Back in February, I remember watching a report on 60 Minutes titled 40 Million Mistakes: Is your credit report accurate? The piece focused on a study that indicated that as many as 40 million consumers have a mistake on their credit reports. Correspondent Steve Kroft talked to several individuals who discussed just how hard it is to get any of the credit bureaus to fix mistakes, especially Experian. Now, I’m actually someone who checks their credit report quite often. Every time I do a churn, usually every 90 days, I’ll run a copy of my credit report and credit scores. Remember, you can get your free TransUnion score from CreditKarma and your free score from Credit Sesame. Don’t forget that you are also entitled to a free credit report each year from the 3 major credit reporting bureaus, thanks to Uncle Sam.

I’ve actually been lucky enough to never find any mistakes on my reports…that is until my recent April churn. I noted an incorrect address, one that I had never lived at but was listed as a residence. I was also concerned about a leasing account appearing as active that had been closed six months earlier. These both only appeared on my Experian report which I obtained via the free annual credit report link above. I wasn’t freaking out about fraudulently use as I didn’t see any accounts that I hadn’t personally opened. However, I was fully prepared for an upward fight after watching the 60 Minutes piece and reading some Experian horror stories online. The first step involved visiting Experian’s dispute website.

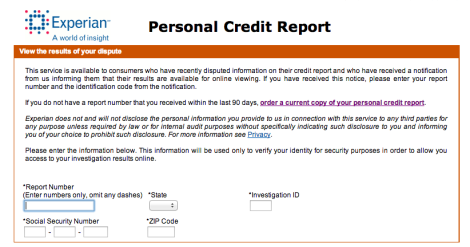

Step 1 – Selecting which type of credit report you have. PROBLEM 1 – the annual credit report doesn’t have a report number. After doing some Google research it seems that some Experian free annual reports print with the number while others don’t. Mine didn’t have the number, so I selected that option. You also must have a report that is no older than 90 days if you want to open a dispute, otherwise you’ll need to purchase a new one (more on that below).

Step 2 – I was then asked to select which of the reports my report looked like. When I did that, I was again asked for the non existing report number. After more Googling, I learned that tons of consumers have had the same problem and gotten absolutely no where online. They were forced to call in for assistance. Something I was very hesitant about after watching the piece showing all calls being routed to Mumbai.

Step 3- They win, I decided to just purchase a $1.00 7 day free trial so that I could have a fresh report with a report number. Now this is going to be easy right?

Step 4 – Wrong! After receiving my new report, I returned back to the dispute site and selected the option that I had a credit report number. After entering the number I was instructed that “online disputes are not available for your account due to security precautions, please call our customer service team for assistance”. UGH!

Step 5 – I thought this would be the most difficult part of the process, but it was quite painless. As a current customer (remember that 7 day free trial), I was routed right away to an agent and told them that I wanted to open a dispute, but was not able to online. The agent was definitely American and he seemed apologetic and happy to help. He asked what exactly I wanted to dispute and had me hold for about three minutes. He then came back and said that I should receive an email response within 14-21 days. I didn’t expect much and after reading other horror stories, I anticipated calling back in after three weeks passed. ***Note, there are some pretty horrible stories about getting an agent on the phone who can actually assist if you’re rejected online…unless you are a “current customer”, not one who has accessed your free report or via a 3rd party website. It’s probably worth the $1 trial, to avoid this just remember to cancel before the 7 days are up, it doesn’t impact the investigation.*

Step 6 – 12 days later I received an email from Experian that indicated that there was an outcome to the investigation. I was instructed to access a special dispute site.

Step 7 – Shocking success – The address was deleted and the leasing account was updated to indicate closure!

Conclusion – Finding the right way to actually dispute items on my Experian report was a challenge, but the actual process worked and was dare I say timely…perhaps I was just lucky.

What has your experience been? Nightmarish?

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

6 comments

I was able to get many things fixed on credit report with various agency. When I pull the free credit report from annual credit report or after credit card application, I get a report number. With report number I have successfully disputed it online and disputes got fixed in few days.

totally useful! thanks.

I’ve had SOOOOOOOOOOOO Many items removed either directly through the 3 CRA’s or through the creditors themselves.

It’s very easy folks. Do yourself a favor and check over your CR’s often, and fire-off letters of debt-validation, etc. and get your file cleaned-up!

It sounds like you had better luck than others. I remember watching that 60 minutes episode and being shocked by how unorganized it can be. Both my parents used to work at Experian and were surprised by what they said during the show. Luckily, no one in my family has had any major problems, just spelling mistakes on a few cards. Stephen -> Steven and Thomas -> Thoms one one or two cards.

My husband was reported as deceased but he isn’t . How do you fix this?

@ Linda Russell – I would follow the same steps as outlined above to ensure you get an agent on the line. Hopefully, once you explain the situation they should be able to assist or provide information on who reported him as deceased. good luck!