Recently I offered Everything We Know About the Coronavirus Stimulus Payments. Here’s some good news! TurboTax and the IRS have announced a partnership to launch a free stimulus registration website so that Americans who do not file tax returns can go online to get their CARES Act stimulus checks faster. Here are the details on how to register for your stimulus payment if you are not going to file a tax return.

UPDATE: “Get My Payment” IRS Web App Launches for Quicker Stimulus Payments, Plus Check Status Online!

Simple Steps: Register for Stimulus Payment

Stimulus Check Web Portal

Where to Register

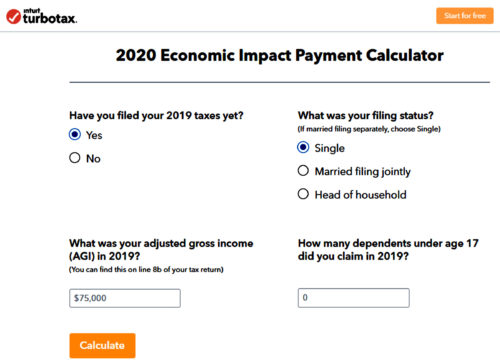

If you are not required to file taxes and don’t receive Social Security benefits, use the free Stimulus Registration for non-tax filers. This form gives the IRS your current mailing address and direct deposit banking information. The registration is free to use. Besides the Stimulus Check Web Portal, TurboTax also includes a payment calculator. The calculator helps you determine how much you should receive from the government with your stimulus payment.

If you did file a 2018 tax return or have already filed your 2019 tax return, the IRS will use those federal tax returns to determine and send individual stimulus payments. Those will be sent using the banking information provided on those returns. Those who didn’t file (or will not file) are at risk of not receiving a stimulus payment since the IRS has no way of knowing how to get it to the eligible persons with only a social security number.

Some Debit Cards Are Eligible to Receive Payments

Debit cards that are used by many tax preparation companies such as H&R Block and Intuit’s TurboTax as well as the Direct Express programs do qualify to receive these direct payments. That’s because these cards (H&R Block’s Emerald Card, Direct Express and TurboTax’s debit card) are linked to an actual bank account (with routing numbers) and all should qualify for the economic stimulus direct payment. This is relatively new information.

Social Security Recipients Will Automatically Receive Payments

On April 1st, the U.S. Department of the Treasury and the Internal Revenue Service announced that Social Security beneficiaries who are not typically required to file tax returns will not need to file an abbreviated tax return to receive an Economic Impact Payment. Instead, payments will be automatically deposited into their bank accounts.

“Social Security recipients who are not typically required to file a tax return do not need to take any action, and will receive their payment directly to their bank account.”

The IRS says it will begin sending electronic payments to those who qualify and have direct-deposit information on file on April 9th. Those who qualify but haven’t provided the IRS with bank information through a tax return, TurboTax’s online stimulus check web portal, Social Security or railroad retirement benefits tax form will begin receiving paper checks beginning April 24th.

Stimulus Checks For Individuals And Joint Taxpayers

Stimulus checks — up to $1,200 for individuals, $2,400 for joint taxpayers and an additional $500 for each qualifying child — will be based on information from your most recent tax filings, either (now) 2020 or 2019. This only applies if you haven’t filed this season yet.

Will You Have to Pay Back the Money?

Many people have questions about the economic stimulus payments. The CARES Act makes it clear that the stimulus payment is a unique fully refundable tax credit. Recipients are getting this special tax credit in advance.

Tax filers will technically claim the tax credit on their 2020 taxes, provided one earns enough in 2020 that requires filing a tax return. This ‘advance tax credit’ will basically wash itself out so filers will not be able to benefit from it twice (once in the form of a payment now and again later to lower a 2020 tax bill).

The stimulus checks are nontaxable. As such, they will not be included in 2020 as reportable income. They are officially described in the CARES Act as a “Recovery Rebate for Individuals.”

Caveat: I am not a professional tax preparer or tax attorney.

The UpShot

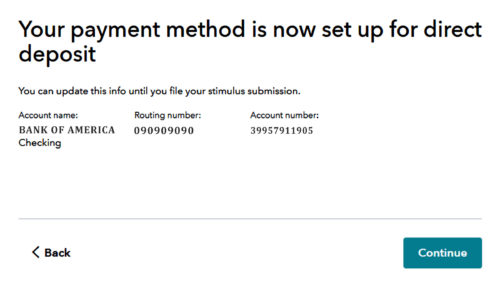

If you have done everything right, you will get this final payment method confirmation screen. You can also set up a paper check to be mailed to you.

Whatever your situation, you may be able to use this site to register for your stimulus payment online for free, making the process faster and easier for those that qualify.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

176 comments

Social security receipients won’t be receiving the money for their dependents tho. This isn’t fair and needs to be fixed. It’s not right. They are fixing it so everyone else gets theirs and us receipients with dependents are the forgotten ones. Fix this please

Hello I was wondering if there is a away to find out if IAM eligible if not was wondering I’m not currently working at the moment but it’s the payee for my child disability that gets out on a direct express card how would that work

Dessie-

You can check using the link provided in the article. I believe payment will only be made by direct deposit (not to a card) or by paper check mailed to you. For direct deposit the government needs your bank’s routing number and your account number. Hence the need for the payment web portal.

Thank you for your question.

So I received my 2019 tax refund on a TurboTax prepaid debit card. The Stimulus Check should go on there as well? Also when I go on the Turbo Tax prepaid website to login it lets me, but when I try to login with the app it says the account has been closed(but I can still check the card on the website and by the automated phone system)…so is my card still valid or is the problem just with the app?

John West-

You should address your concern to Intuit or TurboTax directly.

I’m not sure what the issue might be.

Sorry, I don’t have any better information but it sounds like there’s some specific to your account.

So you’re best off letting TurboTax fix that for you.

Thanks for reading and I hope you get that solved.

What is the portal to claim dependant children, I have custody of my 3 grandchildren and I am retired on SS, my 1 grandchild draws a check for his disability on a direct express card.

What if you have an American Express card from Jackson Hewitt on your direct deposit information from taxes, will the stimulus check be put on it or does it have to be an actual bank?

Jessica-

Those debit cards are linked to an actual bank account so you should be fine.

So I got my taxes on the emerald card and it has an accoumt number and routing number on my tax papers for that card…doesnt that count as direct deposit. It even says right on the tax document “direct deposit” line. I’m hoping so.

Kristina-

You are correct. The direct economic stimulus payment should post to that for you.

Thank you for your comment.

Everything I have read so far is saying that no tax return cards will get the payment. Only if u have a real bank account

Jessica,

Recently it has been noted that these ‘tax return cards’ (which are debit cards) are tied to an actual bank account so those routing numbers and account numbers are provided to the government for payment. So in reality, no direct payments are being made ‘to these cards’ but instead, they are being direct deposited to the bank accounts of which the debit cards are linked.

Hope that helps answer this common misconception.

Thanks for reading.

Ok what are the people who file a 1099 and have to pay taxes. How can we get our bank info to get the stimulus check direct deposited

Ryan-

You should be able to use the link in the main article to update your payment method.

It is also possible that the IRS will create their own direct web portal to process these, but they are moving very slowly.

Thanks for the great question and for reading.

Sarah-

I would expect that the bank account the debit card is linked to has not changed. So you should look for the economic stimulus payment to post to that account.

I already filed my 2019 taxes and close my bank account so I can get another bank…what can I do to update my new account information??

Priscilla-

I think you can check with the new link provided by checking this article I just posted.

Best of luck.

Thank you for reading.

Im disabled and only get $11,000.00 a year and If I was a dependent on someone’s 2018 taxes but in 2019 I was not and did not file and did not have to file. will I get the stimulus payment.

Kevin-

You should check out the recent article I penned that has a new website for the IRS to handle these kind of issues.

Thanks for reading…and best wishes

But what if you have one on these tax cards like turbo tax and you had an advance or fees taken out of your refund? We’re hearing the IRS gets a dummy account to SBTPG so they collect the fees then transfer to us. They say those accounts are now closed and that’s where the IRS will try to send it. My 1040 from the turbo tax site has the same routing and account attached to my turbo card but people are saying that’s not what turbo tax actually sends to the IRS. Turbo tax won’t comment. Just say a generic message to everyone that they are awaiting IRS confirmation on whether they will use our cards at this time.

Trisha-

That’s a great question. I think you should contact TurboTax for the answer.

You might also check this newly penned article I wrote with the IRS’s latest news and another new website to help people.

Thank you for reading.

It will go on that card. They all have routing and account numbers. I have American Express serve and I received a email it will go on there from themselves. I also had a refund advance etc…

I want to change my info for direct deposit I dont want it on the emerald card

Kevin-

You need to reach out to the IRS to change that information.

This is not that site.

Thanks for reading.

What happens if you filed through a finance company and your bank info isn’t on file? Is there a way of adding so you’ll get your check faster?

Keri-

You should be able to use the link in the main article to update your payment method.

It is also possible that the IRS will create their own direct web portal to process these, but they are moving very slowly.

Thanks for the great question and for reading.

tell me this how am I supposed to get my stimulus payment when Jackson Hewitt has no information to the IRS for nobody’s stimulus check for direct deposit or the address that they used a file to get their tax refund direct deposited through Jackson Hewitt is Jackson-Hewitt is committing fraud

Daniel-

I can understand your frustrations.

You would have to direct your concerns directly to the Treasury Department, as they are managing these payments.

This page is just a news article on the program.

Social Security retirement, disability (SSDI), or survivor benefits, Railroad Retirement and Survivor Benefits

SPECIAL NOTE: People in these groups who have qualifying children under age 17 can use this application to claim the $500 payment per child”

Cassie-

Check out the new article I just posted here, with the latest information (and a NEW website) directly from the IRS which addresses many of these issues.

Thanks for reading.

I did thr hr block refund advance so the direct deposit info on the papers is for thier bank then it get deposited and they take their fees out then direct deposit the remainder onto our emerald cards.how will i get my payment in this scenerio

Bennie-

If you used H&R Block’s Emerald Card, then the bank account synced to that debit card should get the direct payment. At that point, the funds would be accessible with the card.

I am not a professional tax preparer.

Thanks for the question and for sharing.

High I had hr block do my taxes 2019 but I had my fees taken out on my return and balance deposit to my bank account will I receive smilus check to my account from irs or will hr do it

Scott-

That’s a great question. I think you should seek your H&R Block agent for the answer.

You might also check this newly penned article I wrote with the IRS’s latest news and another new website to help people.

Thank you for reading.

Will I receive my check on my direct Express card?

Virginia-

Yes, that is what we have been told.

Thanks for reading.

I want to check wheres my payment when u do that and put in all my info it says not enough info u have my hrs block routing number. If my sons father owes child support will it go on my child support card

Angela-

If back child support (arrears) are due then yes the stimulus payment should go to offset that debt

As for your question on when you should be paid, you’ll have to address that directly with the Treasury Department.

Thanks for reading

I disnt recieve payment and I get SSI benefits.

Angie-

This is just a news article on the stimulus payment program. You need to direct your question directly to the Treasury Department.

You might also check our article on Top Reasons Your Economic Stimulus Check Has Not Arrived

Best of luck and thank you for reading!

What about the taxpayers who did file 2019 taxes but used a H&R Block Emerald card to have their taxes deposited to? Will we receive our stimulus payment on our Emerald Card?

Alicia,

You can ensure that you have provided the IRS with your correct bank account or (if you prefer) request a physical check by using the link to the FREE site referenced in the article. It was set up by a collaboration between the IRS and TurboTax. I just recently learned that Emerald Card’s (linked to a valid bank account) are a valid payment destination for the direct stimulus payments. Thanks for your question.

But you mentioned today in a comment that the Emerald Card would be used if that is how it was done, because it does actually have routing and account numbers for it. So Im confused, is that not a direct deposit account or not?

April-

Correct. I’ve been told that the underlying bank account which these debit cards are associated will actually receive the payment. So while technically it doesn’t post to the card, it deposits to the linked bank account.

Thanks for your feedback.

What do you mean linked to a valid bank account? Do we have to link our emerald card account to a different bank account? The emerald card is set up with the hr block bank and comes with a routing and account number initially so i don’t understand.

Cindy-

Recently it has been noted that these ‘tax return cards’ (which are debit cards) are tied to an actual bank account so those routing numbers and account numbers are provided to the government for payment. So in reality, no direct payments are being made ‘to these cards’ but instead, they are being direct deposited to the bank accounts of which the debit cards are linked.

Hope that helps answer this common misconception.

Thanks for reading.

I have a myvanilla card that I used when I filed my taxes. Will those

cards be considered direct deposit?

Brittany-

I am not sure. You may want to check out this article which has the latest information form the IRS.

I am not a professional tax preparer, and I know the IRS is a bit slow getting out all the necessary information. That is why I am trying to share what we know thus far.

Thanks for reading.

Miles, so I don’t have to worry or change my bank info if I have H &R emerald card? I was going to try and put my bank info in when web page became available, but I’m trusting your word that stimulus will load into Emerald card thank you, sharon

Sharon-

Correct. The economic stimulus payment should be directly deposited into the linked bank account to which your Emerald card has access.

Thanks for reading

How about the turbo tax card? My taxes also have the account and rounting number listed as direct deposit for that card….i had fees taken out from a third party…..but they have my turbo tax card info… I want to avoid getting a check…. Thank you

Marie-

Yes, these debit cards (H&R’s Emerald Card, Direct Express and TurboTax’s debit card) all qualify for the economic stimulus direct payment.

This is relatively new information.

Thanks for the question and for reading.

I have read in several articles that you will not get the stimulus direct deposited to an emerald card account nor the turbo tax card account.

Cindy-

Recently it has been noted that these ‘tax return cards’ (which are debit cards) are tied to an actual bank account so those routing numbers and account numbers are provided to the government for payment. So in reality, no direct payments are being made ‘to these cards’ but instead, they are being direct deposited to the bank accounts of which the debit cards are linked.

Hope that helps answer this common misconception.

Thanks for reading.

My taxes were filed by Jackson Hewitt and received a advanced refund loan on a temp card then I received a permanent personalized card that then remaining balance of my return was direct deposited onto the permanent Jackson Hewitt American Express Serve Card, it has an account and routing number for an employer to direct deposit. Will the stimulus be deposited onto this card that I received my return on?

Jetemy-

I’m not a professional tax preparer. You should direct your question to your tax preparer at H&R Block

Best of luck

Im not employed so that being said i dont fill texes i get a medicade care so will i get a check

Pamela-

Correct. Best wishes and thanks for reading.

I have a direct Express card that my disability comes on will I get my stimulus payment on that card

So even if we got an advance , we will still recieve our money on the emerald card?

Sharon,

Yes as we understand it now.

The IRS has just created a new website to help, which you should read about in this article.

Thanks for reading.

you have confirmed that? because everyone else says “i dont know” or “no”

That is what we have been told.

Of course, I am not a professional tax preparer and my information comes from tax preparation sites and the government.

So…you know how that goes.

Thanks for reading.

If u didn’t get advance or refund transfer u will get it on emerald card….if u had either one of the two the IRS is still working on how and if it will be sent to that account. HRBLOCK has advised they are waiting for updated info from IRS and will post on HRBLOCK emerald card site as they know.

Walt-

Thanks for adding this information to the discussion.

What if you haven’t filed your 2019 taxes and the information provided for 2018 is outdated (address and bank account)?

Carolyn,

You can use the link provided in the article to help you file a 2019 return, update your bank account information, or you can file a 2019 return right now.

Thanks for reading and best of luck during this ordeal.

What if i cant file because irs sent me wrong identity pin ..and i cant get in touch to be sent another one ? …didnt file last year

Shalawn-

I would suggest you use the link in the article to register and provide the required information.

I’m not a professional tax preparer or tax attorney.

Thanks for reading.

Will vets with direct deposit of their pension get an automatic payment into their account?

Travis-

Some veterans and individuals with disabilities who are otherwise not required to file a tax return should make sure that the IRS has the needed bank account information required for these direct stimulus payments. You probably want to check on the website (using the link provided in the article) just to be sure you’ve provided it to the government.

Best of luck during this crisis and thank you for your question.

What if you used a individual (cpa) to file your 2019 taxes and the refund went into the cpa account is their a way to change the information to my personal bank account through the portal.

Kristen,

Yes, you do have that opportunity.

Thanks for reading and your question.

I haven’t filed my tax return for 2019 but I have a new checking account, can I just use the update tool and complete the tax form later on?

So if u had a baby in February 14,2020 would u get it credit for the stimulus package

From what I read earlier on the internet, the answer is no. An article stated disabled persons whose parents care for them are ineligible as well as babies born in 2020.

Esha and S-

If you can be claimed as a dependent by another person, then you are not eligible for the economic stimulus payment provided by the CARES Act. You may also want to contact the IRS directly at (800) 829-1040. Customer service representatives are available Monday through Friday, 7 a.m. to 7 p.m. local time. I am not a professional tax preparer or tax attorney. Hope this helps you get a solution to your issue. Thanks for your question and for reading.

What if you used turbo tax does it go on ur turbo tax card

The only source of income that I get is the disabilty(SSI) payment that my daughter gets through her father. Will I be eligible to receive any payment for me or my daughter?

Jennifer,

You should qualify. As for your daughter it would depend on if she is a dependent who is recorded on her father’s tax return.

You may also want to contact the IRS directly at (800) 829-1040. Customer service representatives are available Monday through Friday, 7 a.m. to 7 p.m. local time. I am not a professional tax preparer or tax attorney. Hope this helps you get a solution to your issue. Thanks for your question and for reading.

I filed 2018 and 2019, but my 2019 taxes are still processing because i owe child support. Will they go by my 2018 taxes only? My direct deposit information is the same on both, only thing is i have 2 dependents on my 2018 and only 1 dependent on my 2019. Do you think ill catch a break and recieve 500$ more since there still processing and have been now since March 11th?? I dont owe alot of child support back pay, so if they would go by only my 2018s that would get me some stimulus package refund.

Adam-

Although I’m not a professional tax preparer or tax attorney, as I understand they will pay based on your latest files tax return.

I filed my taxes with h&r and had my fees taken out of my return. H&r then deposited my remaining funds into my checking account. Is that an issue with receiving stimulus check via direct deposit?

Chuck-

I’m not a professional tax preparer or tax attorney. I think you should address your specific concern to H&R since they were your tax preparer.

Thanks for the comment and for reading.

Funny how you seem to know the information on the Emerald card with H&R Block but you have the same boring answer H&R Block has about those who didn’t use the emerald card but used their refund to pay the tax prep fees. Because when you do that it puts H&R Block account number on your filing paperwork and then H&R Block sends it on to us after taking their fees. Yet ABSOLUTELY NO ONE CAN ANSWER THE QUESTION. You’re just referring us back to the same people who are giving the same robotic answer you are. while some of your information is helpful those millions who did their taxes this way are left without answers. So while it it helpful to others it frustrates others

Chuck-

I’m not a professional tax preparer, but I’m trying to share information in an article that covers as many people as possible.

For many answers people need to voice their concerns with their tax preparers. Others will have to rely on the IRS. During these times telephone representatives are particularly overwhelmed.

Does anyone know when a portal will become available to update bank account info for people who OWE taxes?

The option to enter bank account information wasn’t available when taxes were filed this year do to an outstanding balance owed to the IRS despite a dependent.

They may have info from YEARS ago but things concerning bank accounts do change for some people. I need to update my routing info and have no insight to this when payments will be issued soon.

S-

You can try to register via the site linked in the article…they may offer a solution.

You should also contact the IRS directly at (800) 829-1040. Customer service representatives are available Monday through Friday, 7 a.m. to 7 p.m. local time.

I am not a professional tax preparer or tax attorney.

Hope this provides some guidance to solving your issue. Thanks for your question and for reading.

Ok this is the very first time I’m asking a question I get SSI And I have a DirectExpress card do I need to do anything to get the stimulus package I been getting SSI for the past 8yrs I’ve never had a checking account all I have is that direct express card. Please tell me they are going to direct deposit on my DirectExpress

Melissa-

You may also want to contact the IRS directly at (800) 829-1040. Customer service representatives are available Monday through Friday, 7 a.m. to 7 p.m. local time. I am not a professional tax preparer or tax attorney. Hope this helps you get a solution to your issue. Thanks for your question and for reading.

What if you have not yet filed taxes for 2018 or 2019?

Ron-

Then you are the perfect targeted citizen for the registration site. You should register via the link included in the main article.

You may also want to contact the IRS directly.

I am not a professional tax preparer or tax attorney.

Hope this helps you get a solution to your issue. Thanks for sharing and for reading.

I have a direct deposit card me n my w kids get ssi from my husband who is now retired so we also get the stimulus chk I cant work due to health reasons n am waiting to court for my disability am goin to call direct Express cause I get a paper chk while my kids goes on my card do I need to do anything

Michelle-

Given the uniqueness of your situation, you probably want to reach out to a tax preparer or the IRS directly.

Hoping all works out for you. Thank you for sharing your experience.

Michelle,

You may want to contact the IRS directly at (800) 829-1040. Customer service representatives are available Monday through Friday, 7 a.m. to 7 p.m. local time. I am not a professional tax preparer or tax attorney. Hope this helps you get a solution to your issue. Thanks for your question and for reading.

What if I’m on SSD and my wife electronically filed me jointly with her without my permission and she’s threatening not to give me my stimulus money after we separated. We have a court order between us where we can’t be in contact and there’s no way for me to receive my stimulus check. She have everything direct deposited to her bank account which I have no access to.

Brandon Lee-

Sorry to hear about this situation. You probably need to contact an attorney for assistance. Thank you for your comment and reading.

Brandon,

Go on the IRS site and update your direct deposit account information so that you will get yours separately, if she has already received the payment then you cant update your info… Goodluck

Okay question what if you work and you pay your child support but you are behind? I am doing everything I can to catch up but I am off work right now cause of this virus and I have a child to take care of. So I wont get the stimulus check? I need it!

Amanda-

According to the CARES Act bill, under the law, your check can be seized for child support arrears. That would go to offest your arreage.

Wishing you the best during these difficult times.

What if u filed using turbo tax and your taxes was deposited to a turbo tax card will they deposit the stimulus check on there just asking cause that card has been misplaced

Devin-

The payments are being made in one of two ways. First, direct deposit to a bank account. The IRS requires your bank’s routing number and account number. Use the link provided in the article to help you register and determine your qualified stimulus payment. I am not a professional tax preparer or tax attorney. Hoping you get the assistance you need. Thanks for sharing and reading.

What if you have filed for 2019 but you haven’t received your refund yet?

Christa-

To receive your economic stimulus payment all the IRS requires is your bank account number and the routing number. If you provided that on your tax return you should be fine. These economic stimulus payments are being processed separately from tax refunds.

I hope this helps answer your question.

Thanks for your question and for reading.

I am not a professional tax preparer or tax attorney.

I have direct deposit because I have a child that is on SSI but I didn’t provide that information on my tax return from where I used the H&R Block Emerald Card would you happen to know if I’ll receive the stimulus payment on the Emerald Card or will it be deposited on my direct deposit information I have through the social security office Or can I go ahead and update my direct deposit information through the web portal?

April-

I just recently learned that Emerald Cards (linked to a valid bank account) are a valid payment destination for the direct stimulus payments.

You should also able to use the link provided in the article to help you register/change your payment method for your economic stimulus payment. You may also want to contact the IRS directly at (800) 829-1040. Customer service representatives are available Monday through Friday, 7 a.m. to 7 p.m. local time. I am not a professional tax preparer or tax attorney. Hope this helps you get a solution to your issue. Thanks for your question and for reading.

Ok thanks for replying I appreciate it!

My husband and I have not filed 2019 yet and 2018 taxes refund was taken for my student loans. We have a Jackson Hewitt [debit card] the money would gave deposited on if we would had received any. Will this stimulus go on that card. We have got a bank account since then.

Brooke-

I just recently learned that Emerald Card’s (linked to a valid bank account) are a valid payment destination for the direct stimulus payments.

You may also want to contact the IRS directly at (800) 829-1040.

Customer service representatives are available Monday through Friday, 7 a.m. to 7 p.m. local time.

I am not a professional tax preparer or tax attorney.

Hope this helps you with your issue.

Thanks for your question and for reading.

I filed my tax using turbo tax and got my refund on there credit card which has the account number and routing number. Will the stimulus check be sent to that account/ credit card?

Richard-

I just recently learned that Emerald Card’s (linked to a valid bank account) are a valid payment destination for the direct stimulus payments.

I am not a professional tax preparer or tax attorney.

Hope this helps you with your issue.

Thanks for your question and for reading.

Thank you for this article. I filed my 2018 and 2019 taxes, however, I owe each year and we moved. The IRS, will not have my correct address, and there was not any direct deposit info on the returns, because we owe. I tried calling the irs at the number above, and they are not taking live calls. Can I use the link above to update my address and bank account information, even though I filed returns for 2018 and 2019?

David,

Yes. You should be able to use the link provided in the article to help you register and change your payment method for your economic stimulus payment.

However, I am not a professional tax preparer or tax attorney.

Hope this helps you get a solution to your issue. Thanks for your question and for reading.

Thank you, I did speak with my accountant, who was swamped and could not get back to me right away, he did say the same thing, that I should use the link, and register and change my payment method and address. thank you again…

Love it sir

We had our 2019 refund sent to a H&R Block Emerald card. Will our corona virus funds be deposited on it?

Robert-

As I’ve mentioned…at this time only direct deposit and a paper check are your two options. I have learned that Emerald Cards (linked to a valid bank account) are a valid payment destination for the direct stimulus payments. Thanks for the question.

If I already filed my taxes for 2019 and received direct deposit for my refund but I recently closed that bank account. Is there a way that I can update my banking information in order to receive direct deposit for the stimulus check rather than receiving it by mail?

COA-

You can use the link in the article to update your payment method.

I’m not a tax professional.

Hope this helps answer your question.

Thanks for the question and reading.

It states on the website that only if you have not filed a 2019 tax return or don’t need to file then you’ll be able to update or enter your banking information. How about for people who have already filed a 2019 tax return but want to update/change direct deposit information

HI Miles, and thank you for your article.

After reading volumes of conflicting information, and having used TurboTax years ago, my decision was made to try this route yesterday.

Then later found your article.

For me, it went well, and as you described.

Needed to update my TurboTax password, checking account information, address, phone number.

No problem.

Some were reporting that putting $1 in income would be rejected.

This form did use the $1 figure. It went through fine for me.

Some type of job description must be entered.

Mine was SSI/Disability.

The opportunity to save/print was available.

Timeframe was an estimated 24 – 48 hours, longer if state taxes were involved.

For me, no state taxes, and notice that it was accepted came in a few hours.

You are able to sign up for different notifications.

If I understood correctly, once it’s submitted, it’s submitted. No changes until after it’s accepted or rejected.

FAQ are available.

Finding information RE: SSI Disability has been a mission.

One browser tab was used just for searching for information. Kept it set for one hour, refreshing “stimulus check for supplemental security income disability”.

At some point, your article came up.

Where were you a few days ago, buddy!?

Apologies for the long-winded comment. Hope someone is helped.

Thank you again.

Best,

Laubette

— no, I’m not a tax preparer, accountant, or anything else fancy; just another internet hobo.

Laubette-

Thank you for your step by step demonstration. My example experience was equally easy to process.

The article has been around for 3 days, so not sure why you couldn’t find it earlier.

Many thanks…

Miles,

Just wish I’d have found your article earlier.

You are helping people everywhere, and continue to respond to comments.

I appreciate your help.

Best,

Laubette

I think if this was a legitimate place to put on your direct deposit info it would be on the irs website also and it’s not!!

Becky B-

I can appreciate your opinion. However, this has been widely reported. It is a collaboration between the IRS and TurboTax. The link is working now and thousands have reported using it successfully. It could be that the Federal Government is slow to modify their website as many of their resources are being used to address concerns with the Coronavirus. The IRS has not updated that website since March 30th.

Thanks for reading.

The debit cards that have the various tax preparation industry leaders’ names on them are linked to an actual “bank” account that belongs to the respective tax filer. Each has a real account and routing number that were provided to the IRS on the tax return they filed when the card was issued.

Roberta-

Thank you for your explanation. The information was gleamed from sources familiar with the CARES Act. It sounds as if you can get a direct deposit then, if applied to these debit cards linked to an actual bank account.

Thanks for sharing.

If this guy miles Jackson isn’t a tax specialist why is he answering questions

If a SS recipient has dependents then it is my understanding that they need to use the nonfiler option. I use the DirectExpress card, I don’t have the option of putting a routing number in. If I fill out the form and leave the bank info empty, will I get a paper check or will it go to my DirectExpress card? If I don’t do anything I know it will for sure go to the DE card but then I lose out on the $500/dependent

Taresa-

Questions this complex are best answered by a professional tax preparer or the IRS.

I am not a professional tax preparer.

If you owe the IRS for previous years and you are on an installment payment agreement and make those payments via direct debit from your personal bank account, will the IRS use that information to direct deposit your stimulus check?

Sarah,

As I understand, yes, that is correct.

Thanks for the great question.

I have not filed my 2019 taxes yet, but owed taxes on my 2018 return; I am set up on a installment payment agreement and make those payments from my bank account. It seems to me that they would be able to use the bank account information to send the stimulus payment, when they receive a payment from that same account each month already. There isn’t very much information available that addresses this scenario specifically.

Blake & Sarah-

Shaun,

I am not a professional tax preparer, but if that bank information was provided to the IRS for those payments you should be okay.

It is also possible that the IRS will create their own direct web portal to process these, but they are moving very slowly.

I am not a professional tax preparer.

Thanks for the great question and for reading.

I filed taxes in 2018 but did not have direct deposit with irs . How can I sign up with irs for direct deposit?

Joseph-

I believe that you are able to update your payment method by using the link in the article.

Thanks for reading and your question

I recieved my 2019 tax refund on an emerald card through h&r block. I used my bank of America account to receive my 2018 tax refund. My question is if the irs is not using the emerald cards to send stimulus money to will the use my bank of America account information from my 2018 taxes? The account is still active. I only used h&r block so I could recieve an advance on my 2019 tax return. I normally file using my bank of America account but didnt for my 2019 tax return. I have read they will use the latest return information but it never clarifies if that information would lead to issuing a paper check if the irs would go back to the 2018 tax return to see if there is banking information they can use to send stimulus money electronically first before sending a paper check. Any information will be appreciated thank you.

Michael-

The account to which your Emerald card is linked should receive the economic stimulus payment. This is relatively new information.

Thanks for the question

I used the Turbo Card from turbo tax which is Green Dot Bank for the 2019 tax filing. It has the banks routing number and account number under the payment method. Am I good to go?

Mike Gee-

Yes, you should be all set!

Thanks for the question and for reading.

I used a tax preparation service and my taxes were sent to them via direct deposit then to me. Will my stimulus be sent to them as well?

Ashleigh-

We aren’t sure yet. The IRS says they are still working on some of the payment details. According to them this information “will be updated as new information is available.” and their site has not been updated since March 30th.

Thanks for the question.

My SSI disability payment is direct express but I have a payee. Will I receive a stimulus payment on the direct express card?

Lonnie-

I am not a professional tax preparer, but if the IRS is making direct deposit payments through Direct Express, you should be okay.

We recently learned that direct economic stimulus payments should be going to these Direct Express accounts.

It is also possible that the IRS will create their own direct web portal to process these, but they are moving very slowly.

I am not a professional tax preparer.

Thanks for the great question and for reading.

Hello, if ive alreadty filed and re recieved my 2019 return. Can i still use the link provided to upload info on my direct deposit info?

Vic-

I am not a professional tax preparer, but if you should use the link in the main article to update your payment method.

It is also possible that the IRS will create their own direct web portal to process these, but they are moving very slowly.

I am not a professional tax preparer.

Thanks for the great question and for reading.

We filed our 2019 taxes already but we didn’t get a federal refund only a state refund. When we rifled both state and federal we used our bank acc for direct deposit for the state refund. Will the irs have that info as well and be able to direct deposit our check?

Shaun,

I am not a professional tax preparer, but if that bank information was provided to the IRS on those tax returns (regardless if a payment was made from/to them) you should be okay.

Otherwise, you should use the link in the main article to update your payment method.

It is also possible that the IRS will create their own direct web portal to process these, but they are moving very slowly.

I am not a professional tax preparer.

Thanks for the great question and for reading.

Hi, there! We have owed Federal taxes the last couple of years. Typically, I print a voucher form and mail a check. I just completed our 2019 return and, as expected, we owe again. There is an option for direct debit of the payment. Under this option, I prove my banking information (account number, routing number, ext.). Understanding you are not a tax professional, you appear to have researched this issue and thought I’d pick your brain on whether registering for direct debit on our 2019 return would result in receiving the stimulus payment via direct deposit to the listed account? Thanks for your input!

Michelle-

Yes, this should satisfy the requirements needed to get you that economic stimulus check sent by direct deposit. Thanks for the question as I’m sure lots of readers have similar concerns.

So I’m assuming that Jackson hewitts American Express serve card will work?

Joey-

Correct. The IRS should make direct deposit payments through American Express‘s Serve (debit) cards as well, so cardholders of that product should be okay.

Thanks for the great question and for reading.

Hello All

Very special case here..

I m permanent residence, landed in united states on feb 8 2020.

I have SSN, greencard and everything.

I did not file 2018&2019 tax return so IRS

do not have info about me.

I was looking for my first job but impacted by

COVID 19.

Am I eligible to get stimulus check?

Please advise.

Bishal,

Permanent residents are eligible for a direct economic stimulus payment.

You should use the link provided in the main article to register. That’s what the web portal is designed for.

I am not a professional tax preparer.

Thanks for the great question and for reading.

Hello I filed my 2019 tax return and did not use direct deposit I received a paper check sent to the direct deposit account of my tax preparer who then print a check from her office. Ive also moved from the address since filing so recieving a paper check would result

in going to the wrong address. My questions is will I have to wait for a paper check that could take several months. Are is there a way I can provide my bank account info via online?

I am not a professional tax preparer, but if you should use the link in the main article to update your payment method.

It is also possible that the IRS will create their own direct web portal to process these, but they are moving very slowly.

I am not a professional tax preparer.

Thanks for the great question and for reading.

I received my refund on a turbo debit card. I used turbo tax free file. No one took any fees from my return. My question is will i get the stimulus payment on this card. And if someone else filed and received payment on turbo card but had fees taken out will they still receive payment on their turbo card.

Alexander30,

Yes you should receive the payment on your Turbotax debit card account

I filed 2018 taxes and got my refund on emarald card

But I have a daughter who is on ssi and they send her checks directly to my bank account I provided to them

Will I receive it on my emarald card that I used for my 2018 taxes or will it use the info from ssi my personal account from ssi

Nyere-

If I understand correctly, one payment will go to each, separately. One through the Emerald card for you and the other direct deposit for your daughter. You may want to check with the IRS .

Thanks for reading

The bank accounted I used to pay my taxes was closed couple months ago, will they still deposit into that bank account? I tried calling IRS to update bank info but there is no option to speak to a representative at this time.

Michael-

You should check out the latest information on the IRS’s “Get My Payment” website by clicking on this link to my article detailing this exciting new site launch.

Thanks for your question.

I have an 11 yr old pecial needs daughter who receives SSI monthly. Those funds are directly deposited into her mother’s account. But i claim her on my taxes as her mother doesn’t work, so where will the 500 for her go? We are still together so we aren’t concerned, just curious which account to expect it in. Thx

Mike-

I’m not 100 percent sure either.

Eventually the IRS promises to have a Check My Stimulus Payment Status site. If and when that appears perhaps they will have the answer.

So for the people that have the direct express cards for their social security payments. Will their stimulus check go one their direct express card and if so when?

Angela-

Yes, that’s correct. Only the Treasury Department knows when any specific payments will be made. They began processing payments over the past weekend.

Thanks for reading

I am a representative payee for my 9 yr old Autistic daughter. Each month her checks get deposited into my account. I have filed for non tax filer payment, but being that she receives disability, do I need to do anything further? Or nothing at all? I understand I could qualify for the $1200 and additional $500 for her, did i need to do anything at all?

Anita-

First off, I am not a professional tax preparer and I do not work for the government. Any information I provide is based on what’s been made available by the Treasury Department.

I do not believe your daughter will receive a stimulus payment on her own; especially if she is claimed as your dependent.

Parents who are on SSI and have kids under 17 and did not file taxes in 2018 or 2019, you have a deadline of May 5th to sign up your children.

However, parents on SSDI and other forms of Social Security who have kids under 17 have missed the deadline this year. You can still file next year and get the check then.

You should use the link in this article to register and perhaps update your payment information.

You should also check on the latest FAQ’s found here.

Best wishes to your and your daughter.

Thank you for reading.

Yes, your stimulus check will be directly deposited to your Direct Express card. Please open the link I referenced and scroll down a bit to the shaded box and click on number 4.

It verifies this information. Hope this helps!

I am on ssi and have not filed taxes for 2018 or 2019 but have been on ssi for 8 yrs and have a direct express card does the irs have my direct deposit info already on file? If i have to file direct express has no routing # and contacted them to get it!!! With no response what do i do now!!?? Or am i screwed!!!

Daniel-

You qualify for an economic stimulus payment.

This article

Thanks for reading and best wishes.

I filed with Jackson Hewitt, when should I get my stimulus money, I have checked my card and nothing is there

Allen-

The quick answer is only the Treasury Department knows when payments will be processed. They actually began depositing funds Saturday, April 11th.

Eventually the government promises to have a ‘Check My Status’ site. Once that goes live I will pen an article for our readers.

Thanks for reading…

I checked my check my status and the account number on there is wrong i have used the same card for the past two years and there is no way to correct it…how should I handle that

Kenya-

I can understand your frustrations.

You would have to direct your concerns directly to the Treasury Department, as they are managing these payments.

Hopefully you can get that resolved.

[…] Register for Your Stimulus Payment: Free & Easy Online – … […]