Bask Bank has recently introduced a new way to earn American Airlines AAdvantage® miles that doesn’t require any kind of spend whatsoever. Its new Bask Savings Account allows you to earn American Airlines AAdvantage® miles solely for funds you add to your savings account. And it has some killer bonuses that will allow you to travel to nearly anywhere in the world in Business Class. So, let’s dig in – Aadvantage sign up is quick and easy, how to transfer money into the account, and how it earns miles and bonuses so you can get on your way to your dream vacation.

But first, a history lesson.

Bask Bank is not the first bank to offer points/miles for establishing a banking relationship, but they are the first in several years to bring this sorely missed and popular feature back! In fact, this is the first savings account to offer a bonus. BankDirect, a division Texas Capital Bank, N.A.—the bank behind Bask Bank—already offers a checking account that accrues American Airlines AAdvantage® miles.

For those who remember Continental Airlines and their OnePass program, they had a partnership with Chase that allowed customers to earn miles for checking and debit card activity. That airline and partnership is long gone. Today, Sun Trust offers a debit card/checking account combo that earns Delta SkyMiles, also based off debit spend. But these earn 1 SkyMiles per every 2 dollars spent. Even in the world of SkyMiles (cough, SkyPesos), this is a pretty pitiful return. You’d be much better off spending that money through one of Delta’s newly revamped American Express Cards. The uniqueness of earning for saving, combined with the ability to take advantage of special bonus offers (potentially up to 140,000 AAdvantage® miles), brings this much missed banking relationship into 2020.

Setting up and funding your Bask Savings Account

This process really couldn’t be easier. In the upper right hand corner of Bask Bank’s website you can find a button that says “Open an Account.” You can also simply click here.

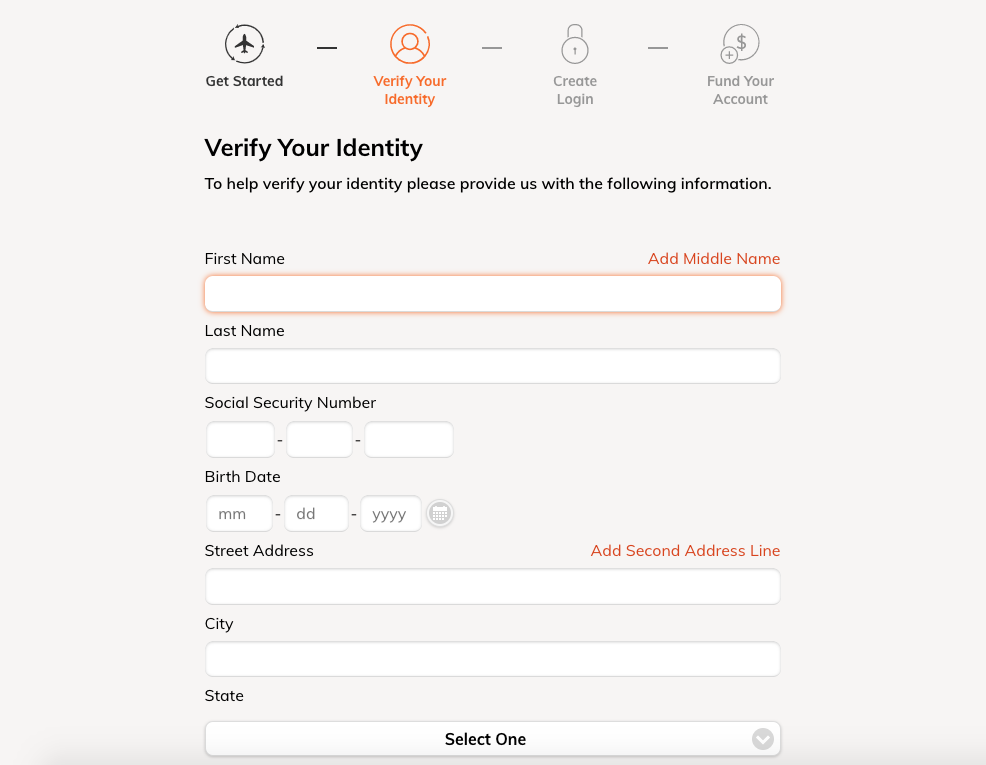

Bask Bank will ask your personal information to begin setting up your Bask Savings Account. The website will ask you for some basic information, including email and mobile number. They’ll send you a text message with a code to verify the mobile number and you’ll have an hour to enter the code after they send it.

As soon as you enter the code (you don’t even have to hit return), you’ll be brought to the second step: verify your identity. Again, you will be asked for all the things any other financial institution would request, including name, social security number, birthday and address. Security questions and your primary source of funding details will also be requested.

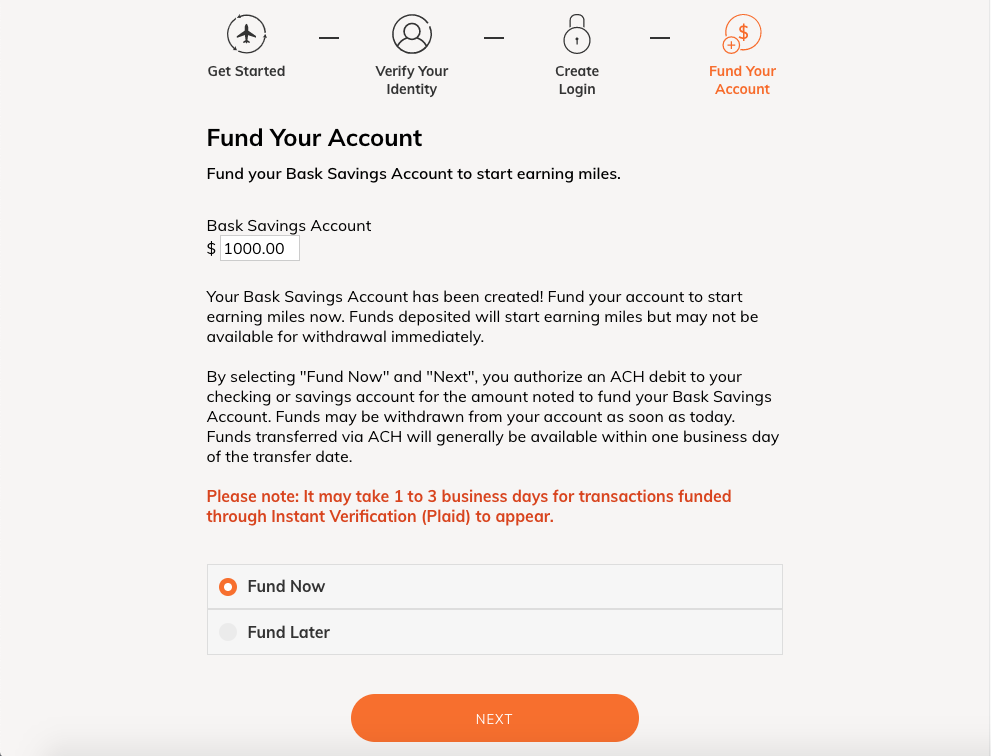

After that, you are asked to create a username and password, before being asked to fund your account. I completed all the above without funding my account – you can opt to do that later! The whole process (including writing about it as I went along) took less than 10 minutes.

How You Earn American Airlines AAdvantage® miles through Bask Bank

It’s extremely easy to earn miles through your Bask Savings Account. You can just let your money sit there!

It’s extremely easy to earn American Airlines AAdvantage® miles through the Bask Savings Account. Once you make your initial deposit, each dollar you keep in the account earns one mile annually. That’s it. Leave your money in the account for a year, and you earn miles. I wish there were more to write here, but it’s really that simple.

Balance Bonuses through Bask Bank

You could earn up to 40,000 American Airlines Aadvantage® miles annually for balance bonuses.

In addition to the money earned through keeping funds in your account, Bask Bank is also offering several bonuses for keeping larger amounts in your account for a sustained period.

*To earn 10,000 AAdvantage® bonus miles, you must deposit a balance of $25,000 in the first 14 months and maintain that balance for a year. 5,000 bonus miles will be paid out after 6 months, and the remaining balance of the 5,000 upon the year completion. *If you’re willing to double the funds in your savings account over that same horizon (with the same stipulations), Bask Bank will double the bonus. So, after 6 months of a $50,000 balance, you’d earn 10,000 AAdvantage® miles, with the other 10,000 miles coming after the full year.

*And that’s not all. You can earn 40,000 AAdvantage® bonus miles, by depositing a balance of $100,000 in the first 14 months and maintaining that balance for a year. 20,000 bonus miles will be paid out after 6 months, and the remaining balance of the 20,000 upon the year completion.

* Accounts must be opened no later than April 30, 2020 and funded within 60 days of account opening.

Not bad if you were going to sit on that money in a savings account, anyway – surely better than today’s interest rates.

Additional American Airlines AAdvantage® bonuses from Bask Bank

There are two final offers that Bask Bank is adding to sweeten the deal and entice new customers.

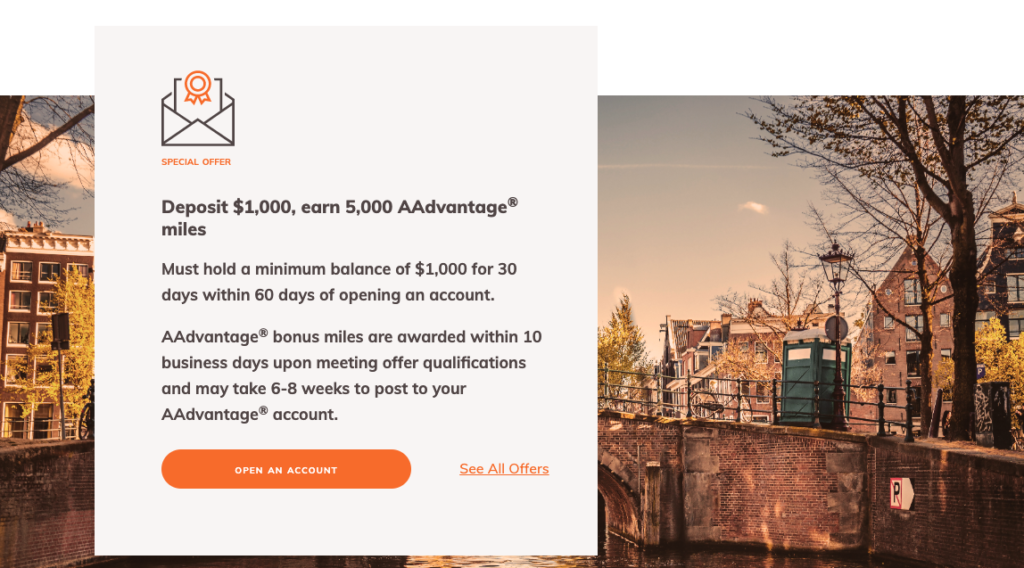

The first is an AAdvantage sign up account opening bonus. If you open your account between March 1, 2020 and April 30, 2020, deposit $5,000 within 60 days of opening, and maintain that balance for 30 consecutive days—you’ll earn 5,000 bonus American Airlines AAdvantage® miles. While the other bonuses come with a fairly large required investment, this is very attainable and an easy way to score 5,000 bonus miles.

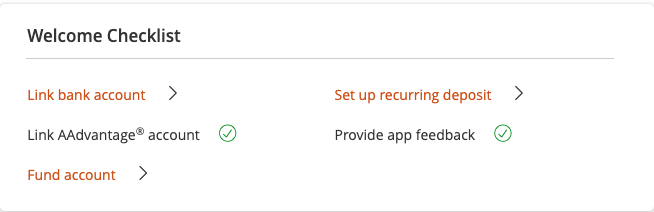

All you need to do to earn 1,000 bonus miles is to complete app feedback survey, conveniently located on your home menu page.

In fact, it’s almost as easy as the other promotion Bask Bank is running. The bank will give you 1,000 AAdvantage® miles for filling out a quick online feedback survey (I’m talking quick—no more than 30 seconds of your time). This one doesn’t even require any kind of money. Offer is valid through 06/30/2020.

AAdvantage® bonus miles are awarded within 10 business days upon meeting offer qualifications and may take 6-8 weeks to post to your AAdvantage® account.

Where can I fly with American Airlines AAdvantage® miles

The Aadvantage sign up bonuses from the first year of your Bask Savings Account could earn you a flight to the Middle East or Africa on Qatar’s best-in-class Q-Suite seat.

The short answer is anywhere your heart desires—or rather, is serviced by a oneworld airline. The next question is: “How can I fly using AAdvantage® miles and how much will it cost me?”

So, if you were to deposit $50,000 in the first 60 days of opening the account (if opened before March 1), you would earn the annual return of 50,000 miles, a 5,000-mile opening bonus, a 20,000-mile balance bonus—and, if you completed the survey, a 1,000-mile bonus. That brings your total earned American Airlines AAdvantage® miles to 76,000 miles.

Where can you go using 76,000 American Airlines AAdvantage® miles?

If flying on American Airlines metal from the U.S., you can afford a one-way business class ticket to anywhere except the South Pacific Region. On partner airlines, the bonuses earned would be enough to fly partner Qatar’s Q-Suites product from the U.S. to the Middle East or Africa, and you can even reach French Polynesia on partner Air Tahiti Nui in business class. These are just a few examples. In fact, we’ve even written a guide on how to use 50,000 American Airlines AAdvantage® miles, in case you don’t max out the bonuses on offer. Plan to invest $100K or more? You’ll earn 146,000 AAdvantage® miles which means highly sought-after redemptions to Australia and New Zealand become available as well.

The Upshot

Bask Bank’s Bask Savings Account is a great way to earn American Airlines AAdvantage® miles for doing next to nothing. Instead of accruing minimal interest on your savings accounts, earn some miles that can be used for your next getaway. AAdvantage sign up is quick and easy. Continuing to travel for free without the hassle of credit card spend requirements sounds like a great way to bring a much-cherished earning method from the past into 2020!

The value of this bonus offer will be reported to the IRS and the recipient is responsible for any federal, state or local taxes on this offer.

Bask Bank and BankDirect are divisions of Texas Capital Bank, N.A. Member FDIC. The sum of your total deposits with (i) Bask Bank; (ii) BankDirect; and (iii) Texas Capital Bank, N.A. are insured up to $250,000. Additional coverage may be available depending on how your assets are held.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.