Although I love visiting new places and doing new things, there is one place that holds a special place in my heart: Disney World. I recently wrote about being able to snag a few nights for cheap in Orlando due to an exclusive AMEX offer. This naturally sparked the conversation between my wife and I to spend a few days at the parks.

Disney recently announced that they are increasing their prices…again. If you’ve been keeping count like I have, this is the third price increase in the last thirteen months. Thankfully, with the help of some credit cards and the points that come with them, we will be spending three days in Disney World for a fraction of the actual cost.

Breaking It Down:

Barclays Arrival Plus: Free Park Tickets For The Adults

Park tickets are, without a doubt, the largest expenditure on any Disney trip. This is especially true on shorter vacations where the net cost per day is more expensive.

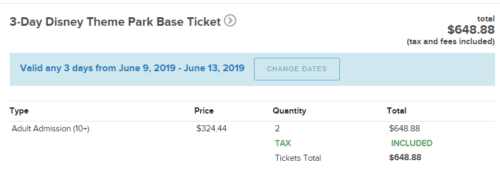

One way to keep costs down, and what we did for this trip, is selecting three-day passes without the park hopper option. Even still, this is supposed to cost a whopping $960 for three people — so how did I book these tickets for free?

Pro-Tip: Not with Disney, that’s for sure. Instead, I used a third party site called Undercover Tourist. They key here is that this site codes purchases as “travel” on your credit card statement. Buying directly with Disney codes them as “entertainment.”

This slight difference allowed me to charge the ticket purchase to my Barclay’s Arrival Plus World Elite Mastercard.

Want exclusive Character Experiences? Use the Chase Disney Visa Card to gain additional in park benefits

The Disney Visa Card by Chase offers additional benefits like discounted dining and merchandise.

Barclays is currently offering 70,000 miles on their Arrival Plus World Elite Mastercard, worth $700 in cash back on travel expenses.

You need to spend $5,000 on the card in order to earn the bonus. As the card earns 2x miles per dollar spent, it earned me another 10,000 miles, or $100 in cash back. That meant $800 in total cash back.

I booked both Disney tickets for both my wife and myself using this card. The Arrival Plus World Elite Mastercard also is currently waiving the $89 annual fee during the first year.

As you can see, I exchanged 64,888 miles to cover two of the tickets needed. One of the perks of the Arrival Plus World Elite Mastercard is that it gives an additional 5% back for all points redeemed. This means that I will receive 3,244 miles for future use.

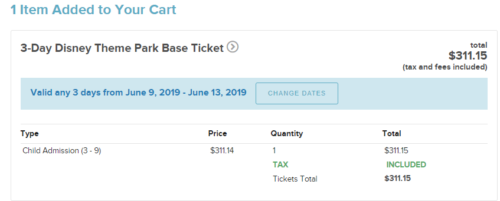

Capital One Venture: Free Park Tickets For The Kid

I was going to be $160 short of covering my son’s ticket cost so I opened a second card. I applied for the Capital One Venture Rewards Credit Card. This card offers 50,000 bonus miles after completing $3,000 in spending. Since the card gives 2x points per dollar on almost all purchases (and 10x on hotels.com!), I earned 56,000 points after completing the minimum spend.

This is equivalent to $560 in travel benefits. Similar to the Arrival Plus World Elite, there is no annual fee in the first year.

For my son’s ticket, I redeemed 31,115 miles leaving me with around $250 in travel benefits to be used on a future trip.

Chase Ultimate Rewards: An (Almost) Free Hotel, Flight, and Car

My favorite transferable currency is Chase Ultimate Rewards points due to their ability to transfer to partners like Southwest and Hyatt. However, one often overlooked benefit is their ability to book travel directly using UR points.

This includes some Disney properties. After going under 5/24, my wife was able to open up the Chase Ink Business Preferred Credit Card. This gave us another 85,000 Chase Ultimate Rewards points to use for this trip, including the minimum spending. We were able to redeem them directly for 0.015/cent a point on the Chase’s travel portal.

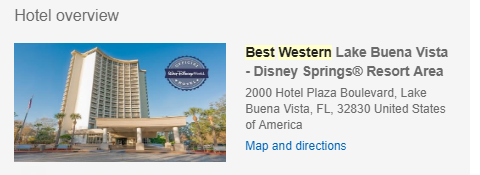

In the past, you could book Deluxe Disney properties like the Polynesian and Contemporary through the Chase portal. Unfortunately, those are no longer options, but you can book all of the Walt Disney World Lake Buena Vista properties including:

- B Resort & Spa

- Best Western Lake Buena Vista

- DoubleTree Suites by Hilton Orlando

- Hilton Orlando Buena Vista Palace

- Hilton Orlando Lake Buena Vista

- Holiday Inn Orlando

- Wyndham Garden Lake Buena Vista

These hotels offer all of the benefits of being “on-property” including 60-day advance Fastpass+ reservations and Extra Magic Hours.

Just 1 of the 7 hotels that are bookable using Chase Ultimate Reward points that retain “on-property” benefits.

For our three nights, I booked us the Best Western Lake Buena Vista and used 22,750 Chase Ultimate Rewards points on my Chase Sapphire Reserve for a total of $341.25 saved. Unfortunately, there are $41.97 in resort fees that need to be paid — even while using points. This left a remaining 57,250 Chase Ultimate Reward points from my Chase Ink Business Preferred Credit Card signup bonus which I used to cover my flights.

Flights & Rental Car

As mentioned earlier, Chase Ultimate Rewards is a transfer partner with Southwest Airlines. Therefore, I used some of the points I acquired during my Chase Ink Business Preferred Credit Card signup bonus and transferred them to my Southwest Rapid Rewards account. I was able to book roundtrip flights from Memphis to Orlando on Southwest using 35,604 Rapid Rewards points and $33.60. However, after earning my companion pass for the year I only needed to pay for two tickets, thereby saving me 11,868 Rapid Rewards points. This left my total cost to get to Orlando at 23,736 Rapid Rewards points and $33.60.

Chase’s Ink Business Preferred Card is perennially one of the best bargains out there.

The best part is that I still had 33,516 Chase Ultimate Rewards points left in my account which gave me the ability to book a rental car using 15,680 of those points. This car will enable my family to get to the property from the airport, shop for groceries, and drive to see some other sites. There is no out of pocket expense on this rental. The icing on the cake is being able to roll 17,834 Chase Ultimate Reward points over for another trip.

The Upshot

Overall, my family and I will be able to fly my family to enjoy three days in the “Most Expensive…I mean…Most Magical Place on Earth.”

All for the price of $74.82, instead of the $1,800 it would have cost us.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.