I keep five Marriott and Starwood credit cards, and every year around this time I have to figure out if I’m justified paying the combined $574 in annual fees to keep all of these cards (which now feed into the same rewards program) open and active.

The changes that have been made by the recent Marriott/SPG merger have provided a unique opportunity for cardholders. Most of the focus in the blogging world about this merger recently has been about booking Marriott Rewards Travel Packages and acquiring airline miles in addition to the 7-night hotel stay.

Previously: Marriott-Starwood Merger Not So Smooth for Hotel Owners

I think one of the best and most overlooked changes from this merger are the SPG cards gaining the same annual free night benefit as the Marriott Rewards Premier Plus and Marriott Premier Business cards.

Between my wife and I, we currently hold four Starwood Preferred Guest Credit Cards from American Express and two Chase Marriott Rewards Credit Cards. The breakdown and their respective fees are as follows:

- Marriot Bonvoy Boundless Visa Signature Credit Card (Previous Starwood Preferred Guest Personal) (self) – $95

- Marriott Bonvoy Business Card from American Express (Previous Starwood Preferred Guest Business) (self) – $95

- SPG Personal (spouse) – $95

- SPG Business (spouse) – $95

- Marriott Rewards Premier Plus (self) – $95

- Marriott Rewards Premier Business (self) – $99

Total Annual Fees Spent – $574

Most people would look at this and probably think it’s a bit insane. I see a missed opportunity to have two more Marriott cards and two more annual free night awards. If my wife wasn’t bumping up against the Chase 5/24 policy, I would implore her to sign up for the Marriott Cards too, for a total of 8 annual free night awards.

Each one of my six annual night certificates is valued at up to 35,000 Marriott points which is good for a standard Category 5 booking, or Category 4 during peak times. I am essentially buying 210,000 Marriott points for $574. If you were to buy those points directly from Marriott it would cost $12.50 per 1,000 points or $2,625 for 210,000 points.

Squeezing Value out of $574 in Marriott and Starwood Credit Cards

This is the fun part! One thing I had always wanted to do, but have never had the opportunity to do, is travel to Europe. As the merger approached I had a slew of extra Marriott/SPG points that I wanted to do something with and so I used them for an older Category 9 seven night Travel Package and grabbed an extra 120,000 Southwest miles in the process. We decided to attach the reservation to the family-friendly Domes of Elounda in Crete prior to the merger.

As this is my first trip to Europe I want to make the most of it. Therefore, we are going to make this a two-week trip using our 7-night package and all six of our annual Marriott/SPG free nights to stay 13 nights in various places in Europe for almost no cost. The first week abroad is when we are looking to use the free night awards at a few cities and then in our second week head to Crete for some R&R.

London

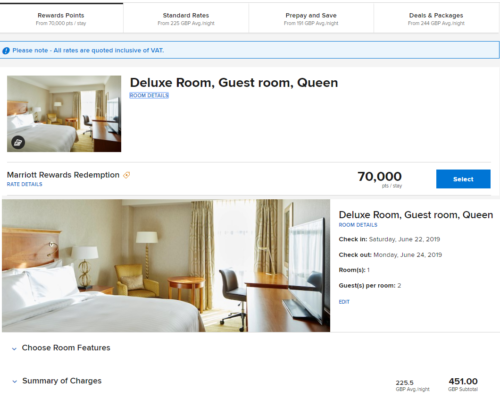

My Deluxe Queen Room at the Marriott Hotel Kensington in London. Image by Marriott.

One of the most expensive cities in Europe, London proved a tricky destination for 3 people. One hotel that I found that would accommodate my family is the London Marriott Hotel Kensington. This Category 5 goes for 35,000 points a night and is only a few miles from some major attractions like Buckingham Palace would require using two free night awards + 50 GBP for a rollaway bed for my son. By just using two free night certificates in London I have already recouped my $574 in annual fees as this hotel would otherwise cost me $579.31 for two nights.

London Marriott Hotel Kensington

Paris

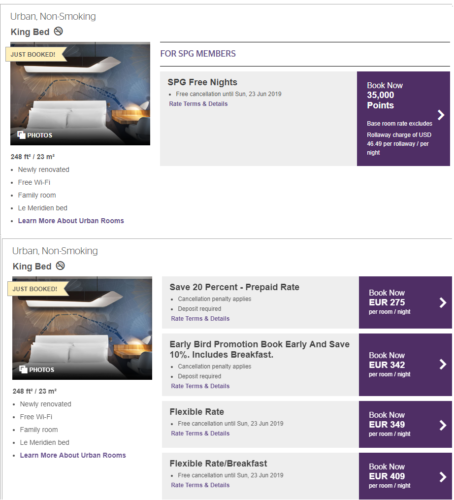

The La Meridien Etoile in Paris provided great value and modern rooms.

Again, finding points space for a family in Paris was a pain, and most of the rooms are on the smaller side. However, we were able to find space at the Le Méridien Etoile. This Category 5 property comes in at 35,000 a night as well and is close to the L’Arc de Triomphe. The other sights, like Cathédrale Notre-Dame de Paris and the Eiffel Tower are further, but as we love exploring cities by foot it works for us.

The Le Méridien Etoile would let us book award space and then for a fee of $46.49 each night add a rollaway bed. By booking this hotel we are getting the equivalent of 349 Euro a night as the free night bookings are fully refundable should we need to change our plans. If we were paying cash, this hotel would set me back $1,244.41. Instead, our 3-night stay will cost me 3 free night awards and $139.47.

The Urban Room at the La Meridien Etoile. Image by La Meidien Etoile.

Athens

The last stop before heading to Crete will take us to Athens. We will be using this as a jumping off point to get to Crete and ultimately the Domes of Elounda. Being close to some of the major sites here is a priority and after doing some research it looks like the Fresh Hotel in Athens, a Category 4 property, will suit us perfectly. The standard rate here would set us back €141 Euro a night, or $328.04 for the two nights. However, by using our 6th award night and another 25,000 points we would not have a bill to pay upon departure.

Upshot

For our family, the $574 I spend this year on SPG and Marriott credit card fees will net just over $2,000 in rewards.

Another perk: everything I book with Marriott and Starpoints is refundable, should circumstances require a change which is invaluable when trying to book an international trip.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

4 comments

I’ve added to my collection. Ritz, chase Marriott and 2 spg Amex personal and biz and the new Amex spg luxury card. But I’m actually a Hyatt loyalist and maintain globalist. Occasionally though, I end up in cities where Hyatt is impractical. But I can easily get SPG status now with a 75k spend so it’s still beneficial. But I think my situation is uncommon. I can easily put about 700k in credit card spend a year without MS.

Hal,

First, that’s a ton of spending in a year so you don’t have much trouble accumulating points and there is no doubt that makes your situation unique. I’m envious of that! I’d keep the SPG Lux card just for the spending Platinum benefit if you don’t already have lifetime status.

Personally, I love Hyatt and their tier benefits, but for us getting Marriott status has been much easier through matches, etc. since I do no traveling for business. Not to mention Marriott counted free nights toward status and Hyatt did not until this year. We spent 400k points at Hyatt last year…

In addition to my SPG/Marriott cards we keep two Hyatt cards for the annual free nights @$75 each. We just used those for the Hyatt Regency Grand Cypress in Orlando worth ~$500. The bonus with those free nights is there is no resort fee attached to award bookings unlike some that we’ve been hit with at Marriott.

Your use of a rollaway bed highlights the challenge of using points for hotel stays for a family of four in Europe and Asia where nearly all of the rooms are either a king/queen or two single beds. I have switched to AirBnB in these regions now that my children are older, or stay in less expensive hotels forced to pay for two rooms a night instead of one.

If i dont have the spg card, cpuld i get the brilliant and downgrade? Thanks.