It’s easy to think that mail we receive from banks is either junk or unsolicited offers. But recently, I learned a lesson about paying closer attention to the letters I receive, particularly from Chase. Chase has been sending out warning notices before they close credit card accounts for inactivity.

I first became aware Chase was doing this a few months ago — when I received written notice that one of my cards had actually been closed completely.

My Credit Card Closure Story

When I received the notice of credit card account closure, I tried to shake loose the memory of having closed that card on my own. Nope, never did it.

Then, I called Chase only to find out they closed it — for inactivity. I never before received a warning that a card would be closed for inactivity. Nevertheless, I didn’t want to close this particular card.

The Chase representative didn’t disclose much information except for that the card was being closed for inactivity. After telling Chase that I didn’t want to close the card and asking if there was anything I could do, I was given the option to put some spend on the card and have it reopened.

I guess that as a first time inactivity offender I was given some leeway.

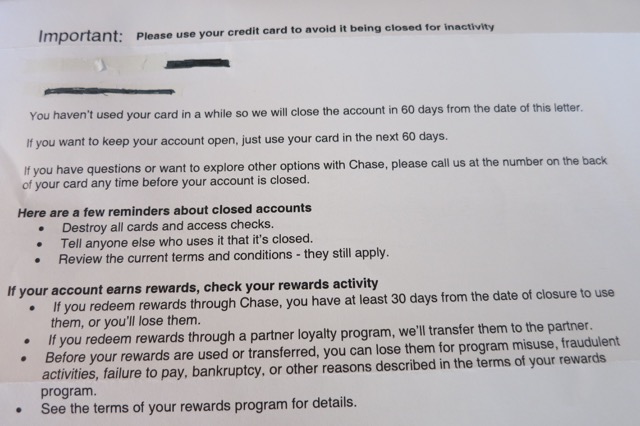

Account Inactivity Letter

Fast forward to a few days ago. Chase sent me an inactivity closure warning letter for my Chase Ink Business Cash card. It basically said I had to put spend on the card within 60 days in order for it to stay active.

I’m glad I’m catching these now and paying closer attention. I appreciate these warnings, and especially the 60 day window to put some spend on the card.

The Upshot

While this isn’t earth shaking news, I do think it’s worth reminding readers to get some of those cards out of the sock drawer and put some spend on them before you get a warning from the bank or worse, a letter that the card has been closed.

And certainly don’t do what I did and ignore mail from Chase. It sure would be a hassle to have an issuing bank like Chase close a card when you want to keep it open.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

4 comments

I got a similar notice a few months back, but don’t recall for sure if it was Chase.

I do try to have some activity on each card at least once a year.

Good idea, Carl. I think that’s what I’ll do going forward. Thanks for reading.

Why not use the Ink Business Cash Card for phone service/internet/cable — 5X UR is such a great return for these purchases. Don’t forget about 5X UR with this card for purchases at office supply stores, where you can use the card to buy all kinds of gift cards, including Home Depot/Lowe’s, JC Penney, Delta, restaurants, Shell, etc.. This really is one of my favorite cards out there.

Hi Michael, Good reminder of the card’s benefits. He’s out of the sock drawer and in the rotation. Thanks!!