing our household as customers I guess. I already pay the fee for using a non-TD ATM when I'm abroad, and now they are going to charge me 3% of my withdrawal too? What garbage.

— Gerry Martini (@Gerry_Martini) January 21, 2020

When I first opened a bank account I chose @TDBank_US because of awesome perks like no ATM fee.

Today they charged me a 3 dollar non TD ATM fee and a 3 dollar balance inquiry which I hit by accident on the machine.

There are multiple other reasons this bank sucks. Stay away.

— Bobby Kay (@BKayZone) October 17, 2019

What’s the best alternative to access your money internationally without fees?

Luckily for customers heading for the exits, there’s another bank offering fee-free debit-card purchasing and ATM withdrawals worldwide. Better yet, you can even get ATM fees refunded.

So-Fi Money is the best TD Bank Alternative

SoFi is most known for loan products, but they also offer a cash management product known as SoFi Money.

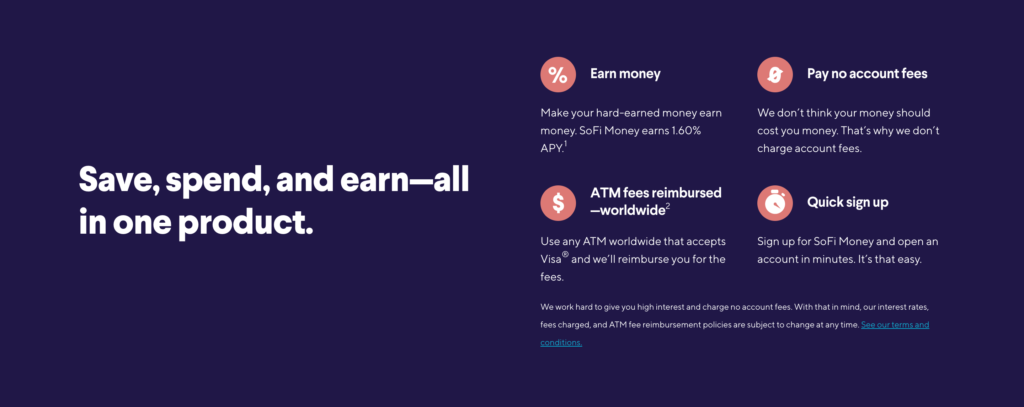

SoFi Money comes with a generous sign-up bonus. Deposits earn a 1.6% APY and they don’t charge account or international fees making your next international vacation that much more affordable.

SoFi Money is an online cash management platform without physical branches — everything is conveniently managed through their website or app. They also have a customer service phone number if that’s more your style. But that doesn’t mean you can’t easily access your money. SoFi Money allows you to withdraw money from ATMs worldwide without a fee, they’ll even refund the ATM owner’s fee.

Signup Bonus

At the moment, SoFi Money is offering a $50 bonus to anyone who signs up and deposits at least $500 through a personal referral link (like this one). That’s a pretty generous bonus.

Getting the bonus is easy. It should post within 10 business days of eligible activity being completed after signing up.

SoFi Money Benefits

I am incentivized for you to sign up for SoFi Money using my referral link, but it’s easy to make a case for this account. The long-term benefits easily outshine the initial $50 bonus:

- ATM fees are reimbursed worldwide. Use any ATM machine and it’ll be reimbursed to you.

- No foreign transaction fees on debit card purchases.

- No account fees

- Modern website and app to manage your money with.

- Get paid a 1.60% APY

International ATM fee refunds, earning an 1.6% APY on deposits, and no account fees are just some of the benefits customers switching from TD Bank to SoFi Money will benefit from.

In addition to the primary benefits, the account will offer Mastercard benefits detailed below and often offers special offers like their recently completed 20% off Netflix offer.

Mastercard World Debit Benefits

SoFi announced in January that it would be switching from Visa to Mastercard. While they noted that “there are no changes to your existing SoFi Money benefits. You will continue to get 1.60% APY on all your cash, pay no account fees, and all of the other features you love with SoFi Money,” they are adding some new benefits.

The new benefits from Mastercard will include:

- Mastercard Airport Concierge™: Available 24/7/365 at over 450 destinations worldwide, cardholders get 15% off personal Meet and Greet agents to escort them through the airport on departure, arrival and/or any connecting flights and expedite them through the security and/or the immigration process (at participating airports).

- Cell phone protection: When you pay your cell phone bill with SoFi Debit Mastercard, In the event your phone is accidentally damaged or stolen you may be eligible to receive up to $200 per claim, $25 deductible, up to 2 claims per year. Unlimited lines associated with the cell phone bill.

- Mastercard golf: Provides discounted access to golf courses, complimentary grounds passes for PGA Tournaments, access to domestic and international golf travel packages, and more.

- Additional SoFi member experiences: On top of SoFi member experiences, SoFi Money Mastercard cardholders will have the opportunity to engage in bonus exclusive, once-in-a-lifetime experiences with the people they love in the cities where they live and travel.

- Enhanced security with credit monitoring, alerts for suspicious activity, and white-glove service to help you resolve issues with Mastercard ID Theft Protection™.

- Purchase assurance: May provide coverage for new items purchased with your SoFi World Debit Mastercard that are damaged or stolen within 90 days of the date of purchase, up to $1,000 per claim.

- Extended warranty: May double the original manufacturer’s (or store brand) warranty. Coverage is for eligible items purchased with your Mastercard.

Bottom-line: SoFi Money Is The Best Account For Americans Internationally

Save on fees around the world while earning a 1.6 APY on your funds with TD Bank alternative SoFi Money.

While the loss of free international spending with TD Bank may be a hard blow, SoFi fills the gap with most of the benefits customers are used to—and more. When I signed up for SoFi Money a few months ago it took about two minutes. The $50 referral bonus for signing up for an account using a referral link is a good reason for signing up. But the account offers solid long-term value like no foreign transaction fees and ATM fees reimbursed worldwide.

Do you have SoFi Money? Tell us your thoughts in the comments. And feel free to share your referral link as well!

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

8 comments

Also CapitalOne 360 and Schwab.

Agreed, I use Capital one 360 in Brazil also and pay no atm or foreign transaction fees.

Eventually going to cancel my TD checking account as well due to the 3% added foreign transaction not to mention the $15 a month fee when my checking account falls below $100 dollars.

Having the tweets in the article is great because then the reader know it’s about TD Bank in the US. TD Bank in Canada is even worse. Every 1000 customers that enter a branch is tied up and punched in the stomach while a clerk takes some money from the customer’s wallet. They then blame America and the culprit even though it’s not true. Canadians like to rip each other off with high prices and high taxes. Milk costs double what it does in the US. Gas and rent are much higher too.

Keep in mind that although Sofi does not charge ATM fees, Visa will charge a 1% foreign fee for using the ATM overseas. Please look at the conditions at the Sofi website. I think this destroys the benefit of this bank

Actually, since SoFi switched to MasterCard this fee is gone as well — it’s totally free

This article is misleading. TD Bank still doesn’t charge any fees for non-TD ATMs, and even reimburses fees for non-TD ATMs as long as you keep a $2,500 minimum balance [TD Beyond Checking, old TD Premier Checking]

Schwab Bank is excellent. They give you a free $100 for your checking account and a free $100 to open a stock account. I love my Schwab card-I’ve had no issues-it’s simply the best way to get money in foreign countries -bar none!

SoFi might be good, but I can’t seem to get my ID accepted to open up an account there. The reps keep telling me to take another photo of my ID.