Chase offers some of the most compelling credit card products for consumers. From cash back to travel cards to premium cards, people find tremendous value in Chase cards and Chase’s Ultimate Rewards program. However, there is a pesky little Chase rule that will prevent you from applying for too many cards…

Breaking It Down:

The Chase 5/24 Rule

Unfortunately, Chase operates under one of the most rigorous rules in the industry – known as the “Chase 5/24 Rule.” The name “5/24 Rule” comes from consumers based on shared information across the internet from Chase credit card approvals and denials.

Wording used in application denial letters (an applicant “opened too many new accounts in the last 24 months”) as well as telephone conversations with Chase credit analysts have supported the existence of this rule and it’s been appropriately dubbed the “5/24 Rule.”

If you plan on getting a few cards that will earn you points, you need to know the ins and outs of the Chase 5/24 Rule.

Here is a how-to guide using a hidden Credit Karma login to show where you fall within Chase’s 5/24 rule. Additionally, another way to find this information out is via the Experian app. This will help you know how many accounts Chase will use to determine your 5/24 rule status.

First, How Does 5/24 Work In Practice?

Basically, Chase will not approve applications for certain credit cards if the applicant has already opened five (or more) credit card accounts in the past 24 months. As a part of this rule, these accounts include not only cards you open at Chase, but also cards you open at any bank. Because all of these are reported to your personal credit report, Chase knows what accounts have been opened (and when).

However, most business credit card accounts are not reported on your personal credit report. As a result, that leaves most business credit cards you may have opened not being counted by Chase on their 5/24 rule.

See also: 7 Great Reasons To Acquire and Keep No Annual Fee Credit Cards

Which Accounts Are Counted in the 5/24 Rule?

In addition (making matters more difficult), Chase’s 5/24 Rule is an internal rule and the bank does not formally publish it or its guidelines. Therefore, information comes from crowd-sourced feedback. As a result, here is what we currently believe are accounts being counted by Chase in their 5/24 rule.

- All new personal credit cards that you open at any bank. Even if you have closed an account, Chase still counts them.

- Retail credit cards that you open are counted as long as they can be used outside of that store.

- If you are added as an authorized user to someone else’s credit card account.

- Some business cards (Capital One, Discover, and perhaps other banks.) However, generally, most business credit cards DO NOT count against you under the 5/24 Rule.

Feedback suggests all personal cards are impacted including charge cards (i.e. American Express charge cards), as well as if an applicant is an ‘authorized user’ on a card. Also, that authorization would count if the user was added within the past 24 months.

For the most part, retail store cards only count if the card can be used outside of a specific store and is part of American Express, Discover, MasterCard or Visa’s payment network. Also, loans and other non-credit card accounts do not count. For example, these are things like house mortgage, auto loan, and lease agreements.

Which Chase Cards Are Affected by the 5/24 Rule?

It is certainly worth it to see if you can qualify for one of their top cards. For example, all of these Chase cards listed below (and more) will be affected by their 5/24 rule. If you are over the 5/24, then you will get denied.

- Chase Sapphire Preferred

- The Chase Freedom Card

- Southwest Rapid Rewards Priority

- Chase Freedom Unlimited

- Sapphire Reserve

- Chase Ink Business Unlimited

Tools To Check Your Chase 5/24 Status

To know where you stand, you need information. Thankfully, there are some tools to know where you stand with 5/24 and Chase’s official count of your accounts. These two great tools help you tackle the 5/24 rule.

Using Credit Karma To Check Your Chase 5/24 Status

The first method is using Credit Karma, a free credit and money management company with both a website and mobile application. In particular, Credit Karma allows users to retrieve free credit scores and credit reports from two of the nation’s credit bureaus —TransUnion and Equifax. It also feature free tax preparation plus a tool to identify and dispute credit report errors. You can log in or sign up here: Credit Karma.

Credit Karma Workaround

Previously, there used to be a login on the site you could use to directly check your Chase 5/24 Rule status. However, neither the mobile app nor the current interface works, so here’s the link for the workaround. It’s also the only part of the site that will show you the accurate info you need. For this to work, you need to click that legacy link after you login to your Credit Karma account.

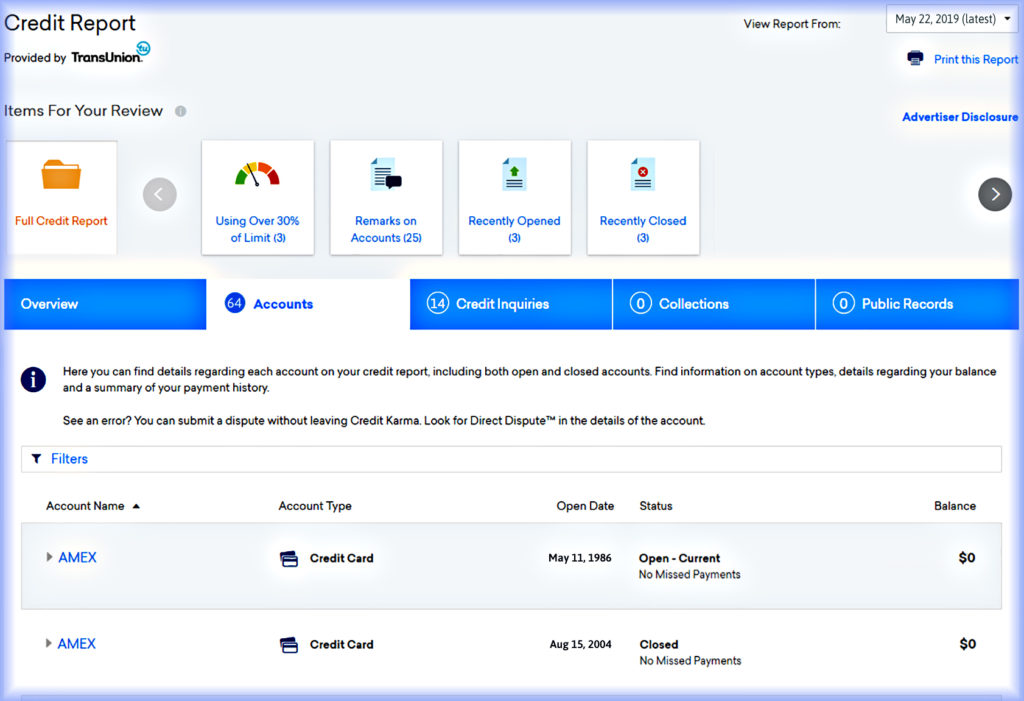

Here’s what the next page should look like after clicking that link (and you’re logged in):

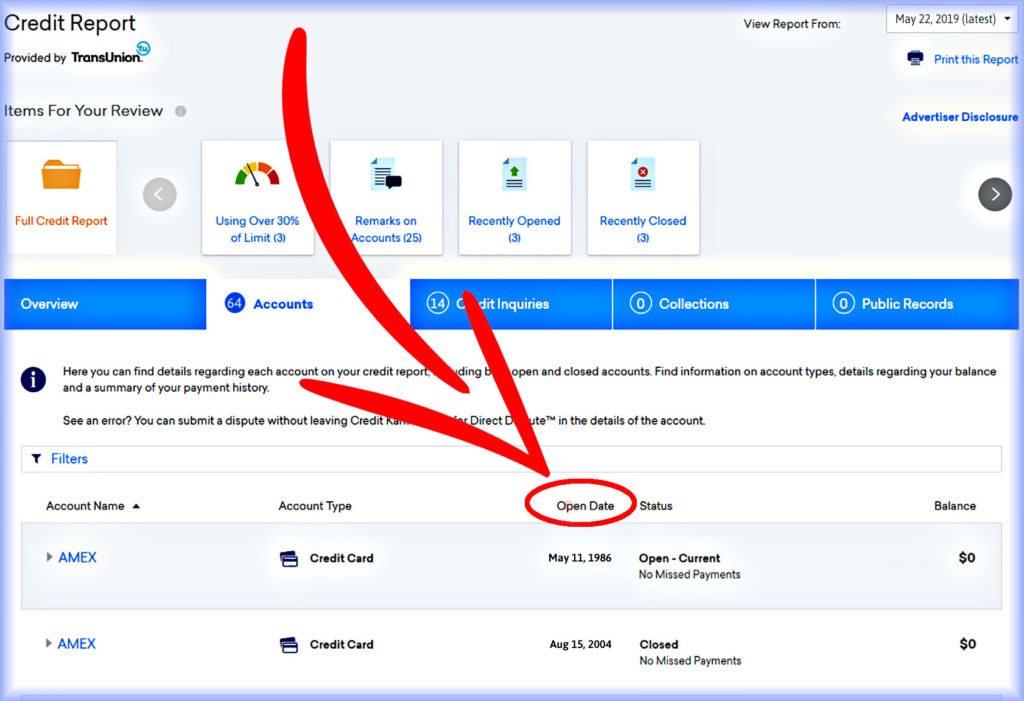

Next, you want to sort by opened date, so click the heading “Open Date” once to sort:

After sorting your opened accounts, locate the first card opened within the past 25 months. For example, if the current date is within June 2019, then you would look for the first account opened since April 2017 (any date in April.)

Counting Up Your Accounts

Begin counting all accounts that appeared within the past 25 months.

Begin with that first card that appeared within the past 25 months, and count all of the cards that were opened on that date or more recently. Closed cards do count. You also have to include those you have been made an authorized user.

Note: Authorized User Accounts & Reconsideration

If you have five credit cards reporting as new accounts within the past two years and one or more of them is an authorized user account then it’s possible to call Chase reconsideration and plead your case. The reconsideration line does have the ability to approve you in this specific scenario. Remember, it’s not certain and still up to the credit analyst to make the final decision.

Keep in mind this is not a guarantee. Nonetheless, it certainly is worth a try as people have reported getting approved going this route in the past. One key point you should make is let the agent know that you have no financial responsibility for the authorized user accounts on your report.

(Later, I’ll show you later how to cancel an authorized user.)

Using Experian to Check on Your 5/24 Status

Another convenient method to uncover your 5/24 totals is to create a free account at experian.com.

Experian is a credit reporting agency, one of the three major bureaus in the United States. Together with TransUnion and Equifax, these make up the major agencies. Particularly, using Experian to help you count up your Chase 5/24 Rule status is quick and it comes directly from a credit reporting bureau.

1. Install the Experian app on your smart phone.

This is the iPhone link for the Experian app or Google Play Store link. Install the app and register, or log in if you already have an Experian account.

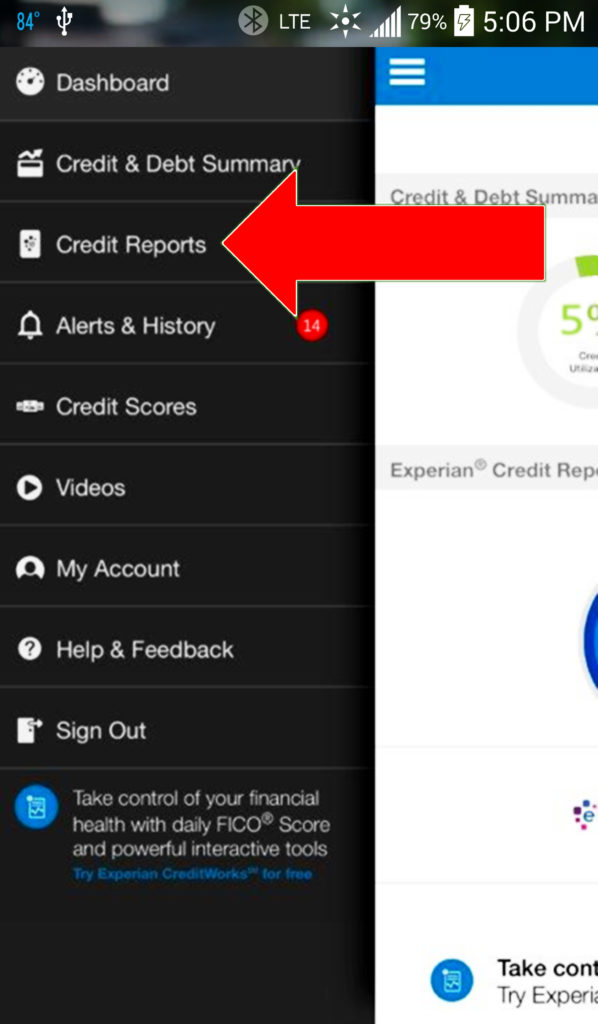

2. Select “Credit Reports”

On the mobile app, click the menu directory, (it looks like three horizontal bars), and click “Credit Reports.”

Experian app menu

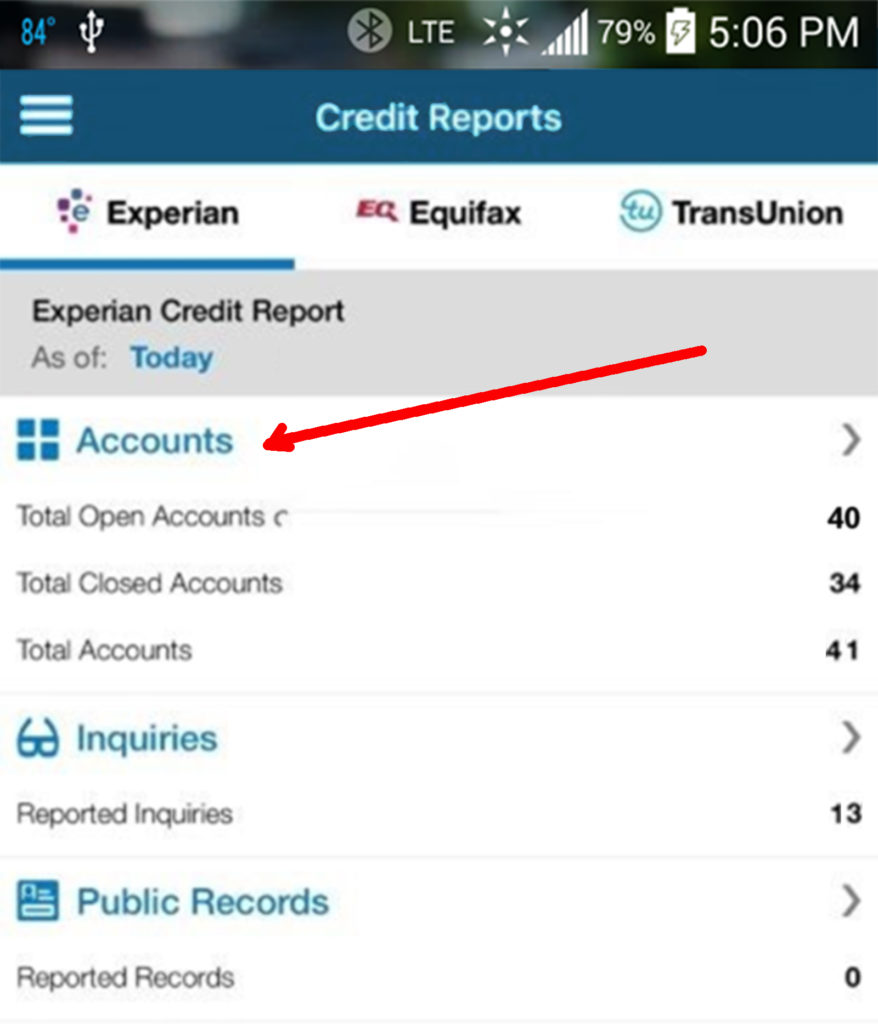

3. Select “Accounts”

After getting to Credit Reports, you will see the three major credit reporting agencies listed on the top of your mobile app. On the mobile app, click “Accounts”

3. Sort Your “Accounts”

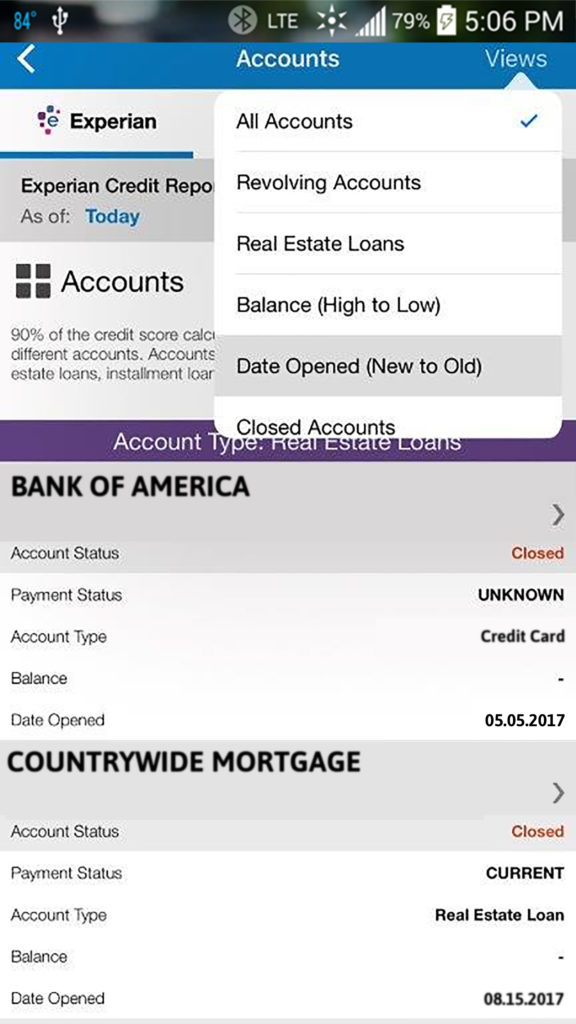

Next, sorting the report by “Date Opened (New to Old)” will allow you to see chronologically all accounts opened.

4. Count Up Your Potential 5/24 Impacted Accounts

Count backwards to get a total of the accounts that were opened within the past 24 months. Remember, Chase considers all accounts opened — it doesn’t matter to Chase if you’ve since closed any account. For example, in my report, the earliest account opened within the last 24 months is a Bank of America credit card, opened May 5, 2017. If I am running my check in May 2019, then I would count that and all credit cards opened since then. (In contrast, the real estate loan shown would not count.)

What’s Your Chase 5/24 Total?

In my case, I have 11 credit cards opened in the past 24 months so Chase will deny me because I am limited by the 5/24 Rule. Likewise, check your total so you know if it is even worth applying for a Chase card, or make the decision to wait until you fall below the 5/24 Rule count. Consequently, you may just choose to go after another credit card not offered by Chase.

Frequently Asked Questions

Here are some common questions about the Chase 5/24 Rule.

See also: Does Closing Credit Cards Help or Hurt Your Credit Score?

- If you are an authorized user on someone else’s account, will that count toward your 5/24?

Yes, however, you can remove authorized users. (See instructions below.) - What if you get a targeted mailer (or perhaps email) from Chase for a specific card or offer? Would that application be exempt from the 5/24 rule?No, Chase is holding fast to the rule. The right hand doesn’t know what the left hand is doing. Don’t fall for this thinking because you got a ‘targeted offer’ that Chase will approve you — they won’t.

- If you apply for the Chase Ink Business Preferred Credit Card, will that count towards your 5/24 count?No, it will not count against your 5/24 total, although you will need to be under 5/24 to be approved.

How To Remove An Authorized User

Are you an authorized user on someone else’s credit card account? Ordinarily, these are reported to the credit bureaus and counted against you for 5/24. Chase doesn’t differentiate between an account in your name (where you are the primary user) and an authorized user account.

Follow these steps:

- Have the primary user contact their bank and remove you as an authorized user

- Removal by the Credit Bureaus

How To Be Removed As An Authorized User by Credit Bureaus

Equifax

- Navigate To Their Dispute Site

Experian

- Go To Their Dispute Portal

TransUnion

- Easily completed using Credit Karma, with their direct dispute feature:

- Pull up your list of accounts

- Under each account there is a link to dispute that account

- Click that link

- Click “Ownership – I am no longer liable for this account” as your reason for the dispute

The Upshot

If you have more than five new accounts opened within the past 24 months, you are therefore subject to the Chase 5/24 rule. The legacy link to Credit Karma or Experian technique can help you get that information. Evaluate your future spending habits and travel plans, and balance those against the benefits of having a Chase card.

Churning: Credit card churning is the strategy of signing up for a new credit card in order to take advantage of the sign-up bonus, and then canceling the card rather than adding it to your wallet for the long term.

We get it. Chase doesn’t want consumers to churn their cards, or accumulate a bunch of anyone’s cards, just to earn the sign-up bonuses. On the other hand, sign-up bonuses have increased over the past two years as competition (and the incentive to get a new card) heats up. In short, it’s a complex landscape.

Hopefully, this will help you navigate the Chase 5/24 rule and perhaps you can take advantage of Credit Karma’s login and Experian’s app to help you with your choices.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

2 comments

Super useful. Thanks.

Christian –

Hi and thanks for the compliment. I’m glad you found value in the information. Thanks for being a reader.