This post contains references to products from one or more of our advertisers. We will receive compensation when you click on links to those products. For an explanation of our Advertiser Disclosure, and advertiser partners, such as American Express, CreditCards.com and others visit this page.

For seasoned travelers and those who have been in the points and miles game for a while, you probably already know everything I’ll discuss in this post. However, I also recognize that many readers might be new to the game. I figure I’d do a little primer on how to take advantage of Amex Offers.

What are Amex Offers?

Essentially, these are offers that are provided directly through American Express. Instead of getting a discount code or going through a special link, American Express has offers available that you can “enroll” your card in. As a result, the offers become tied to a specific American Express credit card of yours. Most offers come in the form of “Spend $___ at XYZ, and get $___ back in statement credit,” however some also come in the form of a multiplier on the points you will otherwise earn.

It sounds restrictive, since you have to use your enrolled card to make the purchase associated to the offer. However, Amex Offers can actually be extremely lucrative. Many coupon codes cannot be stacked, and sometimes cash back portals won’t give you cash back if you use a promo code, etc. However, since American Express—the credit card company—is the one providing the offers, merchants basically have nothing to do with it. This means if there is an existing offer from the merchant, you can double dip: use any coupon codes or cash back portals you’d like and get the Amex offer.

An Example: 1-800-Flowers

A while ago, there was an Amex Offer where you’d get $15 back when you spend $50 on 1-800-Flowers. I enrolled my card, and went shopping at 1-800-Flowers.

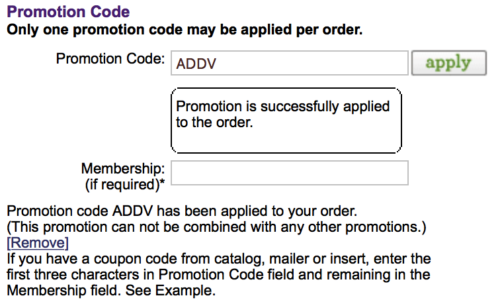

I found what I wanted, a bouquet that costs $54.99. I checked out as usual, and since 1-800-Flowers basically doesn’t “know” about the Amex offer at check-out, I was free to use a code from American Airlines.

I was able to use my promo code from American AIrlines in conjunction with the Amex offer.

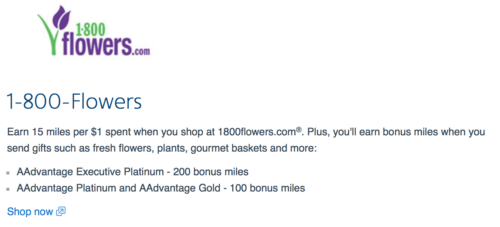

This earned me 15 AA miles per dollar spent on flowers, or 825 miles in this case. Because I am an Executive Platinum member with American Airlines, I also earned 200 bonus miles, for a grand total of 1,025 miles, from this purchase.

Earn 15 American Airlines miles per dollar at 1-800-Flowers, or more as an AA elite member.

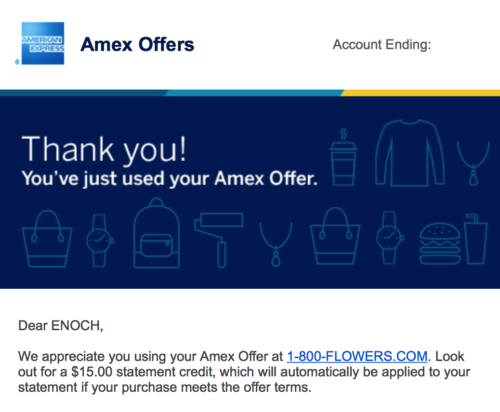

I checked out with my enrolled American Express card, and that was it! American Express was even kind enough to send out an email, confirming that I’d redeemed the offer, right away.

American Express sent me an email right away confirming that I’d redeemded my Amex Offer

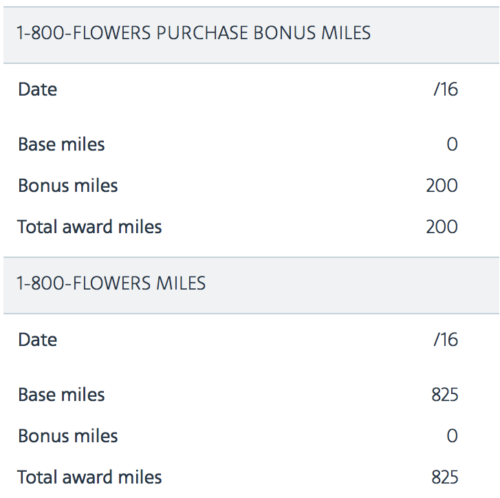

Sure enough, both my American Airlines miles and my $15 statement credit posted shortly.

American Express posted my $15 statement credit shortly after the transaction itself posted.

I was able to double dip with my Amex Offer and American Airlines bonus miles

By leveraging both American Airlines and AMEX, I ended up getting the $55 bouquet of flowers for $40, plus earned 1,025 miles in the process. Keep in mind that my transaction earned points from AMEX on top of all this too! This is just a tiny example of what is possible with Amex Offers.

Enroll via Your Accounts Page on American Express

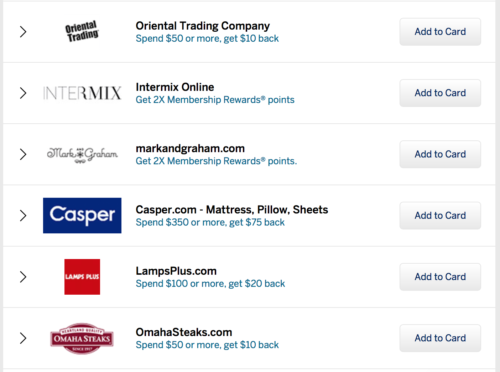

There are a few ways you can enroll your card with an Amex Offer. The first one is pretty straightforward—when you log into your account summary page on American Express’ website, you can scroll down to see a list of offers.

Your “American Express Account Summary” page has a list of offers you can add to your card.

Simply click “Add to Card,” and your card is enrolled with that offer! But before you do, keep in mind that once you add an offer to a card, it will disappear from any other cards you might have from American Express. I will discuss a potential way to get around that below.

Multiple Cards with American Express?

It’s worth noting that offers can differ between different American Express card. If you have more than one AMEX card, you will want to look through all the offers before enrolling. As I mentioned earlier, once you enroll an offer to a card, it will disappear from all other AMEX cards you own. Sometimes the offers can be so good, that you might want to take advantage of it more than once.

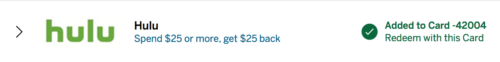

This offer basically makes getting Hulu Plus free, and I want to take advantage of it multiple times!

The easiest way to bypass this mechanism is to open a separate browser for each card. I usually just right click on the card icon on the top of the page, and select “Open in a New Tab.” Once every card has its own separate tab, you can then click through each one and enroll the same offer. Keep in mind, American Express only intended for you to take advantage of one offer per account. Therefore, this multi-tab trick is really just taking advantage of the lag time between your click and AMEX actually registering you for the offer. So you have some time to go around each browser, but do this quickly!

Finally, I know it seems like an obvious thing, make sure you use the right card when “redeeming.” You can also link your cards to offers via the American Express mobile apps, but I won’t cover that here.

Sync Offers with Your Social Media Accounts

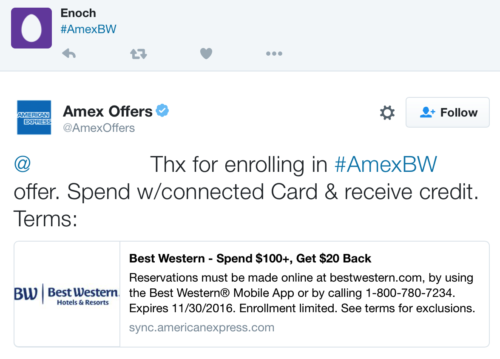

Another way to enroll offers to your card is via social media. Here, I will use Twitter as an example, but you can also get Amex Offers from Facebook. Amex Offers also come in the form of #hashtags, and by sending a tweet with a specific #hashtag, you can enroll your card for a specific offer.

An example of an Amex Offer on Twitter.

To do this, you will first have to link your Twitter account to your American Express card. You will need an account that is not protected (i.e. not private); this is presumably because American Express is hoping to get some publicity with your tweet.

You can only sync one card per Twitter account at a time. If you have multiple cards to enroll, you can either sync and un-sync before each time. However, I personally created a separate Twitter account for every single card, just for Amex Offers. This can help you keep track of your offers, and saves you time from having to sync and un-sync.

Once your Twitter account is linked to your card, you can start tweeting! American Express has a list of current offers on their “Favorites” page. Using the Best Western offer above, I tweeted “#AmexBW.” American Express immediately tweeted back to confirm my enrollment in the offer.

American Express immediately tweets back to confirm your enrollment in an offer.

Now I just have to use the enrolled card to pay for my night at the Best Western, and I’ll get $20 back when I spend $100 or more.

Here’s a trick I use to save time: enter as many #hashtags as you can in one Tweet. American Express will recognize multiple #hashtag in one tweet, and respond to all of them.

What Cards are Eligible?

Almost every card with an American Express logo is eligible for Amex offers. But officially, American Express has the following restrictions:

- Any valid U.S. American Express Consumer Card issued by American Express, Business Card from American Express or registered American Express Serve® Card or Bluebird® Card is eligible to participate in Amex Offers using an americanexpress.com account or through Facebook and Twitter.

- Any valid American Express Card issued in the U.S. by a licensed third-party bank licensed to issue American Express-branded Cards is only eligible to participate in Amex Offers through Facebook and Twitter.

It’s worth noting here, that authorized users can get in on the fun too! Unlike many other credit card companies, when you add an authorized user, American Express actually generates a new, separate card number. As a result, you can enroll that authorized user’s card in Amex Offers through social media as well.

Which Card Should I Use?

So which card should you use for an offer? Some offers basically gives things away for free, like the Hulu example above, and I’d enroll all of my cards. Otherwise, unless I want to use an offer more than once, I usually pick the card with the right multiplier.

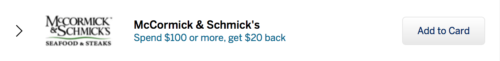

For example, the American Express Gold Card offers 3x on airfares, and 4x on restaurants and supermarkets (on up to $25,000 per year in purchases, then 1X). I’d want to use that for an offer that fits these categories, like this McCormick & Schmicks one below. That way, when I spend $100 or more, I’d get both double points and $20 back.

Use a card with a restaurant multiplier for this offer.

The Platinum Card® from American Express now offers 5x on airfares purchased directly from an airline. For offers that involve airfares, like the ANA one below, I’d use the Platinum card. With this offer, I will earn at least 25,000 Membership Rewards points for spending $1,000 with ANA!

This ANA offer is stackable with the 5x points you earn with the Platinum Card!

Different American Express cards offer different multipliers on specific categories, so these are just a few examples. Ultimately, I don’t think you can go wrong by enrolling your card in as many offers as possible. However, when it comes time to actually make the purchase, make sure you use the one with the right multiplier first.

Saving Offers for a Rainy Day?

You will notice that many of these offers have an expiration date. You must use your card at the specific merchant before that date in order to take advantage. However, there are actually a few ways for you to take advantage of the offer now, and use the credit later.

Many merchants offer gift cards; as long as they are purchased directly from the merchant, AMEX will recognize it as a purchase and trigger the statement credit. You can even take this one step further, by leveraging merchants that sell third-party gift cards. If there is a merchant, say CVS, under Amex Offers, you can absolutely buy an Amazon gift card at CVS and take advantage of the offer that way.

Conclusion

Amex Offers are unique in that they are stackable with cash back portals, as well as any other promotion a merchant might be running. Additionally, authorized users can also take advantage, and you can enroll multiple cards in the same offer!

By leveraging these advantages, you can often find some truly great deals.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

2 comments

[…] Registration Required?: Yes […]

[…] Related: A Guide to Amex Offers — Double Dip And Save […]