On the surface, a discussion about currency exchange rates may sound simple. There are different best practices for how to get the best currency exchange rate when you’re on a trip. The best way to exchange money while traveling can be confusing. These concerns seem like the nuts and bolts of any discussion and best practices do change from time to time.

I remember when a really cool thing to do for Euros was to go to your local AAA office where you could buy Euro starter packs at a pretty decent exchange rate. For people who were just beginning to travel abroad, it was a great idea. I used to get them as gifts for couples going to Europe on their honeymoon! I have no idea if AAA still does that, but they used to sell out quickly.

How Our Philosophy Changes Over Time

As we become more experienced travelers, I think we adopt a more relaxed approach to currency exchange rates and find a system that works well for each of us. For instance, I never mind returning home with a stash of foreign currency because I know I’ll use it again during an upcoming trip.

But recently, a conversation I had with a friend, not so much about where to exchange currency, but more about the value he was getting for his exchange rates, sorta shocked me.

Was he able to get the best currency exchange rate?

Our conversation made me think about how I approach spending when I’m abroad and I gave him some advice that really opened his eyes and relaxed his anxiety, so I’m wondering what you all think. Maybe there are other viewpoints we can add to this conversation too?

My Friend’s Approach

First, let me tell you his approach. Do keep in mind he’s not particularly well-traveled and hadn’t been on a trip by himself in many years. He’s also a generally nervous guy. He was keeping track of the exchange rate every single day and with every transaction! To my way of thinking, he was much too focused on the small picture and driving himself and the merchants crazy. He wasn’t using credit cards as most of us do, but that’s a different topic altogether!

He exchanged some dollars when he first got to his destination. Then every day, he’d calculate that day’s exchange rate and decide whether it was a good day to shop or purchase anything. He said sometimes even for purchases he’d stand at the register and calculate the exchange rate before deciding to buy or not. I could just see the shopkeeper’s eyes rolling and his impatience growing as my friend did all this. Not to mention the growing impatience of the other customers lined up behind him. I listened rather patiently, though I couldn’t believe anyone did all these calculations. I said, “Wow, that’s a lot of work. You must have been exhausted doing that all day everywhere you went.” Then I said, “Let me tell you what I do when I travel.”

My Approach

Being a much more experienced traveler than him, I was hoping he’d listen. But I had no idea my approach would astonish, for all the best reasons. I told him when I get to my destination, if I don’t have any currency left from a previous trip, and when I need some more, I use an ATM machine. OK, basic enough.

And then I don’t fuss about the exchange rate at all the rest of the trip! For me, the exchange rate I get on the day I exchange my dollars is the exchange rate I go by. I do like to keep it simple when it comes to the best way to exchange money while traveling.

And even then, I’ll round it up or round it down just to get a general sense of the rate I pay for items, so I can say to myself, “Hmm, an espresso today in Rome is .90 Euro. That’s amazing, I think I’ll have another!”

Make Sure YOU Don’t Waste Money by Overpaying for Hotel Rooms!

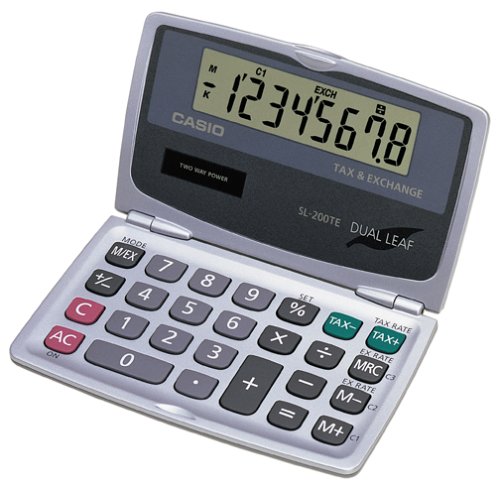

I’m not at all looking at the day to day fluctuations like my friend does. He couldn’t believe I’m not interested, once I get my cash, about the minutia of exchange rates. A light bulb went off in his head and he realized how much he was stressing about exchange rates instead of enjoying his travels. All that math was a real downer and the anxiety about not getting the “best price and rates” was exhausting. Of course, he started laughing and it was as if he couldn’t wait to travel again and not be so stressed, and dare I say, BE a bother to so many merchants. At the very least, he can turn off the calculator function on his phone!

Upshot

So I’m wondering if I gave him good advice. Did you stress out about how to get the best currency exchange rate when you first started traveling? As a newbie traveler, did you think about the best way to exchange money when traveling?Am I more relaxed about currency fluctuations than I should be, or than most people are? Now more and more we’re seeing cashless destinations. On one of my recent trips to Scandinavia I didn’t pull out any cash from the ATM at all. What a pleasure! But of course there are still plenty of places where this isn’t the case.

Related Articles:

- When I book award tickets for my international travels, I always rely on Point.me. They make sure I’m not wasting my miles and points.

- I Always Get the Lowest Prices on Hotel Rooms: Here’s How!

- My Favorite Travel Resources and Products

- 9 Awesome Travel Accessories To Pack for Your Next Trip

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

16 comments

Best advice is not to worry about the rate – rather be smart about minimizing transaction costs by (1) charge as much as you can to a rewards card with zero forex markup (there are many) (2) always have at least 2 back up cards (preferably with 1 in safe with passports) (3) use no fee ATM card to get cash from reputable bank ATMs (4) always travel with a few USD $100 bills to exchange in a pinch where ATMs are unavailable (ie much of Africa)

That’s it. Focus on how you transact and the rate will take care of itself. If you are so worried about how much a coffee costs then maybe you don’t have enough $$$ to travel

All good points, Boraxo. I agree. I also use the idea of a few USD $100 just in case. Thanks for reading!

It was natural when I first started traveling. I’d book a trip in advance and I’ll exchange money at my local money changer in Singapore when I thought the rate was good. I’d be kicking myself if the rate went down more, or feeling great if the rate went up. I looked at rates everyday, much like a stock trader would. But then when I came to the US, I learnt to just minimize cash transactions as much as possible and just enjoy my travel with a zero FTF credit card. I’ll take out $10 worth of foreign currency at the airport (just did that in Serbia – got £10 of Serbian dinars with my leftover £ from a previous trip) and pay the rest with a cc.

I think you make a good point that as inexperienced new travelers we all probably fussed too much and too often over exchange rates. Enjoying travel does mean we need to relax our focus on rates, I agree. Thanks, GL.

I hate it when countries demonetize currency. Sweden did that maybe last year, paper and coins. The UK does that periodically, coins and paper. Trump should make them stop and threaten them with tweets first then nuclear war. Seriously, I get annoyed of demonetization because I often keep a little currency from a previous trip and use it on the next trip. I only do that with major countries, like Australia, Singapore, Japan, Canada, UK, Euro zone, Switzerland, India.

I often keep some currency from previous trips to use in the future, so good point, Derek. Thanks.

Boraxo has it spot on.

In addition, I exchange any remaining paper foreign into USD before I get on the plane to return home. Best case scenario is that I’ve used it all and there is nothing left to exchange anyway. I don’t like having a drawer full of foreign bills in my home – I never know if or when I’ll use them again. Trying to exchange foreign currency back in the US is costly – poor exchange rates and service fees.

Using up foreign currency before leaving is something I do as well as best I can. I’ve never turned it back to USD. Interesting idea though, Ed.

I think it depends on the country. I thought China would be a cash country but they use a system like Samsung Pay with QR codes. If you didn’t have that then it was cash on the streets and credit in the shops. Here in Egypt it is a cash society unless you are in the hotels (not all) or bigger shops. Moscow I used cash because it was easier and I wasn’t there long. The biggest thing I’ve learned is to just use an ATM and not exchange before. I agree with spend it all but I take a coin or two home for a keepsake. My next step is to get an account that doesn’t charge atm fees abroad.

You are right in that it depends on the country, good point. Thanks for reading and adding to the conversation!

I tend to take cash out and never concern myself with the exchange rate. Maybe that’s TOO simple, but I travel too much to worry about it, and I figure that it’ll all work out even in the end. I’m in Europe often, so I keep my euros. I also assume I’ll go back somewhere and I can use whatever I have left.

I will also, from time to time, send a little cash to clients who have a layover somewhere so they can get a coffee and not worry about using a card for so little or needing to get cash. That helps me get rid of extra currency from, say, Iceland.. or the occasional euro (but I ALWAYS have euros)

I travelled with someone who penny-pinched our daily costs — to the point of, if he paid for groceries he would cross out things on the receipt that only one of us used so he wasn’t paying extra for my cheese or a meat he didn’t eat. It came down to mere cents. Drove me effing crazy. THAT is too far, in my opinion.

Your strategy makes good sense. You’ve got a plan for any and all occasions. I have a feeling your friend is no longer your travel buddy! Thanks for taking time to add to the conversation, Sarah. Much appreciated.

Makes sense to not bother too much about the exchange rate. From a security perspective, though, Ive found that it makes sense to carry 1/3rd in cash, and 2/3rd in Amex travellers cheques or preloaded foreign currency cards issued by banks in India which dont have foreign transaction fees on them.

The advantage of the preloaded cards is that you can top them up online as well.

Good to have a plan that works well for both where you reside and your travel destination. Thanks for adding your thoughts, 747A.

I never pay attention to the exchange rate. I take money out of the ATM on arrival and later if needed, pay with CC wherever I can. There are lots of details to think about already when traveling, pinching pennies is not on my agenda. And it’s not like I can do anything about the exchange rate, it is what is, whether I worry about it or not :).

You are totally right, Anna. I agree. Lots of other details more deserving of attention than exchange rates. Great point! Thanks.