Ryanair, the European discount carrier often cited as the world’s most-loathed by customers, has built its entire business out of charging airline passengers for just about every damn thing. But get this, the four big U.S. airlines are now beating Ryanair at its own game.

American, Delta, Southwest and United Airlines all collected incometotal fee revenue last year than Ryanair. Moreover, Ryanair wasn’t even close to the U.S. big three international carriers.

United was the outright nickle-and-dime leader, collecting around $5.75 billion in ancillary revenue, according to IdeaWorksCompany, a U.S. business research firm.

Delta made over $5.4 billion in fee revenue, American $5.3 billion and Southwest $3.1 billion.

Ryanair, the world leader in fees-for-everything, was actually fourth among 73 global airlines, netting $2.3 billion from add-ons.

Ryanair’s Boeing 737-800 Cabin is a picture of efficiency, with emergency placards posted on the back of seats to avoid printing costs and advertisements posted on overhead bins like a subway. Somehow, U.S. airlines are beating the Irish discount original at its own fee-first game. Image by Ruthann.

Astute readers probably question Southwest’s high position on this list and would be right to do so. Southwest remains the last U.S. airline not to charge for checked bags, seat selection or even flight changes. IdeaWorksCompany included up-sell fees in this analysis, which include Southwest’s popular Early Bird Check-in and priority boarding perks.

Total fee revenue isn’t exactly a fair comparison, either. American, Delta, Southwest and United all carry far more passengers than Ryanair, meaning revenue is higher across the board.

Previously: Best Strategies as Baggage Fees Increase

Fees made up 28.2-percent of Ryanair’s total revenue, compared with 12.5-percent at American, 13.2-percent at Delta, 14.6-percent at Southwest and 15.2-percent at United.

U.S.-based discount airlines Frontier and Spirit both relied far more heavily on fee revenue than Ryanair. Fees made up over half of Frontier’s gross revenue last year, and 48-percent of Spirit’s.

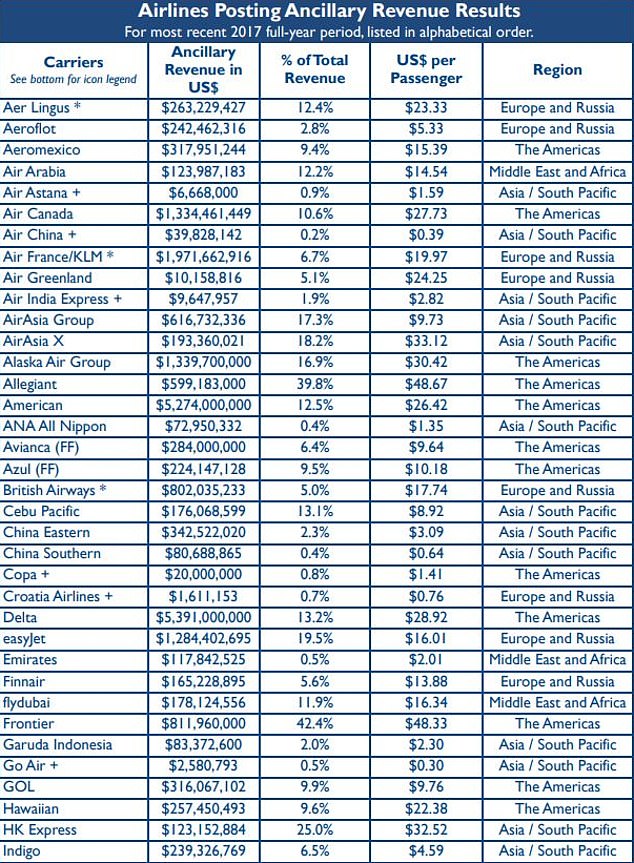

There are a few other interesting takeaways from this assessment. The full table of airline fee revenue in 2017 is below.

- Despite resistance to charge for essential amenities like bags and flight changes, Southwest is still beating two of its largest competitors in ancillary revenue. That should put executives at American, Delta and United all to shame. Southwest seems to know better than anyone how to play this game.

- Asian and Middle Eastern airlines hardly collect any fees at all. Ancillary charges made up less than a percent of gross revenue at Air China, ANA, China Southern, Emirates, Etihad and Royal Jordanian.

- Despite charging for outlandish things like seat selection in business class, British Airways is proving really bad at driving fee revenue. The massive airline didn’t even break $1 billion in ancillary revenue last year.

Image by IdeaWorksCompany

Upshot

Airlines in competitive markets love fees. Unlike fares, which are highly elastic (meaning that small price changes heavily influence customer demand), fees are somewhat hidden and less elastic. In other words, it’s easier to raise revenue through fee increases than through fare increases, as fare increases scare away more prospective flyers than comparable fee increases.

In that sense, this analysis provides somewhat of a financial scorecard for these airlines. Given the significantly less-burdensome nature of Southwest’s fee structure, I’d say the Dallas-based Luv airline is the clear champion here. Southwest has found a way to raise an incredible amount of revenue from after-ticket purchases without ticking off passengers. Bravo.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

4 comments

Doesn’t these totals include revenue from frequent flier miles (credit cards, partners etc)? I think that’s probably the majority of the revenue

It should be challenged they make traveling costly by adding such fees silently. travel charges should be considered to make as affordable as possible.

Thanks for sharing information…….

Very helpful. Thanks for sharing information…….