Thanks to an epic currency meltdown heightened by its government’s mismanagement of the pandemic, the exchange rate has never been better for foreign visitors to Argentina. But a simple hack can make Argentina’s spectacular sights up to 50% more affordable. We’ve put together everything you need to know about the blue dollar currency hack in Argentina.

Argentina’s Dramatic Currency Devaluation

The dramatic freefall in the Argentine Peso’s value is immediately clear looking at the recent improvement in the USD to ARS conversion rate (from xe.com).

While $1 USD equaled ~60 pesos in January 2020, now the exchange rate is 245 pesos per dollar. That’s a huge loss of value for the Argentinian peso.

But many tourists don’t realize that the official exchange rate only tells half of the story. A separate, informal (yet very legitimate) exchange rate known as the blue dollar exists. Using the blue dollar, at current rates, one dollar can equal approximately 480 pesos, nearly double the official rate.

Why the Argentina blue dollar?

The blue dollar, like so many things in Argentina, has its roots in politics. It originally came about as a response to the currency controls imposed by the leftist administration of Cristina Fernández de Kirchner limiting the amount of foreign currency Argentines were allowed to exchange pesos for. The currency controls were eliminated when a more market-friendly president, Mauricio Macri, took office in 2015.

Following their victory in the 2019 election, the left-wing “Peronist” administration (with Kirchner returning as vice president) re-introduced currency controls. Argentinians may only exchange pesos for up to $200 USD a month.

Unsurprisingly, inflation has spiraled out of control and the ‘black market’ for foreign currency has re-activated. And the parallel “blue dollar” exchange rate once again has relevance.

It’s easy to keep track of the unofficial exchange rate. Newspapers list the rate side-by-side with the official rate and multiple sites track the changes day by day. (All three major Buenos Aires papers do this: La Nacion, Cronista, and Clarin.)

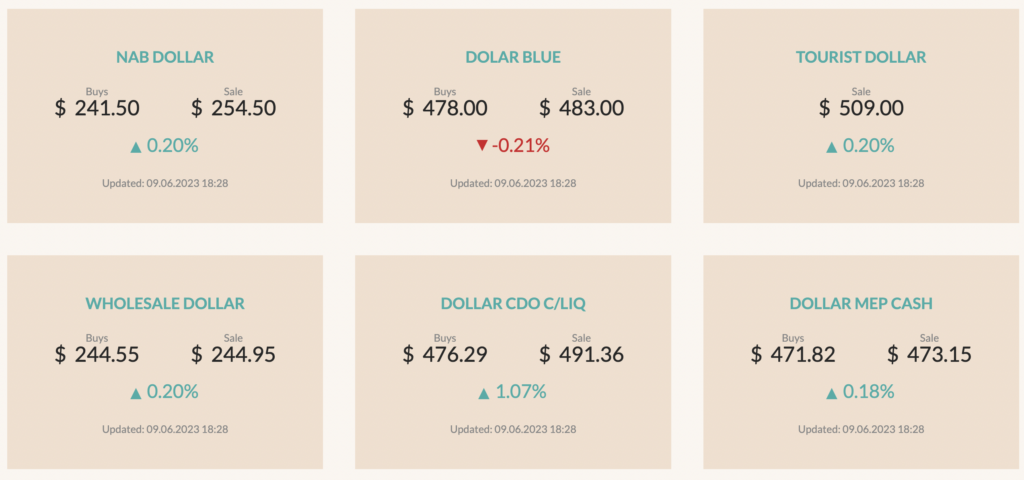

Cronista, Argentina’s business newspaper, lists the blue dollar rate alongside other rates on its website.

Related: Review: Hampton by Hilton Bariloche, Argentina (Gateway To Patagonia)

How to access the blue dollar in Argentina?

Generally, taking literal cash abroad is inadvisable for foreign travel. You’ll be much better served with the combination of a debit card that allows you to use ATMs with no foreign transaction or ATM fees and a credit card with no foreign transaction fees.

Argentina is the exception. If you use ATMs or credit cards, even if you avoid fees, you’ll get the official exchange rate halving your money’s value. No amount of credit card rewards makes up for that. Hard cash is worth at least double what your money back home is worth.

Getting the Dollar Blue on Calle Florida in Buenos Aires

Changing dollars (or euros, Brazilian reais, or British Pounds) to pesos using the blue rate is easy. In Buenos Aires, just head to Calle Florida, a popular shopping street, and you’ll hear “cambio! cambio! cambio!” or “dolar, real, euro, cambio!” from traders looking to make an exchange.

Be sure to know what the current blue rate is and negotiate as close to it before making the exchange. Show the rate you expect to the trader on your phone (from one of the websites linked above).

Warning: Unscrupulous traders have been reported to give unsuspecting tourists counterfeit peso bills. But it’s unlikely. While I’m not a lawyer, the argument is that exchanging pesos for dollars at the blue rate is not illegal but using counterfeit bills is a crime so most traders who work in the same place daily want to avoid making themselves a target.

Keep in mind that Argentinians prefer $100 and $50 notes and that new, crisp notes are valued higher. You’ll get a lower rate for smaller bills and for worn bills. Brand new $50 or $100 bills should get the full blue dollar rate.

Calle Florida in Buenos Aires is a popular place for “arbolitos” — Argentina’s blue dollar traders — to ply their trade.

Your Hotel, Airbnb, Businesses, Individuals – the scramble for greenbacks in Argentina

Remember how the Argentinian government’s draconian currency controls limit each Argentian to accessing only $200 USD in foreign cash a month? That’s why the dollar blue rate exists. And as their currency continues its freefall, Argentinians across the country are motivated to change as much of their hard-earned money to more stable currencies as possible.

That means that almost any Argentian you interact with is likely willing to convert your dollars into pesos. This should be the case whether you’re wine-tasting in Mendoza, exploring Patagonia, or preparing for an Antarctica tour in Ushuaia, the southern tip of Argentina. During my visit to Argentina, I went to a barber shortly after arriving and hadn’t yet changed my dollars to pesos. He enthusiastically offered to help. I returned to his shop a few times during my trip, not for another haircut but to exchange funds.

Check with your hotel staff, your Airbnb host, or any small business you walk into. There’s a good chance they’ll be willing to make an exchange. Or if you have an Argentinian friend, they’ll probably view it as a favor if you let them change your dollars to pesos.

The Easiest Way to Access the Blue Dollar: Western Union

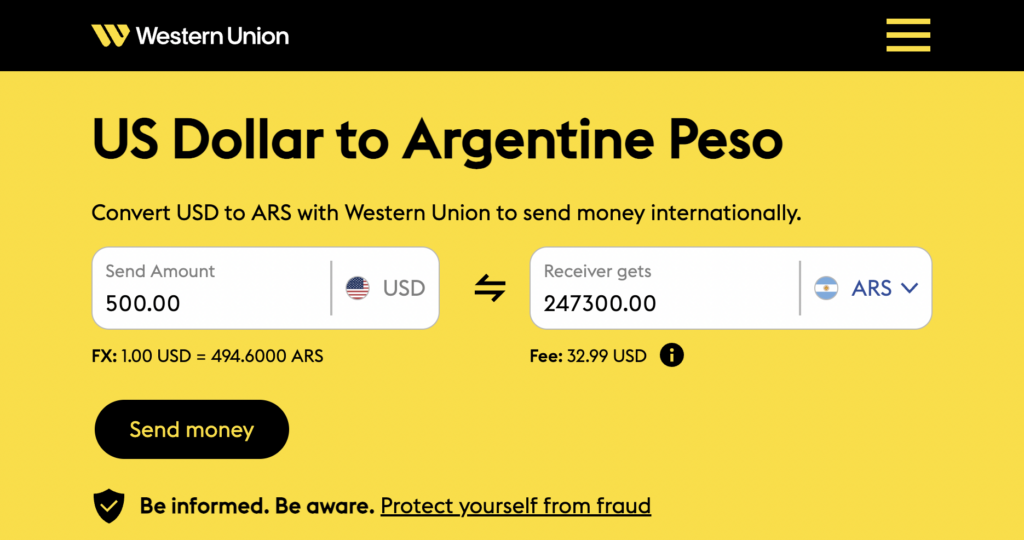

Another method of accessing Argentina’s blue rate is sending yourself money with Western Union. Western Union’s exchange rate to pesos is based on real-time demand and tends to mirror the blue rate quite closely with minimal fees.

Right now, the Western Union rate significantly outperforms the Blue Dollar.

It’s easy to do but requires a few steps.

- First, you’ll need to create a Western Union account (by using this link you’ll earn a $20 Amazon gift card for sending your first $100 within 30 days). It only takes a few minutes so you only need to set it up when you’re ready.

- Add yourself as a recipient in your Western Union account as a recipient in Argentina. Make sure your details are all correct and exactly match the details in your passport.

- Pick up your funds at any Western Union outlet. There are many across the country but make sure there’s one near you if you’re not in a major city.

Western Union has become very popular among longer-term expats for accessing the blue rate. With fees, it may not be quite as favorable as exchanging cash but it is still far better than the official exchange rate from ATMs or credit cards.

The Upshot

Argentina is one of my favorite countries. There are truly spectacular things to do and Argentinians are some of the friendliest people in the world. But with mismanaged interventions from a dysfunctional government, the economy has seen incessant inflation and locals are unfairly seeing their money lose value daily.

The Argentinian blue dollar is a unique quirk created out of necessity by Argentinians seeking an exit from their failing currency. While bringing cash into the country is one way to access the rate, another is to utilize Western Union money transfers. If you’re planning a visit to Argentina, be sure to bookmark this page so you know everything you need to know about accessing the blue dollar in Argentina.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

3 comments

[…] rite of passage for Argentina, in that we found a place that would exchange our money at the “blue market rate.” The blue market rate is almost double the official exchange rate. Swapping bills at this […]

[…] de Bariloche Airport (BRC), I headed directly to the Hampton Bariloche to check in. Be sure to acquire some Argentinian Pesos before arriving at the airport. Taxis in Bariloche do not accept credit cards, there is no airport […]

wow really grateful to darkwebprogrammer@gmail,com , I was able to establish a great business with their aid