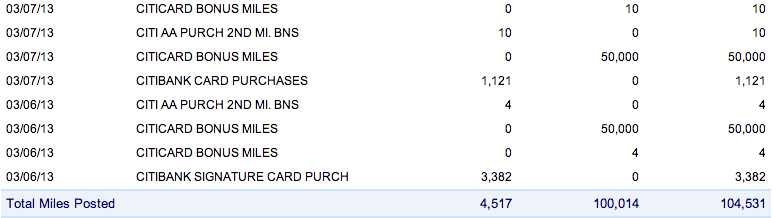

I was very happy to log into my AA account last week and see two separate 50k bonus miles entries for my Citi AAdvantage Visa and AMEX cards from my December churn. However, it was also a little sad to think that this might be the last time I ever have a Citi AA double dip in my account now that the two browser trip has officially been killed.

As you may remember, prior to this churn, the last time I successfully received a sign-up bonus for a Citibank AAdvantage personal card was February 2010, about 34 months prior at application time! I must have been on Citi’s unofficial deny list, as FlyerTalk and MilePoint members generally report receiving approval 18-20 months after their last successful application. I applied at the 20 month mark with no luck and then again at the 26 month mark, also with no success and the dreaded step 3 application acknowledgment page. Well, I decided to give it another shot in December in what became an unofficial churn day.

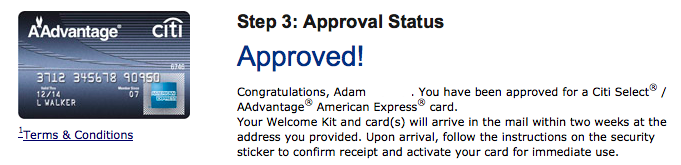

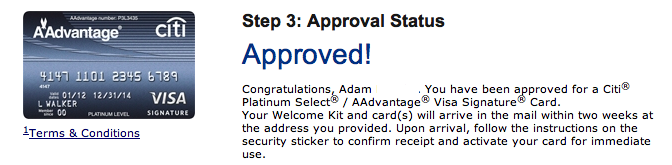

I used the two browser trick and applied simultaneously for the 50k Visa and AMEX cards. Holiday season success! I received immediate approvals on both applications. Going forward, this will no longer be possible as a duplicate application error is received for a second personal card. Any good news? Not really, though Citi only allows two applications for any Citi cards within a 60 day time-frame, so previously you had to wait 60 days if using the two browser trick for two personal cards before applying for the business card version. Now you can do both on the same day, though you’ll receive two separate credit pulls and only receive the bonus 50k on one personal card instead of two.

What a shame! I guess it was good while it lasted. Speaking of the good old days, does anyone remember these previously churnable offers @ 150k per 2 card churn??

Anyway, if you do intend to sign-up for a personal and business card, here are some data points from my previous Citi post:

- Time since last successful Citi AA personal application – Approximately 34 months.

- Credit Score – Just shy of 800

- Links Used – I used the unofficial links which provide better offers than the public links. AAdvantage Visa Signature – 50k miles after $2,500 spend in 4 months and AAdvantage American Express – 50k miles and two Admiral’s Club passes after $2,500 spend in 4 months. Both cards waive the annual fee for the first year.

- Browsers Used – One Chrome window (in private mode) and one Firefox window (in private mode).

- Remember personal cards generally require 18-20 months and business cards 90 days since your last successful application. You will be denied if you apply for 3 or more cards in 60 days or 2 or more business cards in 90 days.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

6 comments

Does anyone know if these links still work?

@JakePB – Worked for one of my family members just one week ago

So it’s your understanding that it’s still possible to get a new citi aa business card after waiting 91 days from getting your first aa business card? I’m just that it’s a case of YMMV but it works for at least some people? Does it matter if you close your previous Citi AA business card or not? Do you just tell them that you want to split up business expenses on different cards and that you’ll move credit from the old card to the new card?

@Paul – Yes, totally YMMV. I was personally able to get a new business card twice within 8 months and then was rejected the next time I tried. 91 days is the minimum but I waited about 120 to be sure. A previous card does not seem to matter in terms of the approval unless Citi deems it a risk to grant you additional credit. When you get a second one though, they are more likely to ask for proof of the business (phone/electric/gas bill) and to provide detailed explanations of the business type. I was able to say I have two businesses – the blog and Juicy Miles. You could have more than one business as well…

In my experience, unlike Chase and AMEX, I’ve never had a Citi representative willing to move credit from one account to another in order to secure an approval.

6 mo’s ago I closed a Citi AA Amex (personal) – the rep said “since you’re an excellent customer, would you like me to move most of the credit line to another card?” After picking my jaw up off the floor, they moved 75% of the line to my personal Citi AA MC.

As of 3 months ago, nothing could be done to re-allocate business cards