Over the past few years, we have seen a the introduction of quite a few “ultra premium” credit cards. These are cards the generally carry an annual fee of $450 or more, but (usually) with benefits that make the fees worthwhile.

The American Express Platinum Card is obviously one of the more established names in the premium credit card market. However, the Chase Sapphire Reserve and the Citi Prestige have now also become major players, perhaps casting an even wider net with an expanded demographic.

Interestingly, this past year has also seen the announcement and launch of two major credit cards: The Hilton Aspire card and the SPG Luxury card from American Express. These cards both carry a $450 annual fee, but come with benefits like hotel elite statuses, airport lounge access, and an annual free night. It seems like hotels also want a slice of the ultra premium credit card market, and is willing to offer up to top-tier status for cardmembers.

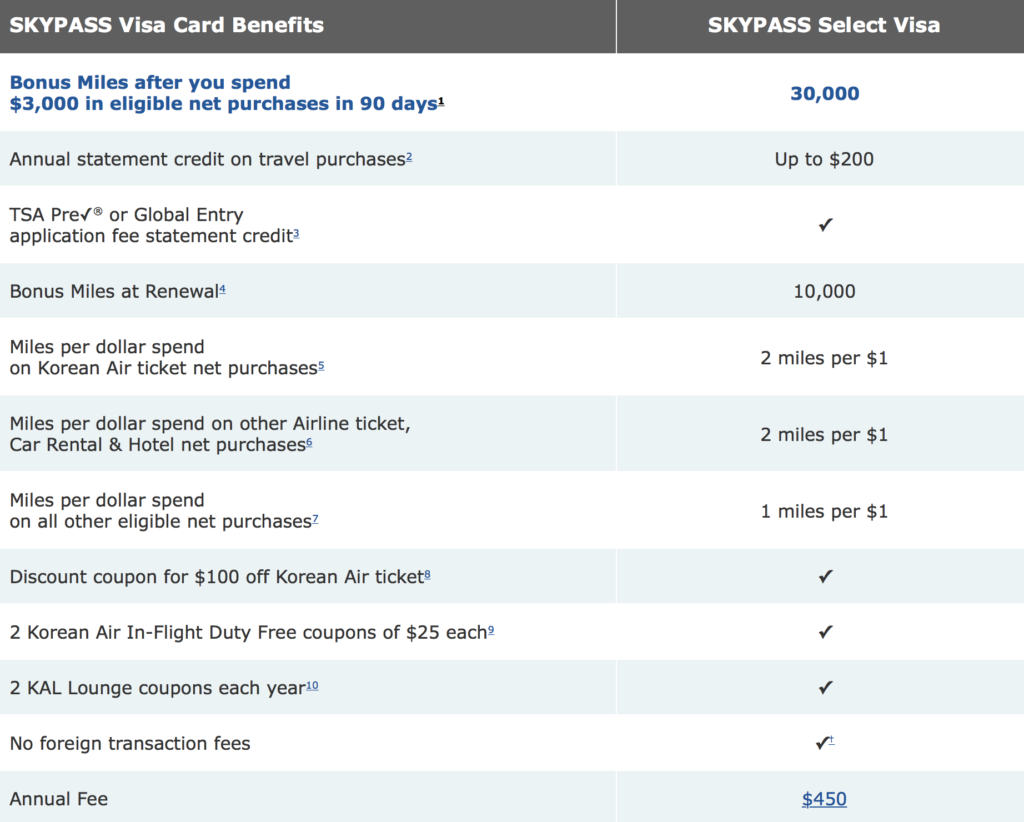

The US Bank Korean Air SKYPASS Select credit card comes with a $450 annual fee. Source: US Bank

Now, I should note, American Airlines, Delta, and United all offer a “premium” credit card, in that they carry a $450 annual fee. However, these cards focus on access to the airlines’ own lounges, and are essentially “discounted” lounge membership with limited other travel benefits.

That brings us to a new player in the high-annual-fee credit card space. US Bank today has announced a new Korean Air SKYPASS Select credit card, which comes with a $450 annual fee. Here are some of the notable benefits:

- 30,000 miles sign-up bonus after $3,000 spend in 90 days

- 10,000 bonus miles upon card renewal after $35,000 spend in a year

- $200 annual travel credit (airlines, hotels, or car rentals)

- $100 discount coupon for travel on Korean Air

- TSA PreCheck or Global Entry credit, once every 4 years

- Two $25 discount coupon for in-flight duty free purchases on Korean Air

- Two KAL Lounge coupons

- 2 miles per $1 on Korean Air ticket purchases

- 2 miles per $1 on purchases made directly with airlines, hotels, or car rentals

- 1 mile per $1 on all other purchases

I can’t help but scratch my head in trying to understand what the target demographic of this card is. The value proposition really is quite poor, both in terms of benefits provided, and in terms of reward earning potential. Even if you take all the coupons at face value, you are still only getting $350 in a restricted currency back, plus two lounge passes a year.

The new US Bank Korean Air SKYPASS credit card.

Consider an alternative, the Chase Sapphire Reserve (CSR) card. For $450 a year, the CSR providers cardmembers with a Priority Pass membership, a $300 relatively unrestricted travel credit, and 3x points on travel and dining.

On top of that, Chase Ultimate Rewards is a transfer partner with Korean Air SKYPASS, so you would actually earn more points with the CSR on Korean Air than with this SKYPASS credit card. Moreover, many KAL lounges are actually in the Priority Pass network, so you could access KAL lounges in Los Angeles (LAX), New York (JFK), Seoul (INC), and Tokyo (NRT), for example, with the Priority Pass membership…for an unlimited number of times.

New products in the credit card market can keep banks competitive, but I think US Bank really dropped the ball on this card. The limited and restricted benefits, coupled with poor reward earning rates, really don’t justify the hefty price tag.

What do you think of the SKPASS Select credit card?

(HT Doctor of Credit)

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

1 comment

Another DOA. This one is worse than Barclays Arrival Premier.