Delta is continuing to take deliveries of its brand new Airbus A220 planes — and they’re headed all over the country. Last year, Delta expanded their order for the A220 aircraft. Delta ordered a total of 95 Airbus A220 aircraft. This includes 45 A220-100s, and 50 A220-300s. These aircraft are quickly becoming a staple in Delta’s fleet. The A220 is replacing less fuel efficient regional and smaller narrowbody planes. So her at PointMe we wanted to share the latest Delta a220 routes with our readers and fans of this new plane.

Delta had its first scheduled transcontinental route with the A220 with a once daily service between Atlanta and Seattle. That route began on June 8, 2020. Since then, we have seen a huge expansion of the routes offered by my favorite US carrier.

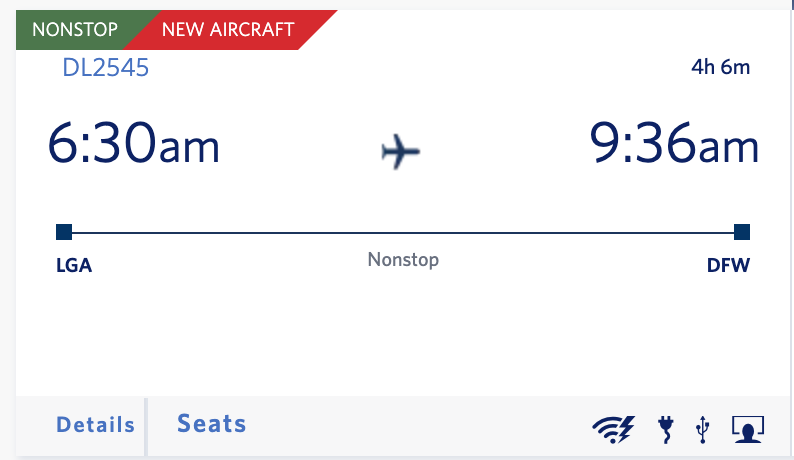

As Delta takes delivery of more of these planes, it’s likely there will be routes that are missed from the list below. However, Delta makes it easy to see what plane you are on — they even have a specific designation called “new aircraft” in the booking process.

“New aircraft” label means this flight is flown by an A220

The Full Delta A220-100 Routes List (Effective May, 2021)

(P.S. This chart is sortable.)

| Aircraft | Delta Hub | Airport Code | Serving City | Airport Code |

|---|---|---|---|---|

| A220-100 | Boston Edward L. Logan International, MA (BOS) | BOS | Austin-Bergstrom International, TX (AUS) | AUS |

| A220-100 | Detroit Metropolitan Wayne County, MI (DTW) | DTW | Dallas/Fort Worth International, TX (DFW) | DFW |

| A220-100 | Detroit Metropolitan Wayne County, MI (DTW) | DTW | Washington Ronald Reagan National, DC (DCA) | DCA |

| A220-100 | Detroit Metropolitan Wayne County, MI (DTW) | DTW | Austin-Bergstrom International, TX (AUS) | AUS |

| A220-100 | Detroit Metropolitan Wayne County, MI (DTW) | DTW | Newark Liberty International, NJ (EWR) | EWR |

| A220-100 | Detroit Metropolitan Wayne County, MI (DTW) | DTW | Minneapolis/St Paul International, MN (MSP) | MSP |

| A220-100 | Detroit Metropolitan Wayne County, MI (DTW) | DTW | Boston Edward L. Logan International, MA (BOS) | BOS |

| A220-100 | Detroit Metropolitan Wayne County, MI (DTW) | DTW | Nashville International, TN (BNA) | BNA |

| A220-100 | Detroit Metropolitan Wayne County, MI (DTW) | DTW | New Orleans Louis Armstrong International, LA (MSY) | MSY |

| A220-100 | Detroit Metropolitan Wayne County, MI (DTW) | DTW | New York LaGuardia, NY (LGA) | LGA |

| A220-100 | New York John F Kennedy International, NY (JFK) | JFK | Dallas/Fort Worth International, TX (DFW) | DFW |

| A220-100 | New York John F Kennedy International, NY (JFK) | JFK | Washington Ronald Reagan National, DC (DCA) | DCS |

| A220-100 | New York John F Kennedy International, NY (JFK) | JFK | Jacksonville International, FL (JAX) | JAX |

| A220-100 | Los Angeles International, CA (LAX) | LAX | Houston George Bush Intercont., TX (IAH) | IAH |

| A220-100 | New York LaGuardia, NY (LGA) | LGA | Dallas/Fort Worth International, TX (DFW) | DFW |

| A220-100 | New York LaGuardia, NY (LGA) | LGA | Houston George Bush Intercont., TX (IAH) | IAH |

| A220-100 | Minneapolis/St Paul International, MN (MSP) | MSP | Austin-Bergstrom International, TX (AUS) | AUS |

| A220-100 | Minneapolis/St Paul International, MN (MSP) | MSP | Dallas/Fort Worth International, TX (DFW) | DFW |

| A220-100 | Minneapolis/St Paul International, MN (MSP) | MSP | Washington Ronald Reagan National, DC (DCA) | DCA |

| A220-100 | Minneapolis/St Paul International, MN (MSP) | MSP | New York John F Kennedy International, NY (JFK) | JFK |

| A220-100 | Minneapolis/St Paul International, MN (MSP) | MSP | Boston Edward L. Logan International, MA (BOS) | BOS |

| A220-100 | Minneapolis/St Paul International, MN (MSP) | MSP | Newark Liberty International, NJ (EWR) | EWR |

| A220-100 | Seattle-Tacoma International, WA (SEA) | SEA | Austin-Bergstrom International, TX (AUS) | AUS |

| A220-100 | Seattle-Tacoma International, WA (SEA) | SEA | Chicago O'Hare, IL (ORD) | ORD |

| A220-100 | Seattle-Tacoma International, WA (SEA) | SEA | Nashville International, TN (BNA) | BNA |

| A220-100 | Seattle-Tacoma International, WA (SEA) | SEA | Washington Dulles International, DC (IAD) | IAD |

| A220-100 | Salt Lake City International, UT (SLC) | SLC | Santa Ana John Wayne, CA (SNA) | SNA |

| A220-100 | Salt Lake City International, UT (SLC) | SLC | Chicago O'Hare, IL (ORD) | ORD |

| A220-100 | Salt Lake City International, UT (SLC) | SLC | San Jose Norman Y. Mineta International, CA (SJC) | SJC |

| A220-100 | Salt Lake City International, UT (SLC) | SLC | Houston George Bush Intercont., TX (IAH) | IAH |

| A220-100 | Salt Lake City International, UT (SLC) | SLC | San Francisco International, CA (SFO) | SFO |

| A220-100 | Salt Lake City International, UT (SLC) | SLC | Austin-Bergstrom International, TX (AUS) | AUS |

| A220-100 | Salt Lake City International, UT (SLC) | SLC | Santa Ana John Wayne, CA (SNA) | SNA |

Seasonal A220 Routes

Winter Routes from December through January

Detroit (DTW) – Austin (AUS)

- New York (JFK) – Tampa (TPA)

- Seattle (SEA) – Portland (PDX)

- New York (JFK) – West Palm Beach (PBI)

- New York (JFK) – Fort Myers (RSW)

- Salt Lake City (SLC) – Las Vegas (LAS)

- Seattle (SEA) – Denver (DEN)

Fall Routes

- New York (LGA) – Fort Myers (RSW)

- New York (LGA) – New Orleans (MSY)

Delta’s Airbus A220 Features

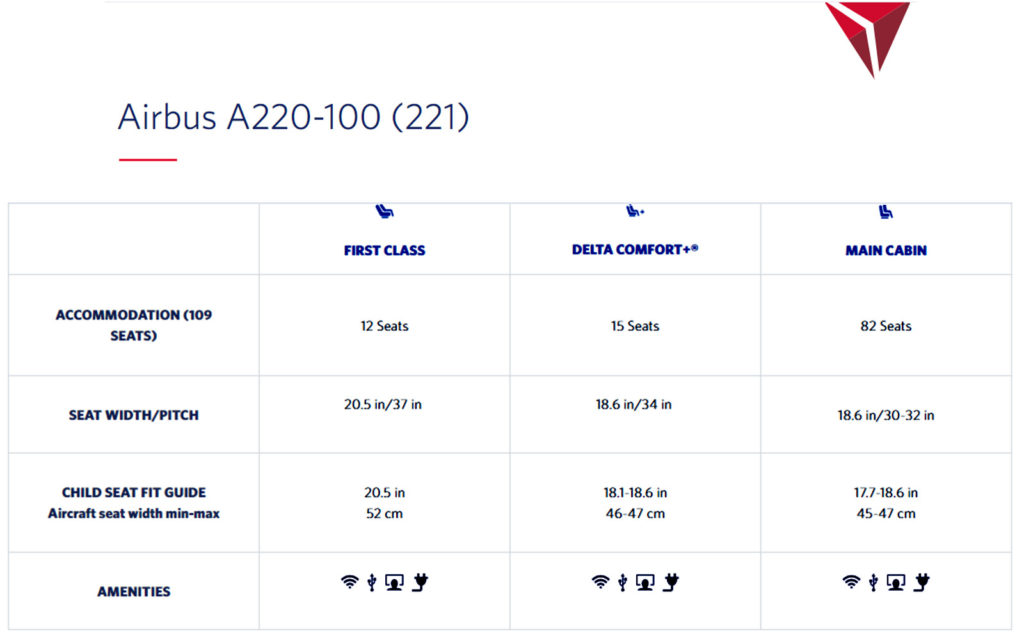

The A220 is a customer-friendly aircraft. We’re talking gate-to-gate Wi-Fi, some of the widest economy seats around, and even a window in the spacious lavatory. Nope, no contorting to use the bathroom here.

Delta’s version of the A220 has a total of 109 seats, including 12 first class seats, 15 Comfort+ seats, and 82 economy seats. It features seatback entertainment at every seat and high-speed Gogo 2Ku Wi-Fi. Seats in economy are an impressive 18.6″ wide, making them the widest economy seats of any narrowbody.

The semi-famous Delta A220 “loo-with-a-view”

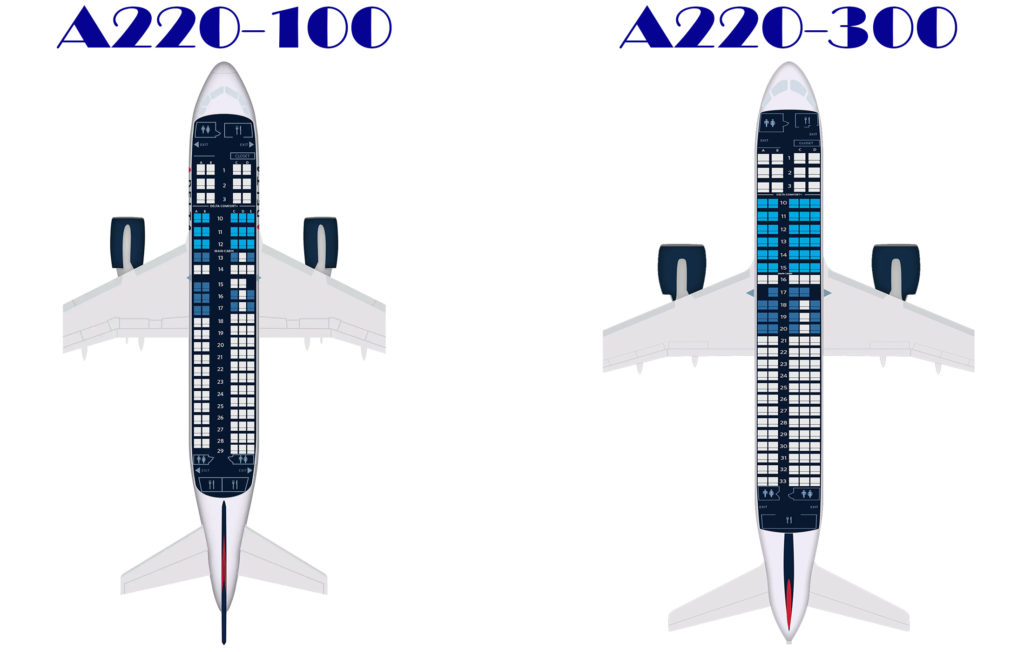

Delta Now Flies the Airbus A220-100 & A220-300 Variant

When we look at Delta’s fleet of the new A220, the airline operates both a A220-100 and the A220-300 aircrafts. What differences will flyers experience between the A220-100 and A220-300? The airplanes have identical flight ranges (2,415 miles, 3887 km,) the big variable is passenger capacity.

There are 109 seats on the Delta A220-100, and 130 seats on the A220-300 aircraft.

Delta’s A220-100:

and Delta’s A220-300:

Seat Distribution by Cabin:

Aircraft A220-100 A220-300 Boeing 717

First Class Seats 12 12 12

Comfort+ Seats 15 30 20

Economy Seats 82 88 78

Since the pandemic, Delta has been aggressively replacing its fleet of Boeing 717’s. There are approximately 45 left in active service as of this post. All of Delta’s B717’s are scheduled to be retired by 2025.

Delta hopes to continue adding A220’s to its fleet. In addition, Delta has signed an agreement to take delivery of up to 100 Airbus A321neo aircraft. Those deliveries should begin (and put into service) beginning in 2022.

Delta’s A220-300 Routes (Effective May, 2021)

(P.S. This chart is sortable.)

| Aircraft | Delta Hub | Airport Code | Serving City | Airport Code |

|---|---|---|---|---|

| A220-300 | Minneapolis/St Paul International, MN (MSP) | MSP | Dallas/Fort Worth International, TX (DFW) | DFW |

| A220-300 | Salt Lake City International, UT (SLC) | SLC | Austin-Bergstrom International, TX (AUS) | AUS |

| A220-300 | Salt Lake City International, UT (SLC) | SLC | Denver International, CO (DEN) | DEN |

| A220-300 | Salt Lake City International, UT (SLC) | SLC | Dallas/Fort Worth International, TX (DFW) | DFW |

| A220-300 | Salt Lake City International, UT (SLC) | SLC | Houston George Bush Intercont., TX (IAH) | IAH |

| A220-300 | Salt Lake City International, UT (SLC) | SLC | San Francisco International, CA (SFO) | SFO |

Delta Will Soon Have Domestic A220 Competition

Delta better enjoy its exclusivity with the A220 as long as it can; JetBlue has ordered the aircraft, upping its initial order by another 10 aircraft at the recent Paris Air Show. According to airlineroutes “Jet Blue has firmed up an order for an additional ten A220-300 aircraft from existing options. This follows an initial order for 60 A220 aircraft – announced in July 2018 – will be phased in as replacements for the airline’s existing fleet of 60 Embraer E190 aircraft.”

Earning SkyMiles With Delta

Some of the best Delta and American Express co-branded credit cards to use for SkyTeam Tickets include:

- Delta SkyMiles® Platinum Business American Express Card (Learn More)

- The Delta SkyMiles® Platinum American Express Card (Learn More)

- Delta SkyMiles® Gold Business American Express Card (Learn More)

- Delta SkyMiles® Gold American Express Card (Learn More)

Check out the best credit cards I hold.

The Upshot

Now is the perfect time to try out flights on both of Delta’s A220 aircraft. With Delta’s 2022 Medallion Status Accelerators, Delta SkyMiles elites can earn 50% bonus for Delta Economy tickets. That earnings bonus increases to 75% for Comfort+, Business and First Class flights!

As Delta continues to take delivery of the A220, there will be even more new routes that be flown on this fantastic plane. While this list includes the routes where an A220 will fly, not all flights are operated by this plane so it’s important to pay attention to the specific aircraft when booking. Also, aircraft swaps are always possible.

All of these flights above are now bookable so if you wanted the chance to try the new bird, get going. We’ll try to continuously update this list as new routes with the A220 are announced.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

33 comments

Typo. Austin (AUS), Seattle (AUS)

Thanks for the catch — fixed!

I Still see AUS and SEA listed twice for December 2019

Ah, the table is quite finicky. Should be updated now, thanks for the catch.

This is a fantastic aircraft! I was on one of them earlier this year operated by SWISS. Love the huge windows and overhead bins. The bathroom was roomy too.

Delta is smiling ear to ear knowing they didn’t order B737’s!

At least in theory I’m scheduled on a SFO->SEA flight in late September on an A220 on DL.

Scheduled on an A220 from SLC to SFO in September 2019

DTW – EWR started end of May 2019

MSP-EWR as well, starting in July I think

This is missing SLC-SJC (already launched).

Flew it last night. Lovely and comfortable aircraft. Haven’t felt this good in economy seats since the 90s. Except for the insanely loud sounds that all Airbus aircraft seem to make during pushback, taxi and after landing. It was like all 100 people in the aircraft were having a collective, strong, loud fart for about 10 minutes.

Bombardier actually designed this plane and brought it to fruition, not Airbus, and it was unfortunately sold to Airbus, which ultimately reassigned it the “A220” moniker. So, are the loud noises on it, which are a staple on other Airbi, really from Airbus (did they change something with the plane) or was it always that way, from Bombardier’s design?

You have Boeing to thank for that, for its anti-dumping petition against Bombardier. If you ask me, the 737 issues are karma for Boeing and Muilenburg.

See map of routes here (Oct 2019)

http://www.gcmap.com/mapui?P=dtw-dfw/iah,+lax-aus/sea,+msp-dfw/iah,+jfk-dfw,+lga-bos/dfw/iah,+slc-dfw/iah/sea/atl/jfk,+sea-sjc/sfo/fai/sna

This is fantastic, thanks Jack!

Any chance of DCA or IAD getting the A220 on any flights?

Nothing formally announced, but I noticed some unannounced routes like DTW-EWR with the A220 so always worth checking as more of these planes are deployed.

Where could I find an updated list? I know they’re on way more routes these days!

Anony-

Thank you for the comment. I have updated the list, supplied directly to us from Delta (effective May 2021.) Hope this helps you and many more fans of these two great aircraft experience many, many happy & safe flights in the near future!

Looks like many of these routes out of MSP are replacing old B717s. I guess now that they are rid of those god-awful MD88/MD90s, they can focus on weeding out the 717s and 757s.

Lance-

Exactly! The pandemic has actually increased the rate of retirement for many of these older aircraft!

Thanks for sharing your thoughts.

Exclusivity – LOL

It’s a 717 to the average flyer – 2×3 layout

Delta has ‘exclusivity’ on those too – hope there are pilots to fly them. UNITED is rising this time around.

[…] Delta’s Full List Of Airbus A220 Routes – Two Plane Layouts […]

Great list but you missed SLC-SJC. They’ve been flying SJC for a year and a half.

Joe-

Thanks for the input, however that flight is included in the list. Perhaps it is farther down on your (viewable) screen. If you search SJC in the list’s box, you’ll see the SLC-SJC route.

Thanks for reading!

My flight from STL to MSP is slated to be an A220 also.

Adam-

Delta is adding more A220 routes going forward.

Thanks for sharing and Enjoy!

Searching flights from ORD to SEA until September 7th indicate the A220 -100 Afterwards from September 8th on its showing the 737 -800. Any way to verify that they are changing planes and if so why? Thanks, Roy

Roy,

This is correct. The A220 non-stop service between ORD and SEA is scheduled to end with the last flight on September 7th.

The Boeing 737-800 is not the Boeing 737MAX (Delta never had these planes in their fleet.)

I am sure the reshuffling of aircraft is in response to Delta’s ongoing ramping up of flights as post-pandemic travel improves passenger loads.

great question and thanks for the due diligence!

Thanks for the confirmation. I was going to purchase a 1st class ticket and use my companion credit for my wife but I think I will stick to Comfort Plus and use points and/or some e-credits we have if we end up booking after Sept 7th.

LGA has more A220-100 and -300 routes operating currently / future.

There is LGA – MSP (A223) – ends sometime in September I believe according to their schedule.

LGA – SRQ (A221) – “”

LGA – TPA (A221)

LGA – PBI (A223)

LGA – ORD – (A221) currently – Will soon phase out into all A223s in Late August – Early September

LGA – IAH (A221) – to get 1 (A223) added in the fall

LGA – DFW (A221)

Delta also mentioned an LGA – RDU addition as well. Exact date is still unknown (Doesn’t show in schedule)

[…] Delta […]

[…] an airline releases a press release, usually it’s for positive news like perhaps a brand-new aircraft, a revolutionary business class, or a branded product […]