The IRS just announced a new website where you can get your stimulus relief check if you’re not required to file taxes. Called “Get My Payment” the launch is in conjunction with the US Treasury and the IRS. In addition to setting up registration, the Treasury claims people can check the status of their stimulus payment.

Breaking It Down:

IRS Stimulus Payment Web App “Get My Payment”

The IRS Site shares the details for qualified recipients:

Who is eligible for the Economic Impact Payment?

U.S. citizens or resident aliens who:

- Have a valid Social Security number,

- Could not be claimed as a dependent of another taxpayer, and

- Had adjusted gross income under certain limits.

Who will receive the Economic Impact Payment automatically without taking additional steps?

Most eligible U.S. taxpayers will automatically receive their Economic Impact Payments including:

- Individuals who filed a federal income tax for 2018 or 2019

- Individuals who receive Social Security retirement, disability (SSDI), or survivor benefits

- Individuals who receive Railroad Retirement benefits

Who should use Non-Filers: Enter Payment Info to provide additional information to receive the Economic Impact Payment?

Eligible U.S. citizens or permanent residents who:

- Had gross income that did not exceed $12,200 ($24,400 for married couples) for 2019

- Were not otherwise required to file a federal income tax return for 2019, and didn’t plan to

You can provide the necessary information to the IRS easily and quickly for no fee through Non-Filers: Enter Payment Info. The IRS will use this information to determine your eligibility and payment amount and send you an Economic Impact Payment. After providing this information you won’t need to take any additional action.

Easy Click to Register

The site offers a simple one-click to the site where people can register their information and payment method to receive the economic stimulus payments. Using the “get my payment” IRS stimulus payment site promises to expedite those checks for non-filers.

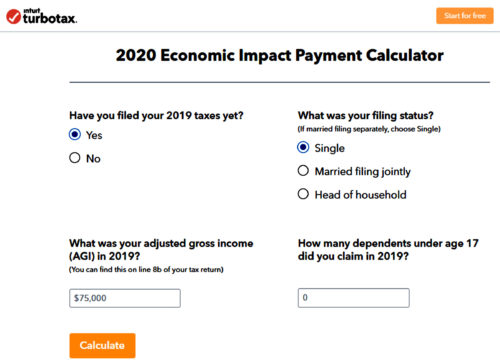

Stimulus Payment Calculator

Besides the Stimulus Check Web Portal, TurboTax also includes a payment calculator. The calculator helps you determine how much you should receive from the government with your stimulus payment.

New Site for Tax Filers

The Treasury Department will be setting up a new site (coming mid-April) where people who have filed tax returns can use the Get My Payment application to let the IRS know your bank account information if they do not already have it and you haven’t received your payment. I’ll pen a new article once that site goes LIVE.

UPDATE 4/15/20 – Now Live: IRS “Get My Payment” Site – Check Status of Your Stimulus Payment

The UpShot

For tax non-filers, this is great news. Hopefully this will make things go smoother and quicker for users. As a matter of fact, during the 2008 recession, the government’s stimulus checks took as long as two months to reach people.

Are you using the new IRS’s “Get My Payment” site to help you get your economic stimulus payment?

Click here for all the latest coronavirus updates and policies by airline as well as hotel, travel insurance, stimulus payment, plus our own expert advice posts.

Stay safe and help #StopTheSpread

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

87 comments

Thanks!

I’m waiting for the second part of the portal. By mid-April those that DID FILE should be able to verify/add bank info. I owed in 2018 and 2019, so I didn’t include the banking info. My social security has it, but I’m not sure when they will look at that piece of the puzzle.

I’ll see which wins the race – that part of the portal, or the direct deposit. At any rate we’re getting closer.

Carl WV-

I hear you. Lots of people who did file are anxious to see if their information is enough to get a swift tax return payment.

Best wishes and thanks for reading.

Where my payment is not active on the irs website.

Ashley-

Without knowing the exact nature of the problem, I have no suitable answer for you.

The IRS website is quite overloaded at the moment; as one might expect.

You need to contact the Internal Revenue Service directly. According to the IRS “Contact an IRS customer service representative to correct any agency errors by calling 800-829-1040. Customer service representatives are available Monday through Friday, 7 a.m. to 7 p.m. local time, unless otherwise noted (see telephone assistance for more information).”

Thank you for reading.

I am not a professional tax preparer.

Irs is closed there is no way of contacting anyone at irs or unemployment ive been trying for weeks now still havent recieved my unemployment and and cant contact noone I called my local unemployment office and they told me they have nothing to do with the covid 19 part of it this government sucks Ive been trying to contact irs and cant get anyone to pick up at all been out of work for a month now due to covid 19 threat and cant get any help from humans what so ever

Paul,

I’m sorry to hear about your frustration trying to contact someone. As we should expect, all telephone representatives are overwhelmed.

Best wishes and thank you for reading

On Social Security how do I get a check?

Mary-

Only the Treasury Department knows when specific recipients will receive their payments.

Thank you for reading

Ummm this is not an IRS website:

No way Im entering anything on thatSteve-

Well, actually the IRS set this up…and I understand it’s not based off the IRS.gov’s web address…but I guess that’s because they wanted to work quickly. That’s not something the government does too well.

You can start here which is the IRS website…and follow the links directly FROM THE IRS site…but ultimately they take you to the same place.

I have personally seen this in action and it works.

They are do error-checking and promise to respond within 48 hours if there are any issues.

Thanks for reading.

I filed but haven’t received my taxes yet cause it had to be reviewed and I didn’t use direct deposit how can I go about that will I recieve a stimulant check

Ora-

You can use the site to update your payment method.

Otherwise, you need to contact the IRS directly.

As we’ve learned in the past few hours the Treasury Department has stated that the first payments are beginning to arrive in some Americans’ accounts.

Thanks for for question.

I do my taxes every year with h&r block an have my refund put on my emerald card . does that count as direct deposit account

Kristy-

If you used H&R Block’s Emerald Card, then the bank account synced to that debit card should get the direct payment. At that point, the funds would be accessible with the card.

I am not a professional tax preparer.

Thanks for the question and for sharing.

That’s what i want to know every year my taxes are deposited to my Emerald card. Is that where i will receive my payment? Irs web site won’t be letting you add account info till mid April.

Victoria-

Yes, that’s correct. The IRS sites are coming soon; they promise

The site seems very sketchy why does it ask you for your PIN number for you bank account they don’t need that to put money into the account. At the bottom of the form asks for account # routing # and pin# no why I’m putting my pin on to a from

Eric-

I didn’t design the websites.

There seem to be two (both run by Intuit.) There are two possible PIN numbers.

One is a security PIN used by the site to keep your information secure.

Another is your PIN assigned (again as a security measure) to your last year’s tax return.

NEITHER of these PIN’s are your debit card PIN !

If you have more questions, please refer to the website or Intuit directly.

Thanks for the question.

They shouldn’t ask u for anything of the sort I went on the get my payment irs website make sure it’s real it’s website and if u need to give them ur direct deposit bank info go under non filer if u didn’t file taxes in 2018-2019 or if u are a filer go under filer then u will have to provide ur ss# ur filing status I think ? Not sure on that one and then just ur address that irs has for u and ur birthdate then it’s gona ask u for ur bank routing # and bank checking account # but it has to be checking account not savings or anything and then submit it will tell u if u are a person who is eligible for stimulus then after u submit it all it says to log on next day or next u til it gives u updated approximate deposit dates

That’s all but the website for non filers and filers is now open I did mine yesterday and it went thru.

I was in the hospital last year doing tax season and didn’t get a chance to file my 2018 taxes on time so I was waiting to file 2018 & 2019 together this year but with the Coronavirus shutting everything down I haven’t did my taxes at all, So what do I do….

Keica,

The site does help you file a 2018 or 2019 tax return.

You should use the links I’ve provided and go to the IRS website for assistance.

there are also some tax preparation sites (i.e. TurboTax) who offer some return services for free.

Best wishes.

Ive tried on my phones and get to the last page to send it and wont let me move it far enough to hit the file button ive tried making it small everything

Larry-

Perhaps try on a PC, laptop or tablet?

It could also be that the site is overwhelmed with users. It’s so new we don’t have a lot of datapoints.

That site just went live on Friday.

Thanks for the question.

I got my tax refund on Jackson Hewitt American Express serve card will payment go there ?

Chris-

Yes, that is thew latest information. At some point the IRS is going to open another site where you can check the status of your stimulus payment.

No word yet on when that will be.

Thanks.

yes it wouldnt let me transmit on my phone but it did on my tablet. That last page is Huge!

Carry-on

Great to hear it worked for you.

Thanks for the datapoint and for reading

Does the h&r block emerald card qualify as a direct deposit bank account?

Medrick-

That is what we have been told.

Of course, I am not a professional tax preparer and my information comes from tax preparation sites and the government.

So…you know how that goes.

Thanks for reading.

I get my taxes on the H&R block emerald card so is that where my stimulus check will go to?

Desiree-

That is what we have been told.

Of course, I am not a professional tax preparer and my information comes from tax preparation sites and the government.

So…you know how that goes.

Thanks for reading.

If you have filed and select or Updated on the non tax filers site will that potentially delay payments?

Beth-

I have no information on how the IRS is processing all of these. The CARES Act, the stimulus payments process and these websites are too new for any real datapoints.

Thanks for the question and for reading.

did you receive updated information stating stimulus deposits will now be approved for emerald cards even the ones that had advance and or fees taken by axos bank first?

Mark-

That is what we have been told.

Of course, I am not a professional tax preparer and my information comes from tax preparation sites and the government.

So…you know how that goes.

Thanks for reading.

Any news on FL unemployment stimulus payments will be paid along with the regular extended UI?

Mike-

I have no information on those Florida (or any state’s) unemployment payments.

You need to to contact your states’ unemployment insurance office.

Thank your for reading.

ise mi declaracion no com deposito directo tengo que esperar hasta el 17 de abril para aser el cambio a deposito directo y si habrá tiempo de coger la información para aserme el deposito directo

Milton-

Yes, you have plenty of time to update the information. The IRS seems to be moving slowly on many of these payments.

Thanks for reading

I did my income tax on jan 3 with Jackson Hewitt will I be getting my stimulus check in the American Express Serve card?

Sylvia-

Yes, these debit cards linked directly to these accounts are eligible for the direct payments.

I get my Social Security and SSI on separate Direct Deposit cards, will my stimulus money go on one of those or will it be a paper check? I don’t have to file taxes and I don’t have a bank account.

Sherry-

It should go on one of those two cards.

Thank you for reading.

I use loan Central to file my taxes , so my refund gets direct deposited into their account. Where will my stimulus money go?

Margie-

You should reach out to Loan Central or the IRS for help with your question.

Thanks so much for reading.

Hey Margie– I did the same thing. I called my tax center (K.C. Tax Services), & they said the money will not go into their account, the IRS is gonna mail it to the address on file, but they “said” the IRS will definitely not deposit it there; idk if I believe them tho… I’m just gonna put my deposit info in when the portal drops, which SHOULD be in a couple days. Also, if ur payment is already scheduled for delivery, you won’t be able to put in deposit info, it WILL be mailed..

Wanna-be

It’s definitely a ‘work in progress ‘ for the government. Once the new site is live, I’ll write about it making sure people know.

Thanks for reading

Will Direct Express cardholders receive the stimulus payment directly to their cards and possibly, when? I have received SSDI since 2017 on Direct Express and have no other bank accounts or cards.

John H-

Yes, that’s how it’s supposed to work.

Thanks for reading

I have already filed for 2018 & 2019 and had to pay . I used the E.F.T. payment option with my checking account information, will they use this for my stimulus ?

Jamey-

Yes, that’s what the government is saying.

They also promise to provide another site soon so people can track their stimulus payments

Thank you.

I have a direct express card that my SSI comes on you know when they will put the money on it cuz it doesn’t say anything about it

Tracey-

Yes, that’s how it’s supposed to work.

Thank you

I receive SSDI will I receive the stimulus package on my Direct Express Card

Kenneth-

Yes, that’s how it’s supposed to happen

Thanks for reading

If I get ss and get my money on a direct express debit card will my stimulus money be deposited on it ?

Arthur-

Correct. That’s how it’s supposed to work.

Thank you for reading

For the last few years I have received my refund on an Emerald Card thru H & R Block. Apparently, there are some issues with getting your stimulus money thru that card IF you used your tax refund to pay prep fees or a refund advance. So now I am unsure what i am suppose to do. There are so many people that are in the same situation. It’s really frustrating. So I am looking forward to the new Get My Payment where I can update my direct deposit Info.

Marsha-

It’s definitely a ‘work in progress ‘ for the government.

Thank you for your comment and for reading

When is the next round of deposits to go out?..I filed my taxes but I have not received them yet??Will that effect my stimulus deposit??

AJ-

The Treasury Department began sending out payments over the weekend. It’s anyone’s guess at to when your payment hits your account. However, the IRS has promised to develop a tracking site to help people know the status of their economic stimulus payments.

I’ll pen an article as soon as that goes LIVE.

Thanks for reading.

i have a jackson hewittt america express serve card will my stimulus payment come on that card

Victoria-

Yes, that is the latest information.

At some point the IRS is going to open another site where you can check the status of your stimulus payment.

No word yet on when that will be.

Thanks.

I really want to put mY debit info in the system, but don’t know how

Pashie-

Use the link in the main article to access the site where you can update your payment method.

Thanks for reading.

i get social security goes to my bank will they use that info, I filed taxes but got a paper check

Polly-

The economic stimulus payment will be direct deposited using the same bank account you receive your Social Security payments through.

Hope that helps answer your question.

Thanks for reading.

Just used the Get My Payment website. It was indeed very easy and straight forward and took just a few minutes. After entering my information, it told me that my wife and I are indeed eligible but that they had no direct deposit information on file; because we’ve had to pay for the last two tax years. So i put in my bank account information and that was all. The final screen confirmed that my banking information had been recorded.

Now the question is , after giving them my bank account info for the direct deposit; How long will it take them to actually deposit the money to my bank?

Frank-

The quick answer is only the Treasury Department knows when payments will be processed. They actually began depositing funds Saturday, April 11th.

Eventually the government promises to have a ‘Check My Status’ site. Once that goes live I will pen an article for our readers.

Just tried Get My Payment and it can’t determine my eligibility at this time. Haven’t yet filed 2019 and I owed for 2018. Wondering if the IRS has fully populated their database for this app yet.

Anyone else experiencing problems getting their eligibility information?

The site also said for me that It wasn’t sure of our eligibility . We paid taxes in 2018, and our 2019 was just filed Monday but haven’t paid that bill yet. My daughter also couldn’t get eligibility verified. She also pays, does not get a refund. Anyone know why this is happening to us?

Donna-

Your payments are processed by the Treasury Department.

You have to forward your concerns to them directly.

Their new Check Your Status site is supposed to help answer those questions.

Thanks for reading.

Same issue here. Filed and owed 2018, used direct debit option for payment. Haven’t filed 2019 yet. System says it can’t determine eligibility at this time. Sounds like maybe the app is only looking at 2019 filings?

Labaraby-

I can understand your frustrations.

You should check out this article for more information.

I check online through IRS to make sure I was receiving a stimulus check , and they sent it a closed bank account.

Not sure if that means ill receive a paper check?

strange… i got my stimulus refund, but it was significantly less than what turbotax calculated. what gives?

I L-

Are you referring to a tax refund or your economic stimulus payment?

This article has more information on how to determine what payment you qualified for.

Hopefully that helps answers some questions.

I just tried to enter my Direct Deposit information and received this message.

“Technical Difficulties

We apologize for the inconvenience but this service is currently unavailable. Please try again later.”

Martin-

Your payments are processed by the Treasury Department.

You have to forward your concerns to them directly.

Their new Check Your Status site is supposed to help answer those questions.

Thanks for reading.

Website irs.gov is not very good, irs is not very good. IRS has my ss deposited info and my wife works for govt and they also had her direct deposit info and no stimulis get my payment…says it has no info on us

Randy-

Sorry to hear this. Hopefully things will improve.

Thanks for reading

Get My Payment site totally sucks. SUCKS! Blew me away for 24 hours. Tried again, same shitty results. Technical issues. Classic government incompetence. Maybe they need more COBOL programmers. Jesus Christ, get in the current century.

J. Narlock-

Sorry to hear about the issues. I am pretty sure their site has to be overwhelmed as so many Americans are seeking information on their economic stimulus payments.

Only the Treasury Department can answer your question; I’m sorry.

Hello, I desire to subscribe for this blog to take newest updates, therefore

where can i do it please help.

@Free Tech Guides-

It’s very easy!

Subscribe to Point Me Awake, a morning jolt of the top stories in travel every Monday, Wednesday, and Friday — straight to your inbox. Our curated list includes deals, reviews, and the best ways to use points and miles.