If you have been contemplating adding a new business credit card to your wallet, Chase just increased the Ink Business Preferred® Credit Card welcome offer from 80,000 to 100,000 Chase Ultimate Rewards. That’s for customers who spend $15,000 in the first 3 months of account opening, giving Chase Ultimate Rewards fans the opportunity to rack up more points.

New Offer! Earn 100,000 bonus points after you spend $15,000 on purchases in the first 3 months from account opening.

Chase 100,000 Ultimate Rewards Bonus Offer

Cardholders can redeem those points for travel, cash back, gift cards and more, and your points won’t expire as long as your account is open.

The new bonus is a great and competitive offer. However, keep in mind you’ll have to spend an extra $15,000 on the card during the first three months to earn the full welcome bonus.

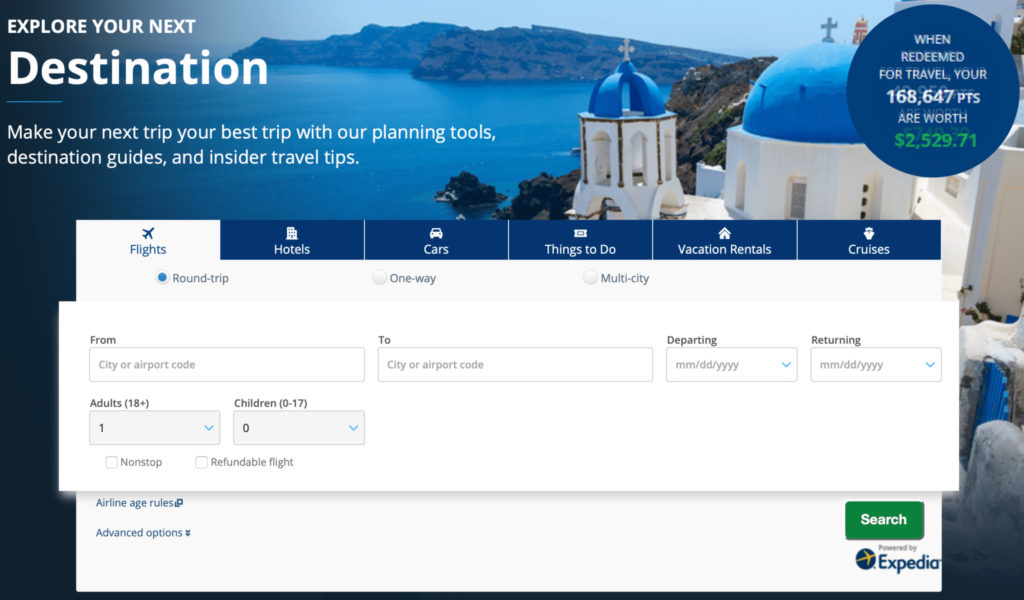

Estimating The Value of the Welcome Offer

You can get up to 100,000 bonus points when you spend $15,000 in the first three months of opening an account, which is equivalent to $1,250 toward travel when redeemed through Chase Ultimate Rewards. Don’t forget your points are worth 25% more when you redeem for travel through Chase Ultimate Rewards travel portal.

If you travel often for business, this card could offer you an excellent rewards value and be worth the high spending requirement.

Ink Business Preferred® Credit Card Benefits

Along with the new offer, cardholders will continue to receive the same benefits:

New Offer! Earn 100k bonus points after you spend $15,000 on purchases in the first 3 months from account opening. That’s $1,250 toward travel when redeemed through Chase Ultimate Rewards®

- Earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year

- Earn 1 point per $1 on all other purchases – with no limit to the amount you can earn

- Points are worth 25% more when you redeem for travel through Chase Ultimate Rewards

- Redeem points for travel, cash back, gift cards and more – your points don’t expire as long as your account is open

- No foreign transaction fees

- Employee cards at no additional cost

- You’ll pay a $95 annual fee for this card, which is relatively low compared to other business cards.

However, remember you must spend $15,000 on the card within three months of opening it to earn the full welcome bonus.

Application Tip:

A new EIN (or using an SSN instead of a previously used EIN) will qualify a reader / customer for this card. You should NOT call the reconsideration line. Instead, waiting 10-12 days will likely result in an approval.

RELATED POST: Getting the Best Value from Ultimate Rewards

The UpShot

Yes, we are facing a worldwide crisis brought on by the coronavirus outbreak. At the same time we need to remember that things will get back to normal at some point. While you may not be traveling (and you should not during this time) it still makes sense to continue a strategy to accumulate rewards for your future travels.

While a 100,000-point welcome offer is high, it’s not uncommon among business credit cards. Cardholders will find a lot of value in 100,000 Chase Ultimate Rewards points, and there’s a multitude of redemption options.

However, this offer doesn’t offer great value for everyone — it likely appeals particularly to business owners who travel frequently and pay for common business expenses. You could get value from this offer if your business will spend at least $15,000 via a credit card in the next three months, but it’ll pay off exceptionally well if you use the Ink Business Preferred® Credit Card when traveling regularly for work. You can apply for the Ink Business Preferred® Credit Card here.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.