The Citi Prestige went through a pretty significant overhaul last year, after briefly disappearing for months. As part of the overhaul, the much raved about 4th night free hotel benefit will become significantly devalued as of September 1, 2019. Additionally, we just got noticed that Citi is gutting “Protection” benefits, including trip delay and lost baggage protection, on September 22, 2019.

But in light of valuable benefits going away, it’s worth reminding ourselves the perks that come with the Citi Prestige. For instance, the card does now come with a pretty compelling lineup of bonus categories that stacks up really well in a sea of travel credit cards. This includes:

- 5 ThankYou points per dollar spent on airfare and restaurants

- 3 ThankYou points per dollar spent on hotels and cruise lines

- 1 ThankYou point per dollar spent everywhere else

Since the rollout of these changes a few months ago, I have been putting all of my airfare and restaurant purchases on the Citi Prestige card. While the American Express Platinum card, a key competitor in the premium travel card space, also earns 5 Membership Rewards points per dollar, I personally value the travel insurance that comes with the Citi Prestige card. Sadly, these benefits are going away, which will definitely affect where I put my travel spending.

But in the mean time…

The Citi Prestige Earns 5x on Travel Agencies!

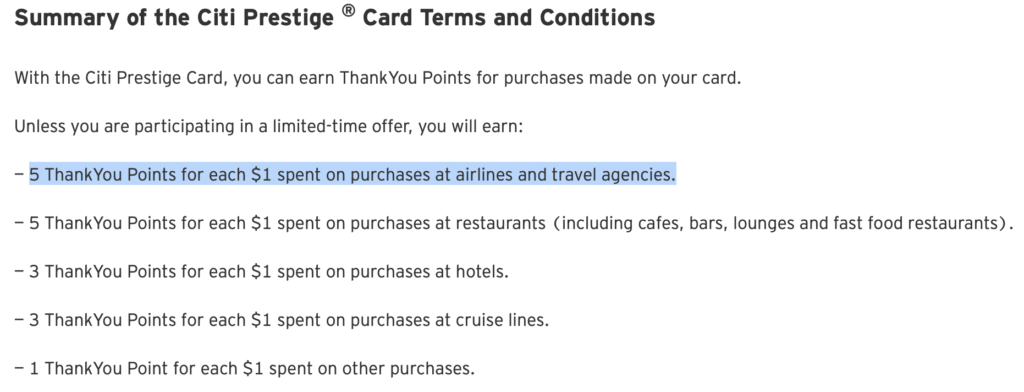

What I was unaware until recently is that the Citi Prestige actually earns 5 ThankYou points per dollar on purchases through travel agencies as well. This is not very well advertised, but is clearly stated in the fine print of the card. This means that even if you purchase airfare from an online travel agency (OTA) like Expedia or Priceline, you will still earn 5 points per dollar. This is in contrast to the American Express Platinum card, which only grants you the bonus if you buy the ticket directly from the airline.

The Citi Prestige card earns 5 points per dollar spent at travel agencies.

5x ThankYou Points On Hotels

Interestingly, this also means that booking a hotel with an OTA earns you more points than if you were to book with the hotel directly. Now, there are a few caveats to this. Often OTAs charge a higher rate, which might negate the value of the bonus points you earned. Additionally, many hotel chains won’t let you earn hotel loyalty points or even get status benefits unless you booked direct. But for those instances where you might be booking an independent hotel, at the same rate, you could potentially earn more points booking through a travel agency.

What Counts as a Travel Agency?

A tour booked through an OTA counts towards 5x points

Not Just Hotels: Tours Too!

Data points from folks on FlyerTalk seem to validate that travel agencies do indeed earn 5 ThankYou points per dollar. For example, booking tours through Viator and airline tickets booked through Expedia are all eligible to earn the 5x multiplier. It seems that this policy dates back quite a bit, but I was certainly unaware until now.

I don’t think there is any deceit on Citi’s part in not advertising this. After all, “travel agency” is not as clear cut as “airlines” when it comes to coding purchases. For example, would Airbnb count? What about a food tour that you book abroad? As noted on FlyerTalk, some things booked through Costco Travel are actually charged directly by the operator. In this case, Citi seems to have erred on the side of not confusing customers.

Is It Easy To Tell If Your Purchase Was Made Through A Travel Agency?

Unlike Chase or AmEx, Citi does not break down how many points an individual purchase earned. Instead, Citi simply pools all the points you earned at the end of a cycle; it shows only the total points earned per category on your monthly statement. As a result, it’s difficult to validate individual purchases in granular detail. Still, if you were to, say, drop $5,000 on a cruise booked through a travel agent, it would be pretty obvious when the statement comes out.

Sure, it would still be a tiny bit of a gamble if you book through a “travel agent” that is not as well known. They might not code as travel agencies, and you’d lose out on bonus points.

Still, I am definitely changing which card I use when I book tours and activities, as well as independent hotels if the rates are the same. In the past, I have always preferred to use the Chase Ink Preferred or Chase Sapphire Reserve. This is because those cards earn 3 Ultimate Rewards points on all travel-related purchases. But the difference between 3x and 5x is big enough—especially when it comes to tours and activities—that I personally think it’s worth the switch.

Those of you with experience, please do chime in with data points as to what counts!

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

3 comments

I called on Monday to cancel my Prestige card, given the loss of protection benefits, the drop in TY point value from 1.25 to 1.0 when booking air, and the change with the 4NF benefit. The card renewed last month, and I thought I’d keep it one more year, but can’t justify charging any travel to the card, as the protections/insurance is disappearing. I would never book flights without credit card trip delay/interruption insurance regardless of how many TY points they offer.

“Citi does not break down how many points an individual purchase earned.”

Yes it does. I’m looking at my account right now, and every posted transaction has the points earned (or lost, if it’s a credit) right next to it. You need to be on the desktop site. The sum of earnings on all posted transactions is at the bottom, after the other totals. Categorized sums are, I think, on the ThankYou site (I normally check those in the app, under Services > Rewards). Roundup on the Rewards+ I think goes in on the following statement, but once this statement closes, you’ll be able to see them in the “by category” section (on the ThankYou site or in the app) as well.

[…] Related: Citi Prestige’s 5x Points Benefit That No One Talks About (OTAs) […]