As much as I would love to be able to focus on my points/miles strategy for hours everyday to maximize all of my earning that isn’t always possible. Blogging for Point Me to the Plane is actually my fourth job, behind teaching, poker, and educational consulting. This means my free time is extremely limited and meanwhile I will have to continue to live in envy of those bloggers that can make elaborate spreadsheets to track everything or plan out every minute detail. Oh how I wish…

I have accepted that until I make some major changes I am going to have to live with the fact that every once in a while something unexpected falls through the cracks. What mess did I have to clean up this time? A letter from my favorite lender, Chase, saying that they shut down my Marriott Rewards Business Card.

Breaking It Down:

Reasons for the Closure

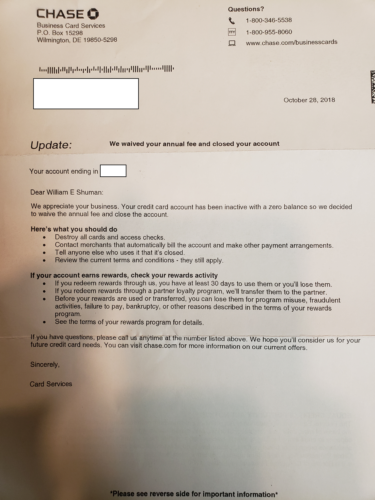

The letter sent by Chase notifying me of the closure.

Upon receiving the letter I immediately called Chase to see exactly what was going on with my account. Speaking with two representatives in two different departments led me to realize that there had been no activity on the account in some time. Whoops! That meant it was an easy decision for Chase to close the account.

What was interesting was that Chase seemed to have no problems with the inactivity prior to the annual fee posting, as I had not used it for a few months prior to the renewal. Since the annual fee posted on Aug. 1, there were no charges on the account for almost three months before the closure. The representative said that a reevaluation of the account is common after the annual fee comes around

Hmmm.

Fortunately, Chase provided me with a full refund of my annual fee.

I asked the representatives to see if they could reopen the account as I was worried about losing some of the benefits of the card, most importantly my yearly free night. As I posted previously, I have plans for Europe in 2019 and would like to use my free nights to see some additional cities. After being transferred to three different departments I was told that I could reinstate the account, as long as inactive for six months or fewer, and it would be a fairly painless process. If the account was closed for other risk related reasons, it might have been a different story.

Learning from Mistakes

Overall there are a few things that readers can takeaway so this doesn’t happen to them:

- Regular Usage – In this situation my obvious problem was just not using the card at all for several months. I broke my own rules here by not cycling this card through my wallet as it got set in the wrong pile so I thought I had a reoccurring payment on it. By putting regular spending on the card it shows the lender you are accessing the credit line they have extended.

- Reoccurring Charges – One thing I do on some of my oldest accounts is set up my recurring payments (Netflix, gym memberships, etc.) to pay to those cards. I then set them on autopay so I do not have to worry about forgetting to pay them. This protects my accounts with 15+ years of history and prevents them from being shutdown for inactivity.

- Online Accounts – The cards that do not have reoccurring payments set up, and aren’t used for everyday purchases, I set up automatically with different online retailers. For example, my Amex EveryDay cards is my primary payment for Amazon, while I my Chase World of Hyatt card is setup to pay Paypal purchases. I do this for a few reasons: A) To keep the credit card account active so I do not have to think about inactivity; B) To earn points with various loyalty partners, which also keep those points from expiring; C) If an account gets compromised I can shut it down easily without it impacting other things.

Did Chase Do Me a Favor?

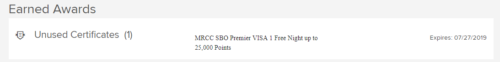

Marriott’s free night is still showing in my Marriott account.

In the end, I decided to leave the account closed as I was thinking about closing this account next year anyways. If drop my SPG Personal Card to meet the new signup bonus rules, I will then be able to reapply and claim another Marriott card bonus. The cherry on top: I still have the Annual Free Night showing up in my Marriott account that I can use for the next eight months; this free night will have effectively cost me $0.

Final Thoughts

While I certainly do not recommend going about managing your account like I did there is a takeaway for all as very few account closures work out advantageously. If you have a multitude of credit cards use some of the methods outlined above to continue putting spending on them to avoid account closures.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

15 comments

Bummer about the shutdown. On my older accounts that help my fico score, I set an ‘Amazon allowance’ for $5 a month (smallest amount you can) to myself. So every month I have a $5.00 charge and I set it to autopay. This does mean I’m paying $60 annually in Amazon gift cards per account, but I tend to use the gift cards anyways.

Really great suggestion. Like you I buy enough Amazon that have a recurring $5/month charge wouldn’t change anything and give me another monthly charge to put on another card.

Every 2 or 3 months, I used my Square reader to change $1 to each of the cards I haven’t used… How safe does that make me?

Honestly no idea as the condition for inactivity seems to vary by bank. It’s probably slightly better than no use, but I would think that if someone does a manual review of the account it could be a problem. You could try some like another reader Ramzi suggested.

Imagine having accounts in excess of 20 plus years and making timely payments on all accounts. Then they decided unilaterally to close all my accounts. Upon a phone call, I was told that I would receive a letter in the mail. I asked why and they refused to respond except to state that I would I receive aletter advising why they were closing all my accounts. It turned out to be a 1 page form letter. You would think at the very least that they had a moral obligation (not legal) to advise the customer. Chase can keep the accounts closed. They turned perfectly good accounts into BAD ACCOUNTS

Michael,

UGH! Did something happen with another account or on your credit report that would cause them any concern? Or did you open too many accounts with them too quickly. Those are the only reasons I can think of off hand where they would close accounts that are 20 years old out of the blue. Either way, that’s awful!

Your timing is GREAT, Bill – thanks so much for this important reminder. A question (out of the blue): I’ve always avoided PayPal because several years ago it seemed like I got phished every time I used my account. In your opinion, am I worrying needlessly? I could sure use PayPal every once in a while. Again, thanks for probably saving me from spending hours trying to reinstate a Chase account.

Huey,

Honestly, I use Paypal all the time for buying/selling on Ebay and on various forums for my hobbies. I’ve never once had a problem with a card. As long as you using your internet smarts to be safe I would think you should be alright. Glad I could assist and thanks for reading!

Apocryphal online stories suggest that Chase is more eager than most big lenders to take adverse action and close ALL of a customer’s accounts. I have never done any business with them and don’t have any burning desire for that to change. If they closed it for non-use , that’s understandable, but the other stories of shutdowns make me nervous. To be fair, Barclays is accused of the same thing and I’ve never had an issue with them. I guess the real answer is, spread your business around to multiple lenders, and use the card(s) periodically.

[…] When Chase Suddenly Closes Your Credit Card Account: No Notice […]

[…] When Chase Suddenly Closes Your Credit Card Account: No Notice […]

[…] When Chase Suddenly Closes Your Credit Card Account: No Notice […]

[…] When Chase Suddenly Closes Your Credit Card Account: No Notice […]

[…] When Chase Suddenly Closes Your Credit Card Account: No Notice […]

[…] When Chase Suddenly Closes Your Credit Card Account: No Notice […]