SoFi is probably best known for its student and personal loan products, but they also have something called SoFi Money.

SoFi Money is an online cash management account with no physical bank branches (but deposits are held in partner banks meaning up to $1,500,000 in deposits are FDIC insured). SoFi provides a debit card and you can withdraw money from ATMs worldwide without a fee. Everything is managed online or through their mobile app. And in case you were wondering, the company is legit.

At the moment, SoFi is offering $25 to anyone who signs up for an online cash management account and deposits $10 (SoFi Money) through a personal referral link (like mine here). They offer a further $250 if you set up SoFi to receive your direct deposits.

SoFi Money comes with a generous sign-up bonus and it’s packed full of benefits to make your next international vacation that much more affordable.

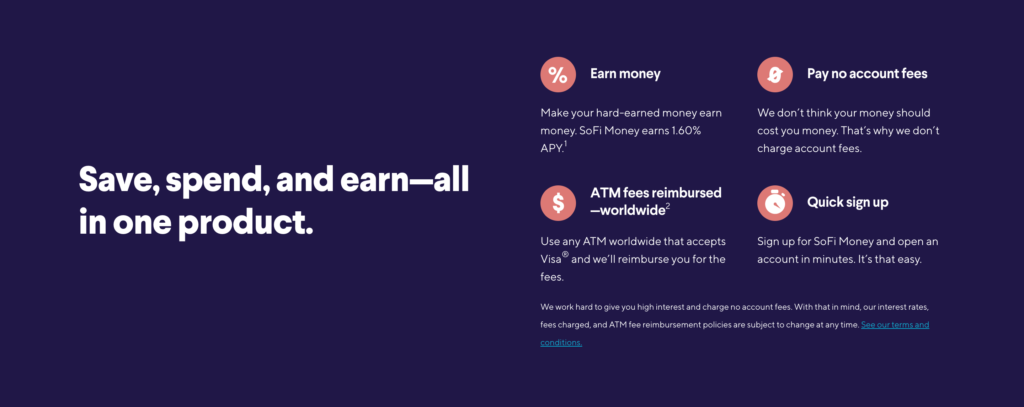

SoFi Money Benefits

I am incentivized for you to sign up for SoFi Money using my link, but the product is easy to make a case for, signup bonus or not.

- ATM fees are reimbursed worldwide. Use any ATM machine and it’ll be reimbursed to you.

- No foreign transaction fees on debit card purchases.

- No account fees

- Modern website and app to manage your money with.

- A generous APY

In addition to the primary benefits, the account will offer Mastercard benefits detailed below.

Mastercard World Debit Benefits

SoFi recently switched from Visa to Mastercard. While they noted that “there are no changes to your existing SoFi Money benefits. You will continue to get a generous interest rate on all your cash, pay no account fees, and all of the other features you love with SoFi Money,” they are adding some new benefits.

International ATM fee refunds, a generous APY on deposits, and no account fees are just some of the benefits for SoFi customers

The new benefits from Mastercard will include:

- Mastercard Airport Concierge™: Available 24/7/365 at over 450 destinations worldwide, cardholders get 15% off personal Meet and Greet agents to escort them through the airport on departure, arrival and/or any connecting flights and expedite them through the security and/or the immigration process (at participating airports).

- Cell phone protection: When you pay your cell phone bill with SoFi Debit Mastercard, In the event your phone is accidentally damaged or stolen you may be eligible to receive up to $200 per claim, $25 deductible, up to 2 claims per year. Unlimited lines associated with the cell phone bill.

- Mastercard golf: Provides discounted access to golf courses, complimentary grounds passes for PGA Tournaments, access to domestic and international golf travel packages, and more.

- Additional SoFi member experiences: On top of SoFi member experiences, SoFi Money Mastercard cardholders will have the opportunity to engage in bonus exclusive, once-in-a-lifetime experiences with the people they love in the cities where they live and travel.

- Enhanced security with credit monitoring, alerts for suspicious activity, and white-glove service to help you resolve issues with Mastercard ID Theft Protection™.

- Purchase assurance: May provide coverage for new items purchased with your SoFi World Debit Mastercard that are damaged or stolen within 90 days of the date of purchase, up to $1,000 per claim.

- Extended warranty: May double the original manufacturer’s (or store brand) warranty. Coverage is for eligible items purchased with your Mastercard.

Breaking It Down:

Starting Out With SoFi

To deposit funds, you can link an existing banking institution to easily transfer funds to SoFi. After a couple of days, the $25 bonus should post onto your account. At this point, you can cash out your money if you’d like. Easy, peasy. And no monthly fees.

While I am incentivized if you use my link, this deal makes sense for everyone, no matter whose link you use. It’s a no-brainer.

Frequently Asked Questions:

Directly from SoFi:

Who can open a SoFi Money cash management account?

How easy is it to sign up for SoFi Money?

Are there any fees for having a SoFi Money account?

Does SoFi provide paper checks?

Here’s their full FAQs and key terms.

SoFi Money will help you save money on fees to access your funds abroad when you go on your next international vacation.

The Upshot

When I signed up for SoFi Money a few months ago it took about two minutes and since then, its become my primary way of managing cash while traveling internationally. The $25 referral bonus for signing up for an account using a referral link is nice but the account offers solid long-term value that makes it a must-have for any international traveler.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

8 comments

Thank you for allowing us to post our links!

SoFi Money: https://www.sofi.com/share/money/2733029/

SoFi Invest:

https://www.sofi.com/share/invest/2733029

Thank you to anyone who uses my link(s)!

https://www.sofi.com/share/money/2728683/

Easy money and free atm worldwide! My link below https://www.sofi.com/share/money/2657440/

https://www.sofi.com/share/money/2751008/

Thank you for posting this!

Here is my link, thank you to anyone who uses it. https://www.sofi.com/share/money/2741090/

[…] Related: SoFi Money – the best “bank account” for international travelers […]

very nice!

[…] is inadvisable for foreign travel. You’ll be much better served with the combination of a debit card that allows you to use ATMs with no foreign transaction or ATM fees and a credit card with no foreign transaction fees. Argentina is the exception. If you use ATMs or […]